The BTC price doesn’t move in a bubble. And when geopolitical tension starts heating up, Bitcoin usually acts a lot less like “digital gold” and a lot more like what it really is in today’s market: a risk asset.

That’s basically the point analyst Ardi is making. When conflict escalates, big money doesn’t rush into crypto for safety. Institutions usually do the opposite. They cut risk, sell anything speculative, and rotate into the classic safe zones like oil, gold, treasuries, and cash.

So if tensions between Iran and the US intensify, the first real warning sign probably won’t come from crypto Twitter. It’ll come from crude oil.

What you'll learn 👉

What the Chart Shows: Oil Moves First, BTC Reacts

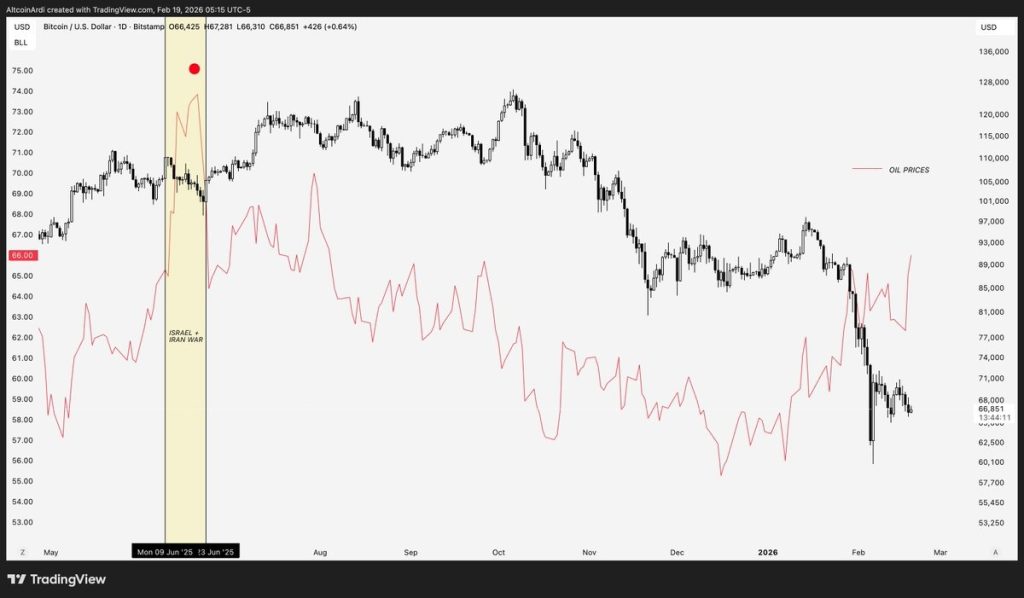

The chart shared by Ardi makes the relationship pretty clear. Oil prices are shown in red, and the BTC price is the black candlestick trend.

Back in June 2025 during the Israel-Iran conflict window, oil jumped from the mid-$60s up into the low-$70s. That spike happened first. Bitcoin was sitting above $105K, but once oil started ripping higher, the BTC price dropped fast into the mid-$90Ks.

That sequence matters a lot. Oil didn’t follow Bitcoin. Bitcoin followed oil. And the chart also shows the broader weakness into early 2026, where the BTC price has stayed under pressure as oil volatility remained elevated. That’s what risk-off looks like in real time.

Why War Isn’t Automatically Bullish for Bitcoin

A lot of people in crypto love the idea that war equals chaos, and chaos automatically sends Bitcoin higher. But markets don’t really work that way.

Bitcoin still trades in the same bucket as tech stocks and other high-risk assets. When geopolitical stress spikes, funds don’t suddenly treat BTC like a commodity hedge. They sell first, reduce exposure, and move into safer assets.

Oil reacts instantly because it’s tied directly to supply disruption. Conflict in the Middle East can threaten energy flows overnight. The BTC price reacts differently, mostly through liquidity leaving speculative markets.

An Oil Spike Could Drag BTC Lower

The bearish setup is pretty simple. Crude is sitting near $65 right now. If Iran escalates and oil starts pushing toward $75 or $80, institutions will likely flip into full risk-off mode.

In that scenario, the BTC price could easily see another sharp leg down, similar to what happened in June 2025, or even worse. If key support levels break, a deeper flush becomes very realistic. The market usually doesn’t calm down until oil volatility cools off. Selling pressure often continues until crude finally tops out.

Read Also: Analyst Warns Against Being Bullish on Crude Oil, Points to Potential Dangers Ahead

If Oil Stays Contained, BTC Can Stabilize

The bullish case depends on oil not breaking out. If crude stays rangebound and tensions don’t disrupt supply, risk markets can breathe again.

That gives the BTC price room to stabilize, especially if buyers step in at major support or macro conditions improve. Bitcoin doesn’t need peace headlines as much as it needs oil to stop flashing danger.

The takeaway is simple: oil is often the lead indicator during geopolitical shocks. If crude starts running, the BTC price usually isn’t far behind on the way down.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.