It is not every day that a cryptocurrency ranks among the most bullish tokens while its price keeps falling. Kaspa gets to this point consistently.

Despite heavy community optimism, consistent development updates, and a growing user base, the KAS price has continued to decline. This confuses even long-term supporters who believe in its fundamentals.

What you'll learn 👉

Kaspa Daily and Crypto Matt’s Observations Reflect a Common Mystery

The conversation around Kaspa’s price has become louder lately because of what analysts and community figures are noticing. On social platform X, Kaspa Daily (@DailyKaspa) pointed out that Kaspa ranks 3rd in bullish sentiment across the entire crypto market. Despite market volatility, KAS continues to attract consistent accumulation and strong community confidence.

So KASPA is consistently rated one of the top most bullish cryptos. And yet price has constantly gone down.

— Crypto Matt ꓘ (@cryptomatt1983) November 12, 2025

Can you say artificial manipulation? You cannot have a crypto with such a strong community base, such strong tech and fundamentals and make this make sense.

They… https://t.co/CdLGmj7JgQ

Shortly after, Crypto Matt ꓘ (@cryptomatt1983) added his own take, questioning why KAS continues to fall even with such enthusiasm surrounding it. He described it as “artificial manipulation,” suggesting that whales and exchanges might be accumulating quietly while the price remains low. According to him, this slow grind could be part of a broader accumulation phase before a major parabolic move.

Both perspectives highlight the same puzzle: KAS remains one of the most bullish tokens on paper, yet the Kaspa price keeps drifting downward. This unusual combination has left many wondering whether the current cycle is simply a cooldown phase or something deeper.

Kaspa Price Is Cooling Off After a 10,000% Rally

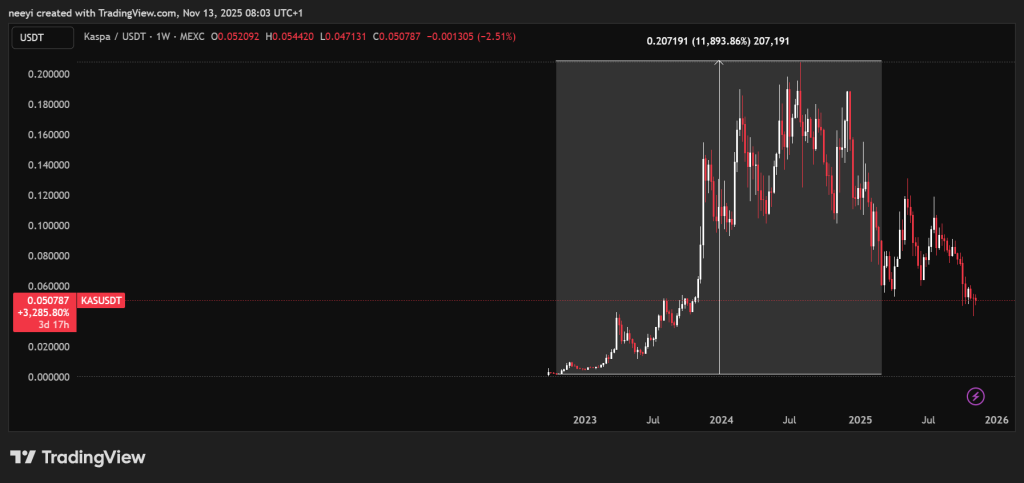

The answer may actually be simpler than it looks. Kaspa experienced a stunning 10,000% surge between October 2022 and July 2024. That move took the KAS price from fractions of a cent to an all-time high of about $0.2.

When an asset rallies that much in such a short period, it usually takes time for the market to reset. Even the strongest uptrends need pauses to allow fair value to catch up. Kaspa price decline of more than 70% since that high can therefore be viewed as a necessary correction rather than a collapse.

What often matters most is how the project performs during the cooldown. In Kaspa’s case, network development and technical innovation have continued at a steady pace. This is usually the foundation that supports a stronger move when the next bullish phase begins.

KAS Limited Exchange Listings Have Restricted Wider Exposure

Another key reason behind the Kaspa price struggle lies in accessibility. KAS has not been fully integrated across all major exchanges. While it is listed on Binance Futures and available on a few other platforms, it still lacks spot listings on major exchanges like Binance and Coinbase.

This limited exposure has a direct impact on liquidity and investor access. Many casual investors prefer trading on larger exchanges due to ease of use and reliability. Without those listings, Kaspa naturally misses out on part of that market flow.

Interestingly, Binance’s indirect connection to the project continues to grow. Kaspa’s founder was recently featured in a list of the top 100 blockchain innovators, and Binance itself has engaged with the project in some capacity through its futures listings. Still, until a full spot listing happens, some traders remain cautious. Listing expansion could therefore be a major catalyst for future KAS price momentum.

Market Conditions Have Also Been Against Kaspa

The crypto market environment since mid-2024 has not favored most altcoins. Bitcoin dominance has risen, drawing liquidity away from smaller projects, and only a few narratives, such as AI, real-world assets, and restaking, have shown significant strength.

Read Also: Canary Funds CEO Hails XRP ETF Approval: “A Win for Free Markets”

Kaspa’s ongoing downtrend is partly tied to this broader sentiment. Even with strong fundamentals, macro market conditions tend to overshadow individual performance. In bearish or uncertain phases, investors often rotate capital into more stable assets, leaving promising projects like Kaspa temporarily undervalued.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.