WLFI suddenly re-entered the radar this week. As soon as Bitcoin bounced back to $85,000, the WLFI price reacted instantly with a sharp 29% pump.

It wasn’t just a random sympathy move either, several catalysts lined up at the perfect moment and shifted sentiment almost overnight.

What you'll learn 👉

A WLFI Rebound Built on Strong Support

The price action tells the story pretty clearly. The WLFI price once again bounced off the $0.12 demand zone, an area that has repeatedly acted as a safety net for buyers.

The 4H chart shows how quickly momentum flipped once the rejection happened, sending the price back toward the $0.14–$0.15 region.

Vespamatic pointed this out, emphasizing how aggressively demand returned right after Bitcoin’s recovery. That quick surge validated the support and reminded the market that buyers are still paying attention.

Token Burn and Fresh Integrations Reinforce WLFI’s Momentum

The rally also came after a major supply event. WLFI burned 166.6 million tokens worth around $22 million, after removing assets linked to a phishing wallet.

That burn permanently reduced circulating supply and gave the community a confidence boost. Moments like this matter because they show the project is willing to protect its ecosystem.

Investors clearly noticed, and the market response confirmed it.

WLFI didn’t rely on a burn alone. The project recently integrated Chainlink CCIP, allowing cross-chain transfers between Ethereum and Solana.

It also participated in the Solana Liquidity event in Hong Kong, putting WLFI in conversations about expanding DeFi liquidity. With DeFi volume rising again, the timing couldn’t have been better.

Those developments helped fuel the momentum behind the rally and added fundamental support to what the charts are already signaling.

The WLFI Chart Hints at a Bigger Structural Shift

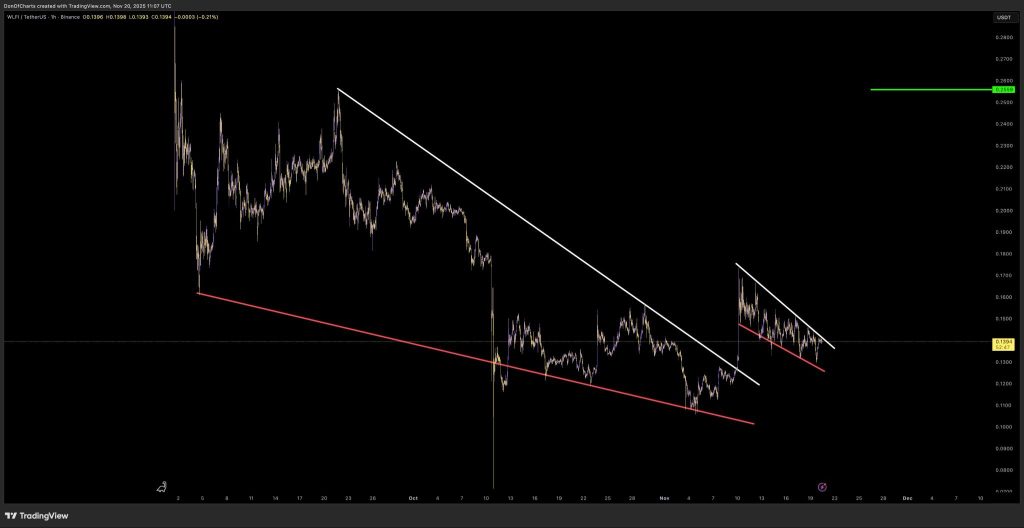

Don’s chart shows the WLFI price has been moving inside a long descending resistance trendline for weeks, but each pullback has gotten smaller, which usually means sellers are running out of steam.

Now the WLFI price is sitting right below that trendline, almost like it’s waiting for a decision. If WLFI can push through the $0.16–$0.17 area, Don points to roughly $0.255 as the next major target.

That level could completely shift market structure and spark a stronger rally. At that point, talk of a new all-time high doesn’t sound unrealistic at all, especially if volume kicks in during the breakout.

Read Also: Behind the Crypto Crash: Bitcoin Hit by a Forced Seller, Not Fear

Is a Breakout Finally Coming?

The WLFI chart has been forming descending wedges for months, and each breakout attempt has triggered a noticeable move.

The newest wedge looks similar, with the WLFI price coiling just below a clean downtrend line. If WLFI pushes above $0.16–$0.17, the next clear target sits around $0.255, which Don’s chart also highlights as the next major resistance.

Of course, Bitcoin remaining strong will play a big role, and WLFI needs to keep holding that $0.12 support. But for the first time in a while, the setup looks constructive instead of reactive.

A new all-time high isn’t guaranteed, but it finally feels like a realistic discussion, not just a hopeful one.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.