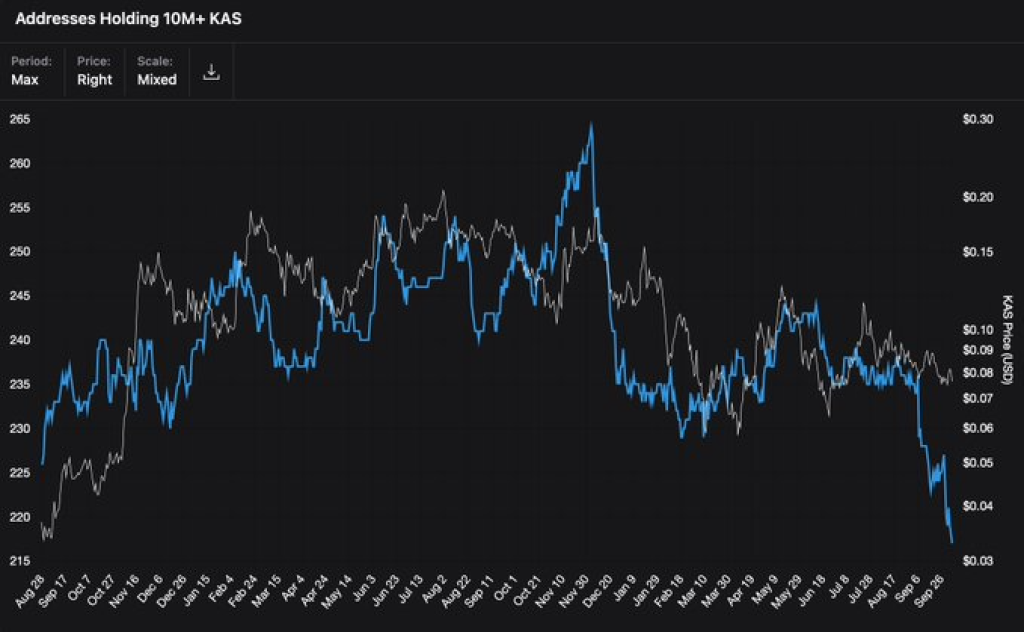

Kaspa’s on-chain data is showing an interesting shift this week. The number of addresses holding 10 million or more KAS has dropped to its lowest level ever, according to data shared by Kaspa Daily.

At first glance, that sounds negative, fewer whales often means big holders are cashing out. But that’s not what’s really happening here. Instead, it looks like large investors are simply reorganizing their holdings, not dumping them.

As Kaspa’s ecosystem grows, many wallets are being split up or moved around to integrate with new tools, Layer-2 infrastructure, and dApps that are beginning to emerge.

What you'll learn 👉

What the Kaspa Chart Is Showing

The chart comparing whale addresses to Kaspa’s price tells a detailed story. Over the past several months, the number of large wallets has steadily declined while the price slipped from around $0.25 to below $0.05.

On the surface, it looks like whales leaving, but the pattern isn’t showing sharp drops or panic moves. Instead, the decrease has been slow and consistent, suggesting redistribution rather than aggressive selling.

When whales actually sell off, we usually see a sudden collapse in both the whale count and price. Here, the two lines have diverged in a more controlled way.

That’s often what happens when large holders split their coins into multiple addresses for operational or security reasons. It’s also something we tend to see before major infrastructure upgrades or integrations, as projects prepare to handle new levels of on-chain activity.

So yes, the whale count is lower, but that doesn’t mean confidence is fading. It just looks like the big wallets are reorganizing behind the scenes.

Read Also: Here’s Why Zcash (ZEC) Price Is Pumping Today

Why Large Holders Might Be Restructuring

According to Kaspa Daily, this decline in large addresses reflects reshuffling, not retreat. Some whales are likely splitting funds to improve risk management and security, while others are moving between exchanges, cold wallets, and smart-contract addresses.

This comes at a time when Kasplex and other dApps are seeing more user activity. While the ecosystem expands, Ethereum whales are adapting, creating new wallets to interact with these protocols and diversifying their portfolios to stay nimble.

Kaspa is currently processing more than 2,000 transactions per second pic.twitter.com/ckZPEtQcI7

— Kaspa Daily (@DailyKaspa) October 5, 2025

Meanwhile, Kaspa’s underlying network is solid. The blockchain now processes over 2,000 transactions per second, a phenomenal achievement for a proof-of-work network.

That throughput volume puts Kaspa in contention as one of the fastest and most scalable L1s on the market, demonstrating that the project’s technology is still leading edge despite cooling market sentiment.

Market Sentiment and Price Behavior

Kaspa’s price has been under pressure for a while and is hovering around $0.07, but the network itself is more active than ever. Seeing over 2,000 TPS shows real demand and user engagement, even as large holders adjust their strategies.

Interestingly, a drop in whale concentration can actually be a healthy sign long-term. It means coins are spreading out across more addresses, which makes the network more decentralized and potentially less volatile. This kind of distribution often happens during accumulation phases, when smart money quietly positions ahead of the next cycle.

Kaspa’s chart still shows lower highs and lower lows, which fits with the broader consolidation phase the market is in. But when you combine strong fundamentals with higher on-chain activity, it’s easy to see why this might not be a bearish development at all.

Kaspa Short-Term Outlook

In the near term, Kaspa price is likely to keep moving within its range. There’s solid support around $0.06 and resistance building near $0.09. If network usage keeps growing and new projects launch within the ecosystem, that could help KAS bounce back toward the upper end of that range.

The decline in whale addresses isn’t a sign of weakness; it’s a sign of evolution. Kaspa’s biggest holders are adapting to a changing environment, not abandoning it.

With the network handling thousands of transactions every second and developer activity staying high, this reshuffling might actually be setting the stage for Kaspa’s next big phase of growth.

Kaspa’s fundamentals look stronger than ever, and if history is any guide, this kind of quiet restructuring often comes just before the next major move.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.