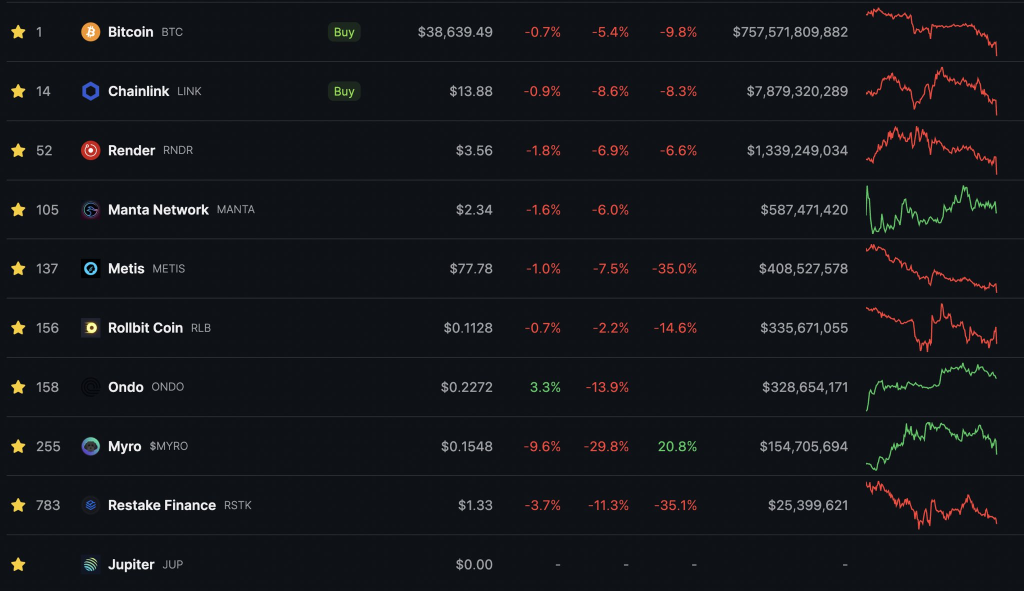

Prominent crypto analyst Miles Deutscher has highlighted several digital assets facing potentially pivotal price action in the coming weeks.

Deutscher publishes a weekly rundown of developing opportunities across both majors and speculative plays. His latest watchlist highlights several notable setups emerging amid the choppy price action.

What you'll learn 👉

Bitcoin ($BTC): Grayscale’s Selling Pressure

The recent “slow bleed” in Bitcoin’s price has caught the attention of many. Grayscale’s selling pressure has been a significant contributor to this trend.

However, the good news is that almost half of this pressure has been attributed to the FTX estate’s sale of their $GBTC, which has now concluded. The key level to watch is the $38k horizontal level on the daily chart, as it may signal a crucial response from Bitcoin in the near future.

Rollbit Coin ($RLB): A Tempting Accumulation Zone

Rollbit Coin ($RLB) has been an enigmatic performer lately, deviating from broader market trends. Despite this, its revenue continues to climb, and recent teases of an announcement suggest something exciting may be on the horizon. This unique valuation makes $RLB an intriguing candidate for accumulating a position during this phase.

Ondo ($ONDO): A New RWA Gem

Ondo ($ONDO) is garnering attention due to its strong capitalization table and support from key players in the industry. With listings on Binance, Bybit, and a recent Coinbase listing (backed by Coinbase Ventures), it possesses the right combination of a low float and high Fully Diluted Valuation (FDV), which often leads to favorable price action. Investors are keeping a close eye on this potential dip buy.

Render ($RNDR): Awaiting the Apple Vision Pro Event

Render ($RNDR) is steadily building momentum as it approaches the Apple Vision Pro Event on February 2nd. The market has a history of responding positively to tokens associated with real-world events, and RNDR has shown this tendency in the past. Its price action tends to be robust, with shallow dips, making it an asset to monitor closely.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Myro ($MYRO): A Controversial Solana Meme Coin

Myro ($MYRO) is a Solana-based meme coin that recently made its debut on Bybit. Similar coins like $WIF doubled in value after their listing, and $MYRO’s increased accessibility through major exchanges could potentially trigger a similar rally. While it’s a more controversial choice, it’s worth keeping an eye on.

Manta Network ($MANTA): Defying Market Trends

Manta Network ($MANTA) has been resilient, maintaining a price above $2 while demonstrating strength even in the face of market turbulence. The recent airdrop controversy may fuel a “hated rally” narrative, and its newness and alignment with current modular and Celestia narratives make it a coin to watch closely.

Chainlink ($LINK): Tied to the RWA Narrative

Larry Fink’s vocal support for the Real World Assets (RWA) narrative is expected to benefit Chainlink ($LINK) significantly. As a key player in supplying price feeds from the real to the digital world, LINK can be compared to the “BTC” of RWAs. This narrative has the potential to gain traction over time.

Restaking ($RSTK): The New DeFi Yield-Ponzi?

Restaking ($RSTK) is emerging as a narrative to watch, especially with the EigenLayer airdrop on the horizon. This narrative resembles a more mature version of the DeFi yield-ponzis seen in 2021. As the market stabilizes, interest in restaking is likely to grow.

Metis ($METIS): A More Attractive Entry Point

Metis ($METIS) has experienced a substantial pullback from $123 to $79. This correction has made it a more appealing entry point for investors. The recent launch of an ecosystem fund and the anticipation of the Dencun upgrade are adding strength to its narrative.

Jupiter ($JUP): Airdrop and Launchpad Season

Jupiter ($JUP) is gearing up for its airdrop on the 31st, coinciding with the early stages of a launchpad/IDO season. The Jupiter team’s track record suggests strong initial performance, followed by cooling off. Keep an eye on this one for potential entry opportunities.

So in essence, while volatility persists across crypto markets, opportunities seem to be emerging for both Bitcoin to stabilize and select altcoins to regain bullish momentum if bifurcation kicks in. And several key potential catalyst events over the coming weeks could act as trend change signals to monitor very closely.

You may also be interested in:

- RAY Stays Strong Above $1, Analyst Says Raydium Is ‘Practically the Backbone of Solana Shitcoin Season’

- Bitcoin Crash Continues, But Experienced Crypto Trader Spots Buy Opportunities – Here His Outlook

- Which Crypto Coin Will Pump Next? 7 Trending Altcoins To Watch In 2024

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.