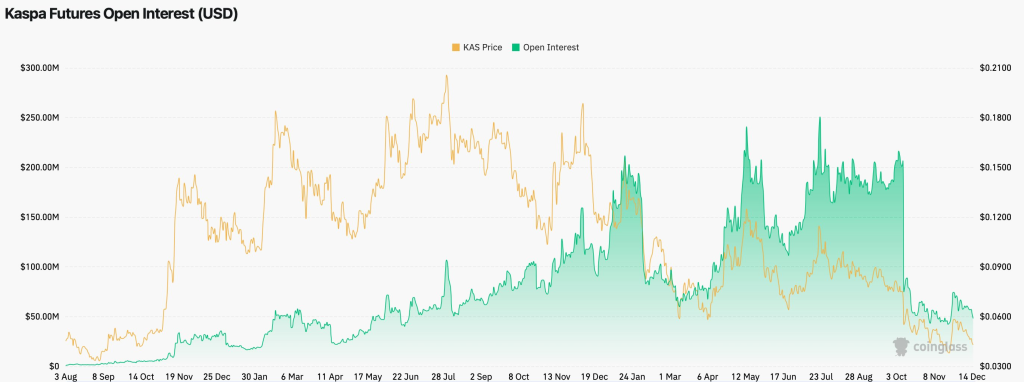

Kaspa is sending a very different signal than it did last year. Futures open interest has dropped back to levels last seen in summer 2024, yet the price is now roughly 80% lower. On the surface, that looks worrying. Underneath, it tells a more nuanced story about participation, leverage, and where KAS may sit in the market cycle.

The key difference this time is not price. It is behavior.

What you'll learn 👉

Open Interest Has Reset, But the Context Has Changed

In 2024, similar open-interest levels existed while Kaspa price was climbing. Spot demand was active, participation was growing, and leverage flowed in alongside real buyers. That combination supported higher prices and sustained momentum.

Today, open interest is low for a different reason. It is not lagging behind price strength. It is reflecting a lack of speculative interest altogether. Traders are not aggressively positioning on either side. Leverage has been flushed out, not rebuilt.

The chart below shows this clearly. Open interest peaked during prior rallies and collapsed during sell-offs, but it never returned with conviction. Each bounce in price failed to attract fresh leverage. Instead of crowding back in, traders stayed on the sidelines.

That is usually not what overheated markets look like.

Kaspa Price Is Weak, But Forced Selling Is Limited

Kaspa price has been under pressure for months, grinding lower with brief relief rallies that fade quickly. The important detail is how that decline has played out.

There have been no major liquidation cascades recently. No sudden spikes in open interest followed by sharp wipes. Volatility has cooled, not exploded. This means most weak hands and overleveraged positions already exited earlier in the cycle.

When leverage is high, even small moves can trigger violent sell-offs. When leverage is low, price tends to move slower and with less drama. That is exactly what Kaspa is showing now.

The market feels quiet because it is quiet.

This Looks More Like Apathy Than Fear

Late bear phases often share one common trait. People stop caring.

Volumes shrink. Price drifts. Sentiment turns indifferent rather than emotional. That appears closer to Kaspa’s current state than panic or euphoria.

Low open interest combined with depressed price usually signals reduced risk appetite. Traders are not chasing upside, but they are also not aggressively shorting. There is little conviction either way.

This type of environment can persist longer than expected. Markets do not bottom the moment leverage disappears. They bottom when selling pressure fades and demand slowly returns.

Read also: Why Kaspa (KAS) Could Be a Superior Tokenization Platform Compared to Ethereum

What Would Change the Picture for Kaspa

For Kaspa to shift out of this phase, the catalyst likely needs to come from spot demand, not derivatives.

A sustainable move higher would require buyers stepping in without relying on leverage. That usually shows up first through rising spot volume, stronger daily closes, and price holding key levels rather than spiking and fading.

If open interest starts rising alongside price and volume, that would signal renewed participation. Until then, any bounce driven purely by derivatives would likely remain fragile.

The current setup indicates the market is waiting, not positioning.

A Reset, Not a Breakdown

Kaspa does not look overheated. It looks emptied out.

That does not guarantee a reversal. Prices can stay low longer than expected in quiet markets. But it does reduce one major risk factor. With leverage already cleared, the downside becomes less sensitive to forced liquidations.

In many past cycles, this phase marked the transition from distribution to accumulation. Not explosive rallies, but slow rebuilding.

For now, Kaspa sits in that gray zone. Price is weak, interest is low, and conviction is scarce. That is often uncomfortable to trade, but it is also where longer-term narratives quietly start forming.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.