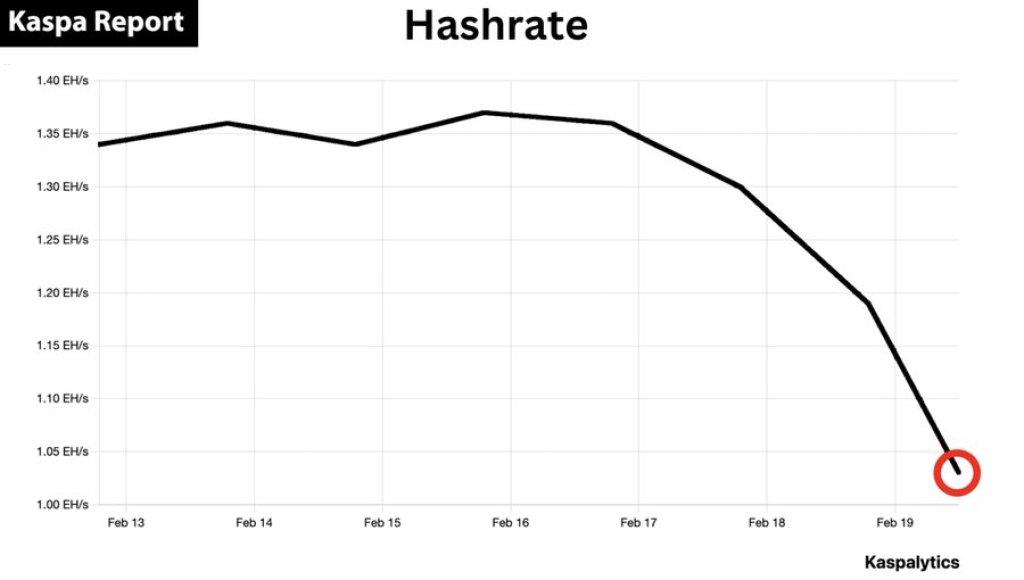

Data from the Kaspa network has shown a continued decline in hashrate, dropping below 1 exahash per second and marking a 40% decrease from its all-time high. According to Kaspa Report, this development, while seemingly concerning at first glance, may actually signal a strategic opportunity for investors.

This development is more concerning when one considers that the KAS price has continued to struggle. The price saw some bullish retracement last week, but for the past four days, it has started to struggle again below a critical support level at around $0.11.

If this struggle continues, we could see more downsides in the coming days. Now that the hashrate has also dropped, some reports from the community suggest it could be an opportunity for KAS holders. But how?

What you'll learn 👉

Understanding Hashrate Fluctuations

The hashrate of a proof-of-work (PoW) network represents its computational power dedicated to solving complex mathematical problems necessary for adding blocks to the blockchain, or in Kaspa’s case, the blockDAG.

While higher hashrates generally indicate better network security, temporary fluctuations are common and often misunderstood.

Kaspa Report explains that hashrate declines can stem from various factors, including routine maintenance by large miners, regulatory changes, or miner capitulation.

These temporary drops, often referred to as “noise” in the mining community, typically don’t impact the network’s long-term trajectory. When viewed on a logarithmic scale over extended periods, these fluctuations appear relatively insignificant.

The Role of Miner Capitulation in KAS Hadhrate Dip

The current hashrate decline appears largely tied to miner capitulation following Kaspa recent price decrease. As noted by Kaspa Report, the hashrate-implied value recently showed a substantial deviation from the fiat price, triggering some miners to halt operations – particularly those who may not fully grasp Kaspa’s value proposition.

We are likely seeing some degree of miner capitulation following Kaspa's recent price decline. At the time of Kaspa's price crash, the hashrate-implied value deviated substantially from its fiat price, as shown in this chart from earlier this month.https://t.co/taBNrmg3hF

— Kaspa Report (@KaspaReport) February 19, 2025

However, cryptocurrency analyst dodgedlol presents an optimistic perspective, suggesting that KAS is currently undervalued relative to its network hashrate.

Through power law analysis of price and hashrate correlation, the analyst indicates that such periods historically present attractive accumulation opportunities.

The Future of Kaspa Mining

Several factors could strengthen Kaspa’s mining ecosystem. The upcoming Crescendo hard fork promises to increase payout frequency by 900%, potentially attracting Bitcoin miners to switch operations to Kaspa.

Furthermore, Kaspa Report highlights that the network’s kHeavyHash algorithm is optimized for optical mining, a highly energy-efficient method that could significantly reduce operating expenses and minimize future miner capitulation events.

Long-term Network Security

Kaspa’s unique approach to mining incentivization suggests a promising future for network security. As Kaspa Report explains, the protocol’s design allows for perpetual mining rewards through continuous adjustment of the smallest unit, ensuring sustained miner participation even as emissions decline.

The relationship between fiat systems and proof-of-work mining adds another interesting dimension. Miners can effectively arbitrage cheap credit in fiat currency by converting it into scarce digital commodity money. This process, as described by Kaspa Report, accelerates the transition toward sound money principles.

Read Also: Can Ripple (XRP) Price Reach $100 and Become the Most Valuable Cryptocurrency?

Should Kaspa Investors Be Worried?

While the current hashrate decline might appear concerning, the underlying fundamentals suggest this may be a temporary setback rather than a cause for alarm.

As highlighted by MikoGenno and referenced by Kaspa Report, viewing money as an energy network helps explain why Kaspa’s efficient design and growing hashrate point to long-term sustainability.

For investors wondering about the implications of the current hashrate dip, the historical pattern suggests this could represent an opportunity rather than a warning sign. The combination of technological advances, protocol improvements, and market dynamics indicates that Kaspa’s network security continues to strengthen despite short-term fluctuations.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.