The renowned Twitter analyst Finish has recently shared an insightful thread on Twitter, providing a detailed analysis of the current situation in the cryptocurrency market.

Recent events surrounding USDT’s depeg and Huobi’s alleged insolvency have raised eyebrows and sparked discussions among the community.

The story began on August 1st, when, without any prior warning, the USDT started to depreciate. Initially, this didn’t raise too many alarms, as such occurrences had been observed several times before. In fact, the graph shows at least four instances of USDT depreciation, and even one instance involving $USDC.

As the situation developed, the share of $USDT in the Curve Finance 3pool began to grow significantly. It’s also worth noting that the depreciation of $USDC (represented by the yellow line on the graph) occurred simultaneously with the significant $USDT depreciation.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +While many might expect USDT to return to its peg as it has done in the past, this time the circumstances are different. Huobi’s involvement and the potential crash of such an exchange could be a black swan event for the entire crypto industry.

Justin Sun, a prominent figure in the crypto world, controls over $1 billion worth of assets. These assets are primarily in:

- $stETH (LSD by Lido Finance)

- $USDD (Stablecoin by Tron DAO)

- $TRX (Main coin of Tron DAO)

A significant event that has caught the attention of many is the massive withdrawal of funds from one major exchange to another. Justin Sun. who is also the owner of a well-known exchange, has reportedly moved a staggering $50 million from his own platform to a competitor’s. This move has led to a wave of speculation and concern among the community. Some are questioning the implications of such a large liquidity transfer to a competing platform.

The owner’s actions have been perceived as contradictory by part of the community. While encouraging others to “keep building” and expressing faith in his own exchange, he was simultaneously withdrawing a substantial amount from his own platform. This has led to skepticism and raised questions about the sincerity of his statements.

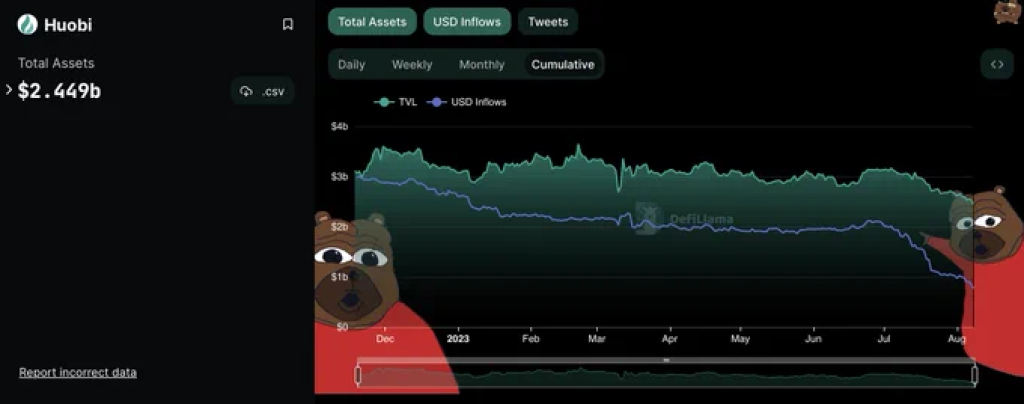

The situation has been further complicated by the fact that the exchange in question, Huobi, has seen massive outflows of over $1 billion since the onset of these events. Interestingly, the second largest share of funds belongs to the token $TRX. The potential impact of this outflow, if it continues to grow, could be significant and potentially catastrophic for the platform.

In addition to these outflows, Huobi has reportedly been converting almost all of the deposited $ETH to $stETH. This move is seen by some as an attempt to consolidate balances in the face of these challenging circumstances.

In light of these events, others in the community have advised caution. The recommendation is to withdraw all funds from centralized exchanges as soon as possible. This advice stems from the uncertainty surrounding these recent developments and the potential risks they pose to individual investors.