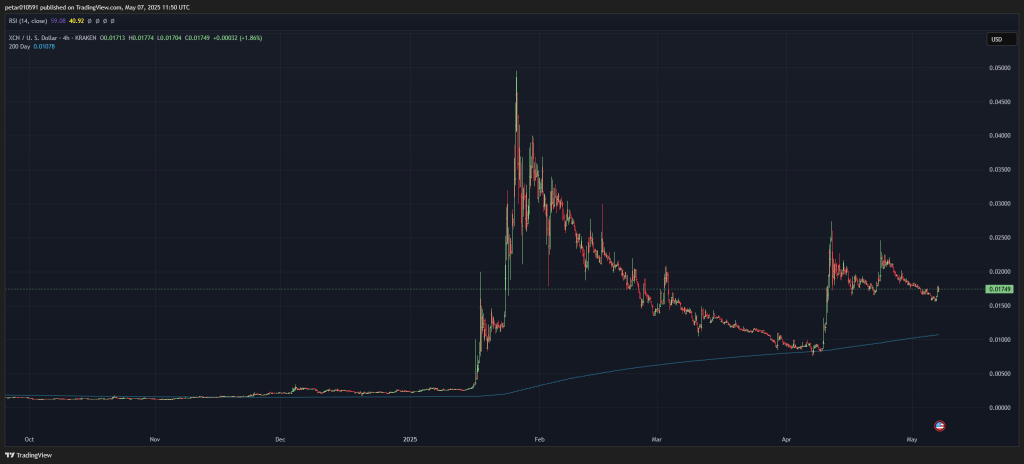

Onyxcoin (XCN) has had one of the most dramatic price charts of the year so far. After exploding from under a penny to more than five cents in early 2025, the token has since fallen sharply, giving back much of those gains.

Now, with the XCN price hovering around $0.017, many are asking the same question. Is it too late to buy, or is this just the calm before the next big move?

What you'll learn 👉

What the Chart and Indicators Are Saying

The chart tells a compelling story. XCN went nearly vertical between December and February, fueled by hype, volume, and perhaps some real belief in what the Chain protocol is building. But like most parabolic rallies, gravity eventually kicked in. The token peaked above $0.05 and quickly fell back into the $0.015 to $0.020 range, where it has been consolidating for weeks.

Interestingly, this is not just a slow bleed. The price action over the last month shows signs of stabilization. Buyers have been stepping in just above $0.015, and the token has managed to stay well above its 200-day moving average, which currently sits around $0.0107. That long-term support is still intact, which is something bulls can hold onto.

We also looked at a handful of weekly technical indicators to get a better sense of momentum.

The MACD is still positive, just above the zero line, showing weak but existing upward pressure. The CCI is sitting close to neutral at around -26, which tells us XCN is not overbought or oversold. It is simply waiting. The Ultimate Oscillator is just under 50, another sign of a balanced market with no clear momentum yet.

Meanwhile, the Rate of Change is sharply negative, confirming how steep the recent pullback was. However, ROC is a lagging indicator and can reverse quickly. Finally, Bull and Bear Power is slightly in the green, hinting that buyers have not given up yet.

| Indicator | Value | Interpretation |

|---|---|---|

| MACD | 0.003 | Weak bullish momentum, hovering just above neutral |

| CCI | -26.27 | Near neutral zone, no overbought or oversold signal |

| Ultimate Oscillator | 46.36 | Slightly bearish, below the 50 midline |

| Rate of Change | -40.82 | Strong bearish momentum in recent sessions |

| Bull/Bear Power | 0.0036 | Slightly bullish, buyers holding some ground |

XCN Price Forecast

In the short term, if the token holds above $0.015 and breaks through the $0.019 to $0.020 resistance zone, it could make a run back toward $0.025 or even $0.03. That would still be well below its February highs, but a meaningful move nonetheless.

On the flip side, if $0.015 breaks down, the next major support sits near $0.011, right around the 200-day moving average. That is where we would expect to see long-term buyers defend the price.

So, is it too late to buy XCN?

Not necessarily. But it is not early either. The explosive gains from sub-cent levels are likely behind us for now. What buyers are looking at today is a token that has cooled off, found support, and may be preparing for its next move, either up or down. It is in accumulation territory, not moon-shot mode.

If you believe in the long-term vision behind Chain and Onyxcoin, then buying in these ranges might still offer upside, especially if the broader crypto market heats up again. But for short-term traders, patience is key. Wait for a clean breakout above resistance or a stronger confirmation of trend reversal.

In the end, it is not too late, but it is definitely not a FOMO moment either.

Read also: We Asked AI to Predict Onyxcoin (XCN) Price in May

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.