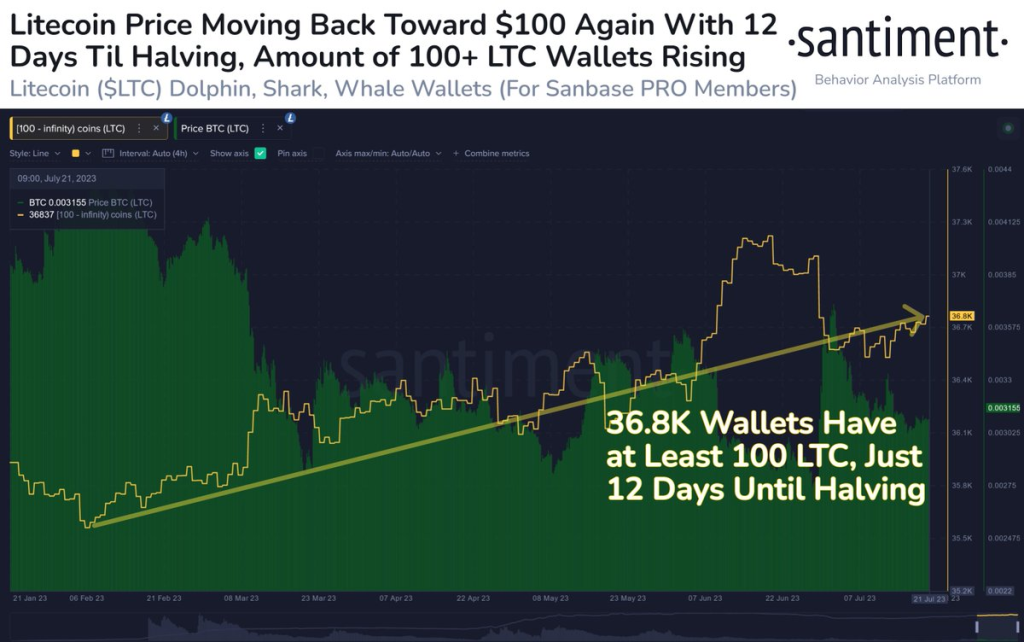

Litecoin’s forthcoming halving, set to take place on August 2nd, continues to generate increasing interest and participation among traders. Over the past 24 weeks, as the event has become more widely recognized, there has been a notable increase in the creation of Litecoin addresses, with an additional 1,185 addresses now owning at least 100 LTC. This growing trader enthusiasm is primarily driven by the widespread expectation of a bullish surge following the halving event.

Historically, halvings tend to precede significant rallies in the price of Litecoin. For instance, before the first and second halvings, Litecoin bottomed out 122 days and 243 days in advance, respectively, and rallied by 820% and 550%. Notably, these rallies tended to peak a few weeks prior to the halving, with the first one peaking 31 days before, and the second one, 61 days before.

f we adhere strictly to historical patterns, it appears that the peak rally leading up to the halving might have passed, given that we are now just 10 days away from the event. In the past, Litecoin peaked 31 days before the first halving and 61 days before the second.

However, it’s important to keep in mind that while history often rhymes, it doesn’t always repeat itself exactly. Market dynamics, investor sentiment, and global economic factors can alter expected outcomes.

A halving event doesn’t necessarily result in immediate, sustained price gains. After peaking, the price can drop sharply, often leading to a strong retracement before the beginning of an accumulation phase. The lows experienced post-halving have historically been higher than the pre-halving lows, with breakouts from the accumulation phase typically occurring around 400 days post-halving.

Investors should remain wary of potential deep post-halving retraces followed by a long consolidation phase in an approximately 70%-wide range. While the reduction in block rewards during halvings can create upward pressure on the price, the halving events themselves may not necessarily be the primary drivers of price movement.

In fact, many market participants may already have factored the upcoming halving into their price calculations and strategies. The cryptocurrency market is notoriously volatile, and price trends can be significantly influenced by a variety of external factors. Therefore, it is prudent for traders to approach price predictions with caution and to conduct thorough research and analysis before making any investment decisions.

In conclusion, the impending Litecoin halving has indisputably stimulated increased trader participation. While historical patterns suggest potential post-halving price gains, the ultimate impact will likely depend on a confluence of factors, including market demand, investor sentiment, and broader market dynamics.