Bitcoin, the world’s largest cryptocurrency by market capitalization, has been the subject of intense speculation and analysis by traders and investors worldwide. With its historical price movements serving as a guide, top-notch analysts have weighed in with their insights on potential future price trajectories. Let’s delve into the details.

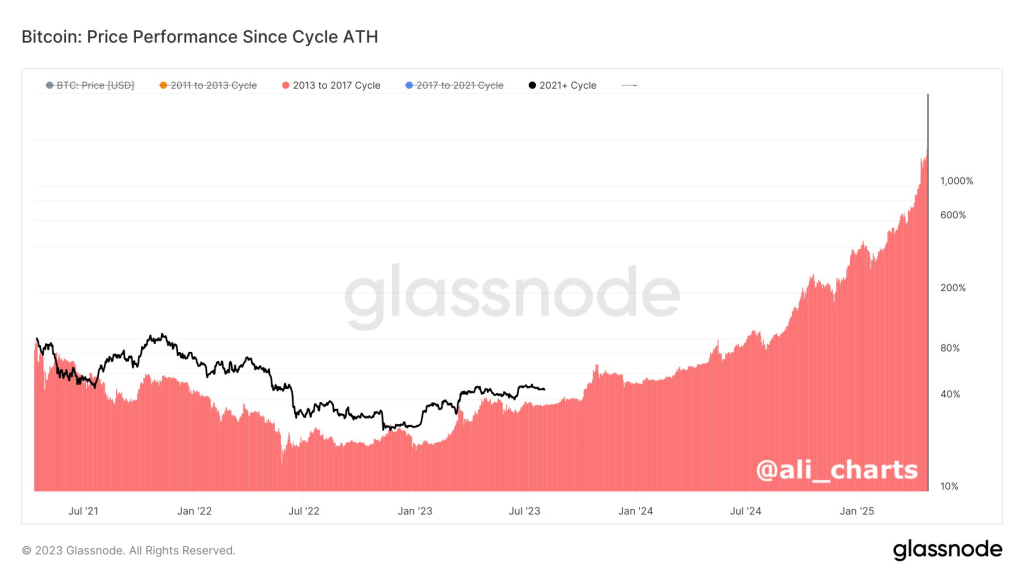

Famous Twitter analyst Ali, known as @ali_charts, recently shared a fascinating observation on Bitcoin’s price history. In his tweet, he noted that Bitcoin’s price trajectory post-2021 all-time high appears to be mirroring the 2013-2017 bullish cycle.

This suggests that if history were to repeat itself, we could potentially see another significant price surge in the near future. However, it’s important to remember that while historical patterns can provide valuable insights, they are not guaranteed predictors of future performance.

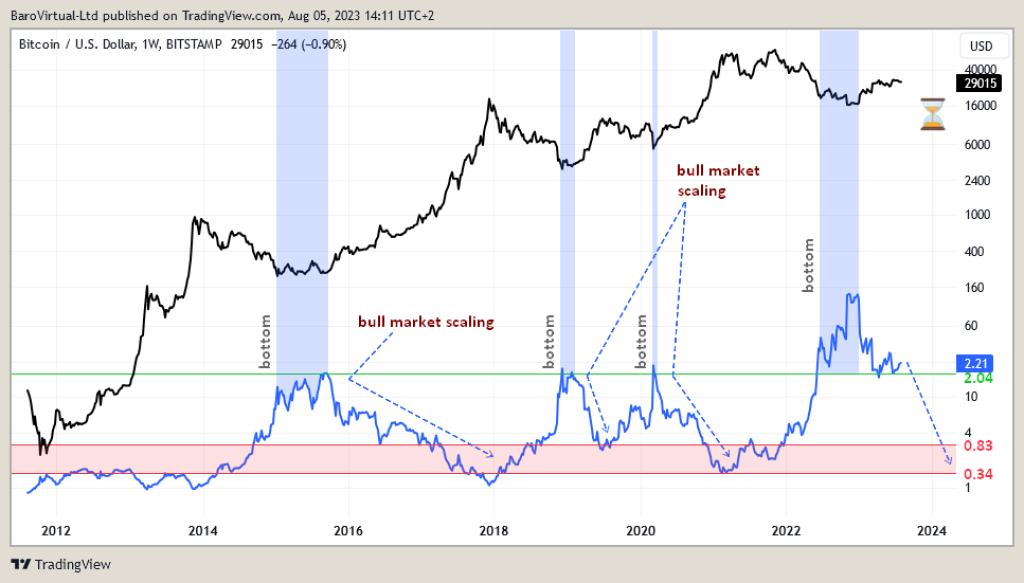

Technical analysis expert BaroVirtual⚡, or @BaroVirtual, provided another perspective using the Accumulation Ratio. This indicator determines the long-term picture of an asset’s value, filtering out local (intermediate) noise. According to BaroVirtual⚡, Bitcoin is still in the value zone.

When the indicator curve, represented in blue, falls below 2.04 and continues to decline, it signals a bull market scaling. Bitcoin usually only tops when the indicator hits the 0.83-0.34 zone. The Accumulation Ratio, in essence, is a tool that helps investors identify periods of accumulation – when the market participants are buying up the asset, potentially indicating a future price increase.

Well-known trader ecoinometrics (@ecoinometrics) also shared his thoughts on Bitcoin’s potential for another parabolic move. He suggested that buying Bitcoin now might not be a bad idea if one believes in another bull run. While he cautioned that the 100x returns seen after 2011 and 2015 might not be repeated, he did not rule out the possibility of 10x to 30x returns.

“You are not going to see 100x returns like you did after 2011 and 2015. But 10x~30x, that’s not impossible.” says @ecoinometrics.

In conclusion, while the future of Bitcoin’s price remains uncertain, these top analysts provide compelling perspectives based on historical data and technical indicators. As always, investors should conduct their own research and consider their risk tolerance when making investment decisions.