A savvy cryptocurrency trader has developed a strategy to profit from the price fluctuations of the LINK token, as revealed by Lookonchain. By analyzing on-chain data, we can reconstruct the trader’s techniques.

The trader’s wallet address, 0xecded8b1c603cf21299835f1dfbe37f10f2a29af, has been actively trading LINK by taking advantage of its price fluctuation between about $5 and $9.

Trading the Range

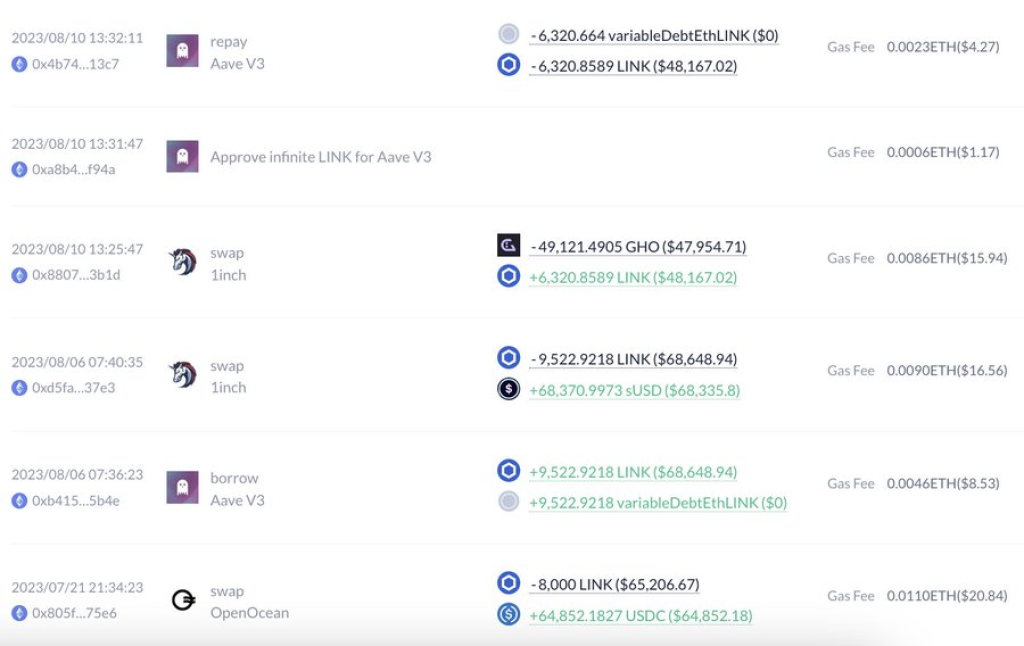

The trader seems to open long positions by buying LINK when the price is near $6. Then, when the price rises to around $8, they sell to close the longs at a profit. They also short LINK – borrowing to sell high and then buying back low to close the shorts.

Specifically, on July 21, the trader withdrew LINK from Compound, a lending protocol, and sold it on the open market while the price was above $8. Later, on August 10, they opened LINK shorts on Aave, another lending platform, right before LINK’s price dropped.

This pattern repeated on October 1, when the trader again withdrew LINK from Compound to sell when the price spiked over $8. They simultaneously opened new shorts on Aave.

By strategically opening longs and shorts based on LINK’s trading range, this trader has managed to extract consistent profits from the volatility. However, they are careful to maintain enough margin to avoid liquidations.

While trading on fluctuations can be lucrative, it also requires patience and discipline. Other traders should be cautious of overtrading and FOMO when attempting similar strategies. On-chain analysis provides valuable insights into proven crypto trading techniques.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.