Injective has stayed far quieter than during its earlier surge, and INJ price has followed the same direction. Momentum that once carried the project toward multibillion valuation has faded into a prolonged correction.

One analyst now argues that the decline did not appear suddenly. Signals of weakness may have existed long before the fall became obvious.

Analysis shared by Our Crypto Talk examines how Injective moved from strong narrative strength to deep price contraction. INJ price once aligned with expectations tied to on chain derivatives, fast execution, and expanding integrations.

Market enthusiasm lifted valuation close to $4 billion during the previous cycle. Liquidity conditions later tightened, which forced investors to reassess whether adoption and capital depth justified that scale.

Injective Price Structure And Valuation Disconnect Emerged Before The Decline

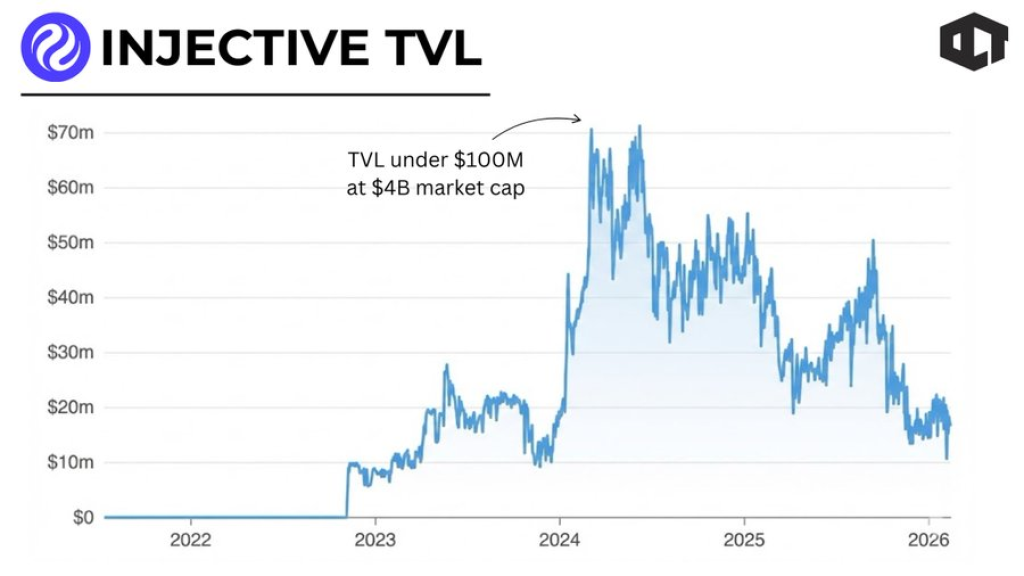

Our Crypto Talk highlights how INJ price rose vertically during the expansion phase. Rapid appreciation can persist only when supported by sustained usage and durable liquidity. Injective struggled to demonstrate capital retention at the same pace as valuation growth.

Total value locked remained under $100 million even as market capitalization climbed into the billions. That imbalance suggested expectations had moved ahead of measurable activity.

Technical structure also began to weaken before the broader drop accelerated. Injective price failed to reclaim the previous breakout region near $10 during a later market recovery attempt. Rejection at that level signaled fading buyer conviction.

Momentum indicators showed limited strength, and the downward trend channel remained intact. Once former support shifted into resistance, probability favored continued weakness instead of quick reversal.

These structural details reinforced the idea that the correction represented more than temporary volatility. Price behavior aligned with a deeper reassessment of fundamentals rather than a short lived dip.

Liquidity Concentration And Lower Expectations Now Shape Potential INJ Recovery Path

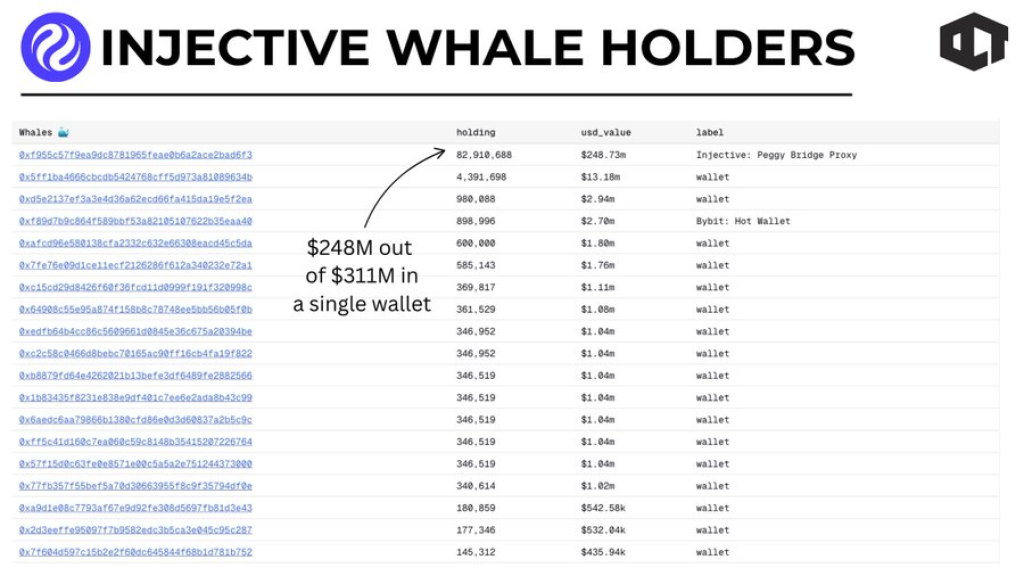

Our Crypto Talk also points to supply distribution as an additional pressure factor. A large portion of INJ sits within infrastructure linked wallets tied to bridge or protocol mechanics.

Even without discretionary selling, concentrated supply reduces effective circulating liquidity. Thin tradable float often leads to sharper drawdowns and slower recovery phases. Market depth becomes harder to rebuild under those conditions.

Current valuation near a few hundred million dollars reflects far lower expectations than during the earlier peak. Paradoxically, reduced narrative pressure can create a healthier foundation for long term rebuilding.

Sustainable recovery would likely require measurable expansion in total value locked, stronger derivatives activity, and broader participation beyond concentrated holders. Technical structure would also need to reclaim previously lost resistance zones before confidence could fully return.

Injective still maintains functional technology and presence within decentralized finance infrastructure. Competitive pressure across DeFi remains intense, which means progress must translate into clear capital commitment to influence INJ price direction again. Our Crypto Talk frames the present stage as correction and recalibration rather than final outcome.

Read Also: Silver Price Time Bomb: Bank Shorts Are Now Bigger Than Global Supply

Market cycles often expose gaps between narrative and measurable adoption. Injective’s journey from multibillion hype to deep retracement illustrates how quickly sentiment can change when liquidity tightens. Observing whether capital, usage, and structure begin to strengthen may reveal if INJ can eventually rebuild from quieter foundations toward a more durable phase ahead.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.