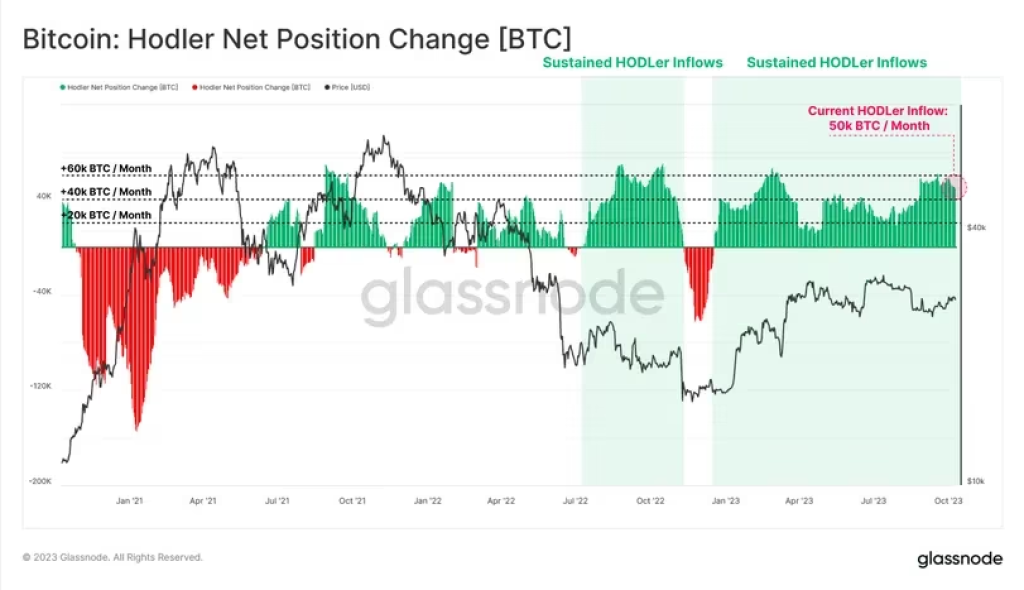

Data shows long-term Bitcoin investors, or holders of over 155 days, are accumulating BTC at a brisk pace of 50,000 per month on average.

According to blockchain analytics firm Glassnode, these loyal holders have amassed 14.86 million BTC – over 76% of the circulating supply and a new all-time high.

The aggressive accumulation is tightening available supply while reflecting reluctance to transact coins. Both factors contribute to growing market illiquidity.

Illiquidity typically precedes significant price rallies, as constrained supply amplifies upside moves. It also discourages short-term trading, encouraging holders to keep coins off exchanges.

The data illustrates that despite bearish sentiment, veteran Bitcoiners are stacking BTC with a long-term mindset. This cohort is taking advantage of discounted prices.

Their sustained buying applies continual pressure on liquid coins available for purchase. With exchange reserves also declining, markets grow more illiquid while strengthening holders’ grip.

Unless a flood of selling emerges, the scarce liquidity makes Bitcoin ripe for exaggerated spikes when bullish momentum returns. For now, aging veterans continue securing their piece of the capped BTC total.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.