There’s always speculation in the crypto space, and Litecoin is no exception. Some community members are still holding on to the idea that LTC could reach $500 this cycle. It’s a popular figure that pops up now and then on social media and among long-time holders. But let’s be realistic. While sharp rallies can and do happen in crypto, the current market structure, on-chain data, and ETF delays all suggest this goal is out of reach for now.

Those who’ve been around crypto long enough know that major price moves sometimes come out of nowhere. So yes, nothing is off the table completely. But based on what Litecoin price charts and fundamentals are showing, this kind of breakout doesn’t look likely in the near term.

What you'll learn 👉

Litecoin Price Keeps Running Into Resistance

Litecoin started to show signs of life in April after bouncing off a long-term support zone around $66 to $73. The price slowly worked its way up, forming an ascending trendline, and reached as high as $95. However, that level has proven to be tough to crack. The $93–$95 range rejected LTC twice, creating a strong resistance zone.

At the same time, a longer-term descending trendline dating back to March 2025 has continued to cap every breakout attempt. That structure remains firmly in place. If the LTC price can’t clear that zone, it’s unlikely we’ll see any explosive upside moves.

Support still holds around $83–$84, and if that breaks, price could revisit the $66–$73 demand zone. Right now, LTC is trading between two opposing trendlines, creating a squeeze. A strong breakout is needed to shift momentum, but that hasn’t happened yet.

Moreover, the idea of a Litecoin ETF gave many investors hope. But the U.S. SEC has pushed back decisions on several spot ETF filings, including those from Grayscale and Canary Capital. These delays push possible approval dates into late 2025. That means any real institutional inflow that might drive a breakout rally is on pause.

Even with pro-crypto regulators gaining traction, many analysts have raised concerns about how much demand these ETFs would actually generate. Wall Street has already rolled out a long list of exotic crypto ETF filings, including ones for Litecoin. But most attention and capital is still going toward Bitcoin and Ethereum products.

So even if an LTC ETF does get approved, it may not create the kind of momentum some investors are hoping for.

On-Chain Data Shows Support, But No Firepower

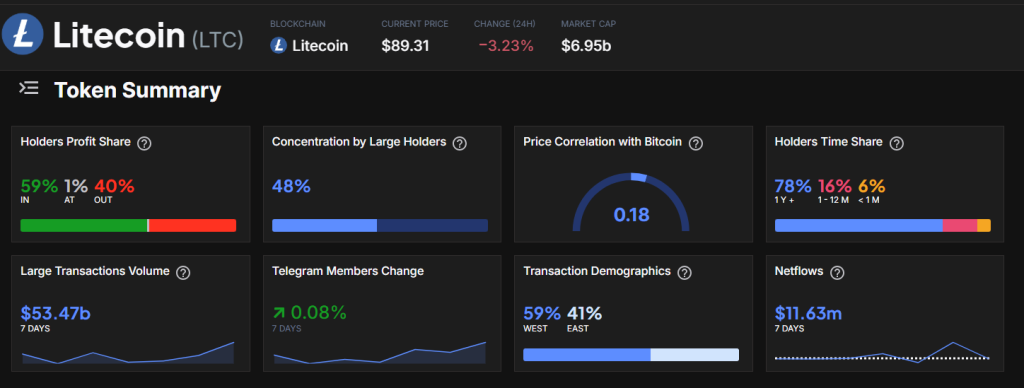

Looking at on-chain metrics, about 59% of Litecoin holders are in profit. That’s a positive sign. Another 78% of holders have held their coins for more than a year, showing strong long-term conviction. Large transaction volume reached over $53 billion in a week, with net inflows above $11 million.

However, the LTC price correlation with Bitcoin is just 0.18, meaning LTC isn’t moving in sync with broader market rallies. That low correlation could limit upside if Bitcoin price continues to drive market-wide sentiment without dragging LTC along.

Despite strong holding behavior and accumulation, none of this has translated into a breakout price movement.

Will the Unrealistic happen?

Litecoin hit its all-time high of around $412 in May 2021. Since then, it hasn’t come close to retesting that level. The market is different now. Liquidity is thinner, investor focus is scattered, and Litecoin faces strong competition from newer networks offering more utility.

Unless Litecoin price clears major resistance, secures strong ETF-driven inflows, and gains renewed investor focus, the chances of hitting $500 this cycle remain extremely low. The technical setup shows compression, not breakout energy. And without a clear bullish catalyst, the $500 target looks more like wishful thinking than a realistic forecast.

Read Also: Why Hedera (HBAR) May Not Reach $1 in 2025 Despite Bullish Predictions

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.