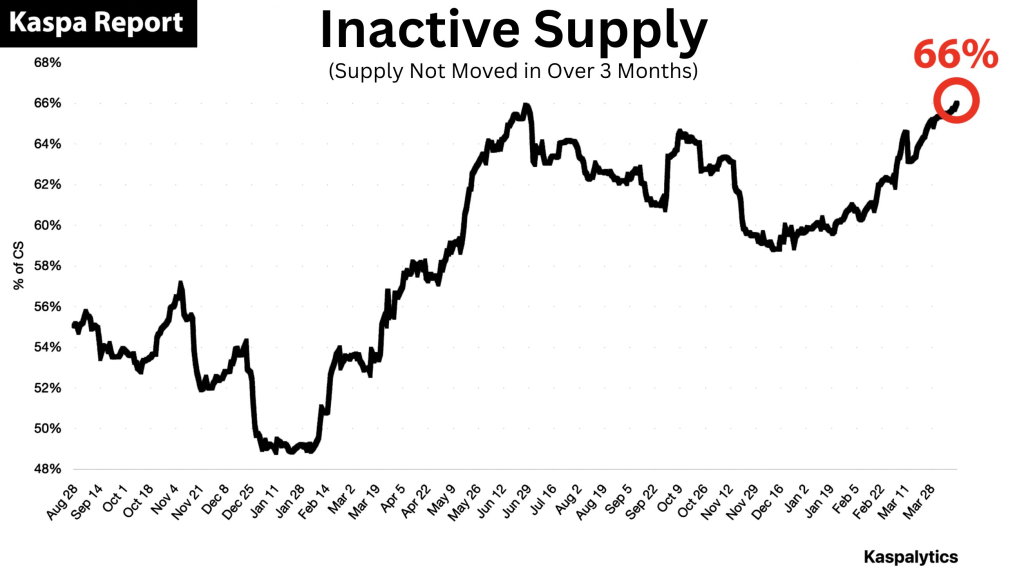

Still relatively unknown X account with 5.5k followers ‘Kaspa Report’ posted another viral tweet about KAS, this time highlighting inactive supply that’s on record high levels.

Inactive supply refers to coins that haven’t moved or been transacted for a specific period—in this case, over three months. When examining Kaspa’s metrics, 66% of the total supply currently sits inactive, which means strong conviction among holders who aren’t selling, trading, or using these coins.

This percentage is particularly significant in the cryptocurrency world, where many tokens see frequent trading activity. The high inactive rate implies that a substantial portion of the Kaspa community sees long-term value in holding the token rather than trading it for short-term gains. This behavior mirrors what analysts have observed with Bitcoin holders during previous bull runs; often referred to as “HODLing” in crypto circles.

The rising inactivity isn’t random but appears to be the result of Kaspa being increasingly used as a store of value, similar to how investors view gold or Bitcoin. Data shows a high coefficient of determination (R²) between time and inactive supply, meaning the longer time passes, the more people hold without moving their coins. This pattern suggests consistent accumulation and holding based on conviction rather than mere speculation.

Inactive Supply as a “Ponzi Detector”

One particularly interesting concept emerging from the analysis is using inactive supply metrics as a diagnostic tool for cryptocurrency legitimacy. The reasoning follows that in Ponzi-like projects, early holders typically dump their assets quickly on newcomers, causing inactive supply to shrink as coins constantly change hands.

Conversely, in legitimate, decentralized projects, early participants tend to hold, and inactive supply grows over time. By this metric, Kaspa’s consistently increasing inactive supply represents a strong sign of trust and long-term conviction among its holders—essentially displaying anti-Ponzi behavior.

Some proponents have gone so far as to claim that “every other asset in existence exhibits more characteristics of a Ponzi scheme than Kaspa.” While bold, this stance stems from Kaspa’s decentralized nature, lack of pre-mine, and absence of any central entity controlling the token. These factors, they argue, give Kaspa structural immunity to Ponzi-like failures.

The implications of this high inactive supply extend beyond technical metrics. It suggests long-term holders are in control of the market, and Kaspa is being treated more like digital gold—a store of value rather than a speculative trading vehicle. This creates a natural scarcity effect in the active market, potentially reducing sell pressure and contributing to price appreciation as demand grows. This may be vsible in Kaspa’s recent performance, which saw a 28% gain last week, bringing its trading price to $0.073.

Read also: How Much Could 100,000 KAS Tokens Be Worth by 2026? | Kaspa Price Prediction

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.