The price of Bitcoin has shown some strength lately, with a continued steady increase. Although it started bearish today, some key indicators that show the price direction of Bitcoin are hinting at where the price could be headed next.

Ali, a well-known crypto analyst, explains the importance of the MVRV Momentum indicator for assessing Bitcoin’s trend. This indicator reflects the ratio of Market Value to Realized Value, providing insights into the market’s valuation.

Read Also: Looking for Next WIF or PEPE? Top 7 Low-Cap Memecoins Whales Accumulate Now

By applying both monthly and yearly moving averages to the MVRV, analysts can better gauge its momentum and the overall market sentiment.

Based on his analysis, the indicator has turned bullish again, showing that the price of BTC still has some upward movement to do.

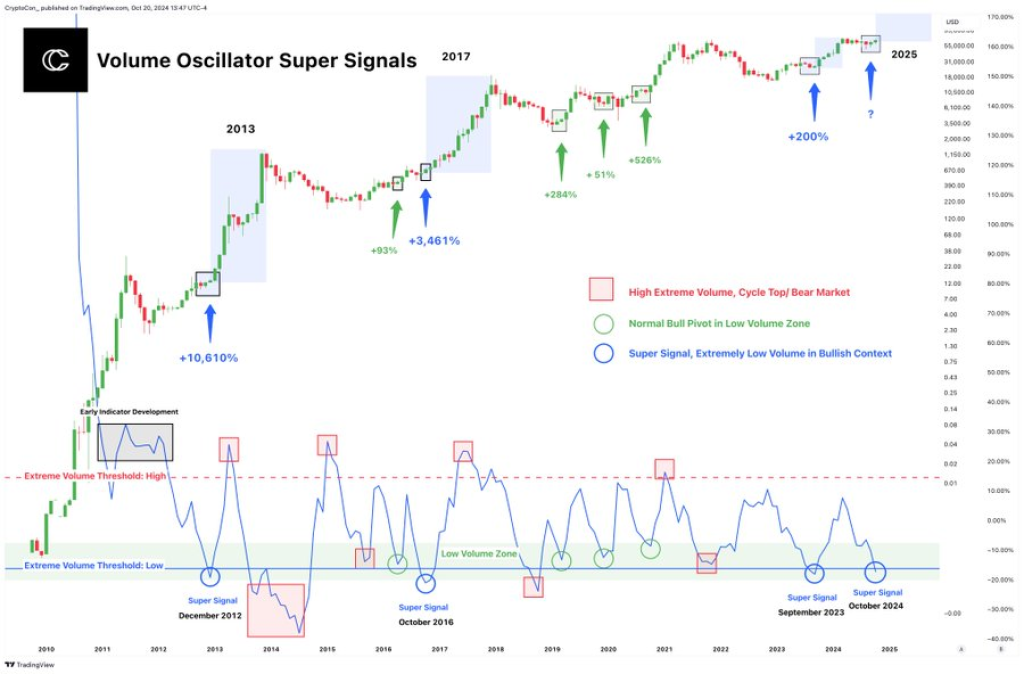

Monthly BTC Price Volume Oscillator

Another expert, CryptoCon, highlights the significance of the Monthly Volume Oscillator. A super signal occurs when Bitcoin’s trading volume drops significantly during a bull market. Historical data reveals that such occurrences preceded massive price surges in December 2012, October 2016, and September 2023.

Read Also: Solana (SOL) Price Explosion Imminent? Key Levels Hint at a Significant Upswing

Notably, the period from 2019 to 2022 did not exhibit any super signals, making the current situation particularly intriguing. The absence of extremely high volume before this low suggests a strong bullish outlook.

We cannot be certain how much the price will rise if the bullish move continues. However, we need to see a decisive break above the $70,000 to $72,000 resistance levels to sustain the upward push.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.