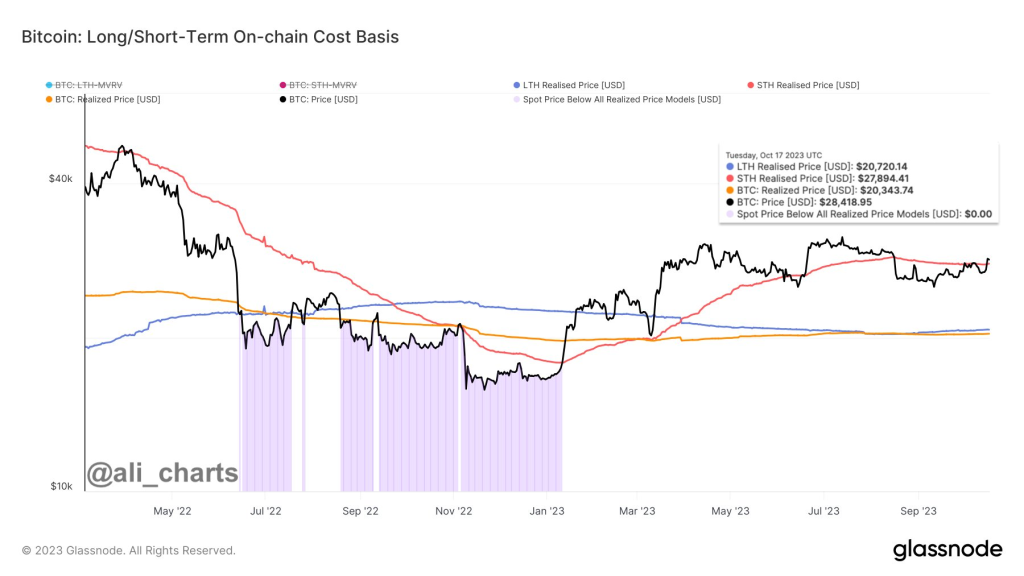

The bitcoin price has climbed back above $27,900 in recent days, an important milestone according to some analysts. This price level represents the average cost basis for bitcoin held by short-term investors who bought during the last several months.

With bitcoin crossing above this threshold, many short-term holders are now back in a profitable position on their investment if they sold at the current price. Previously, these investors were “underwater” as the bitcoin price dropped below their average purchase price earlier this year.

“Bitcoin has crossed the short-term holder cost basis of around $27,900, which is a crucial psychological benchmark.” said Ali, a cryptocurrency market analyst. “If BTC maintains above this level, those short-term holders previously underwater may be back in profit. This could signal a shift to a bullish market sentiment!”

The thinking is that short-term investors are more likely to sell when they are underwater on their investment, creating downward selling pressure on the price. But as prices rise back above their cost basis, these holders have less incentive to sell and may even look to extend their holding period.

This shift in sentiment could start to build positive momentum for bitcoin’s price. Without heavy selling pressure from short-term holders who are back in profit, bitcoin may see further upside as new money continues entering the market.

Whether or not bitcoin can sustain this bullish momentum will depend on various macroeconomic factors. But in the short term, crossing this important short-term holder cost basis threshold suggests the tide may be turning following the massive crypto sell-off seen earlier in 2022 and this year as well.

Bitcoin is currently trading around $28,200.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.