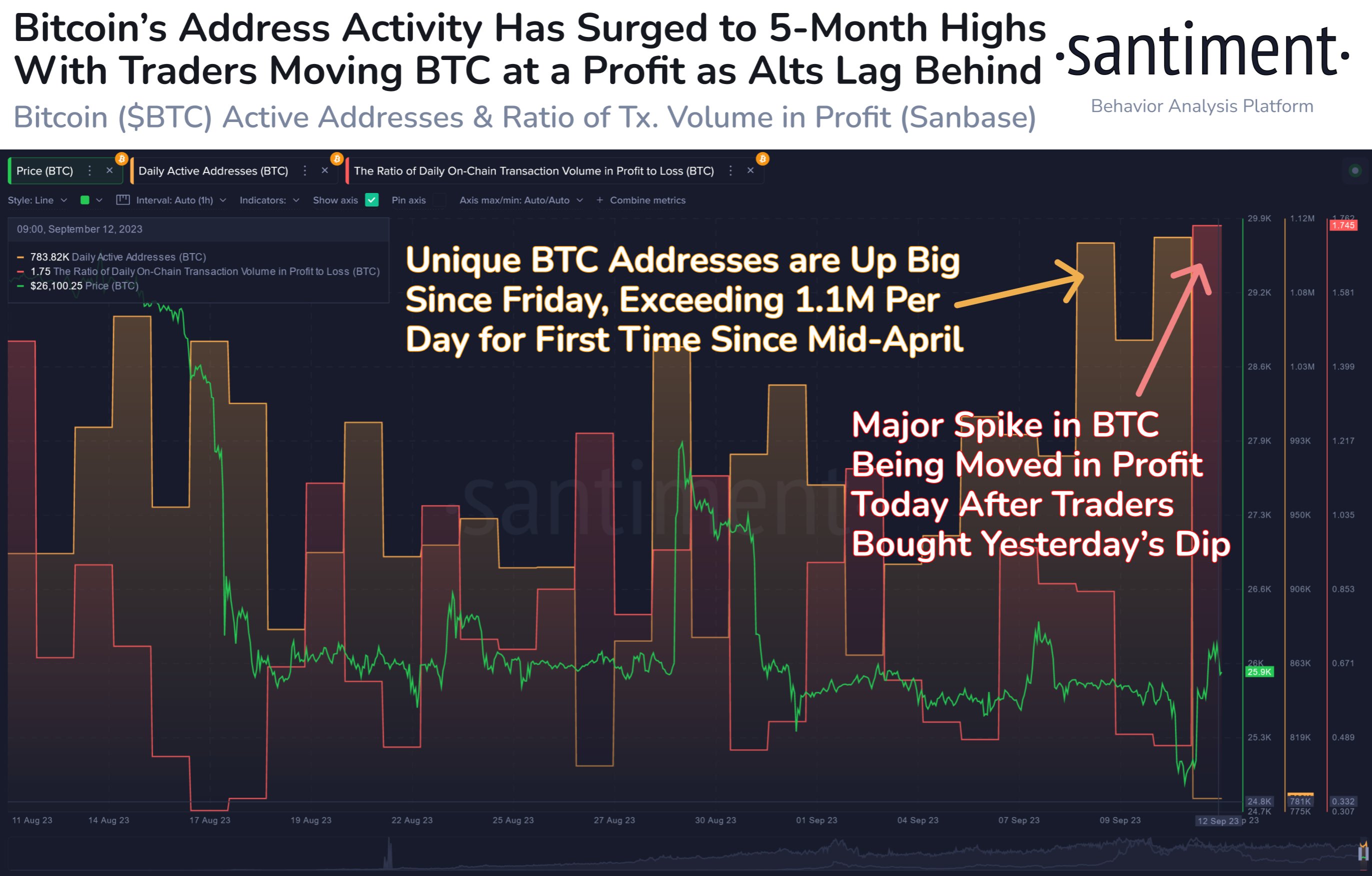

Bitcoin (BTC) has recently experienced a resurgence, seeing its price spike to an impressive $26,500. This comes after a period of turbulence that left investors and traders on edge.

Source: Santiment – Start using it today

What you'll learn 👉

Record-Level Activity

This price hike isn’t an isolated incident; it correlates with an uptick in network activity. The Bitcoin network has registered around 1.1 million daily addresses involved in transactions since last Thursday. To put that into perspective, this marks a 5-month high in network activity, illustrating a renewed sense of engagement and enthusiasm in the cryptocurrency’s ecosystem.

Trader Behavior: Profit-Taking Ensues

As Bitcoin’s price inches upward, today’s trading activity shows signs of traders capitalizing on the recent gains. Profit-taking is in full swing after the mild yet promising price escalation observed since yesterday. While some may see this as a sign of vulnerability, it’s worth noting that such behavior is typical in volatile markets and often lays the groundwork for the next leg up.

A Snapshot of Market Dynamics

This surge in both price and network activity could be symptomatic of various factors—ranging from favorable regulatory news to renewed institutional interest or even speculative trading driven by retail investors.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The Road Ahead

What does this mean for Bitcoin and the broader cryptocurrency market? As it stands, the spike in daily addresses could point toward increased adoption or even serve as an early indicator for future price gains. While traders taking profits today might slow down the immediate momentum, the underlying factors driving the heightened network activity could catalyze further growth.

In summary, Bitcoin’s latest performance offers a cautiously optimistic outlook, buoyed by high network activity and opportunistic trading. As the cryptocurrency continues to shape-shift in response to market dynamics, all eyes will be on whether it can sustain or even build on its recent gains.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.