Injective unveiled what they’re calling “the most advanced EVM to date,” showcasing performance metrics that could reshape the blockchain landscape. According to Injective’s posts on X, their Enhanced Virtual Machine (EVM) demonstrates speeds up to 1200% faster than competing chains, marking a significant leap forward in blockchain technology.

Unlike traditional blockchain platforms that treat EVM as a modular addition, Injective has taken a fundamentally different approach. The team has embedded EVM directly into their core architecture, creating what they describe as a “fully unified environment.” This native integration allows for seamless interaction with WASM, Real World Asset (RWA) modules, and Injective’s institutional liquidity network.

1/ Today, Injective is unveiling the most advanced EVM to date.

— Injective 🥷 (@injective) January 29, 2025

Injective’s EVM is currently over 1200% faster than competing EVM chains. It brings institutional-grade scalability, AI-ready infrastructure, and a MultiVM architecture.

Here’s everything you need to know: pic.twitter.com/FpWAht7Fbs

The performance metrics shared by Injective are nothing short of impressive. During rigorous testing phases, the platform consistently outperformed leading networks across various parameters.

In mainnet-simulated conditions, Injective achieved 800 TPS for lightweight transactions and 320 TPS for heavy transactions, maintaining consistent one-second block times. To put this in perspective, the current record for TPS on mainnet is held by Base at approximately 155 TPS, making Injective’s performance at least twice as fast.

What you'll learn 👉

Pushing the Boundaries: The Path to 20,000 TPS

Injective’s team didn’t stop at basic improvements. Through innovative use of bundlers and account abstraction, they’ve managed to push the system’s capabilities even further. The platform has demonstrated throughput capabilities of up to 12,500 TPS, with maximum throughput reaching an astounding 20,000 TPS. These numbers position Injective as a frontrunner in blockchain scalability innovation.

Read Also: Litecoin Bulls Take Charge as LTC Price Rally Gains Momentum

One of the most significant improvements in Injective’s update is the introduction of complete transaction atomicity. This feature addresses a common problem in most EVM environments where partial execution of failed transactions can lead to unexpected outcomes. Injective ensures that if any part of a transaction fails, the entire transaction reverts, providing crucial protection for users and developers alike.

AI-Ready Infrastructure

Perhaps most intriguingly, Injective has positioned its updated EVM as AI-ready, enabling developers to execute AI inference models directly on-chain. This groundbreaking feature opens up possibilities for DeFAI (Decentralized Finance AI) applications, including AI-powered portfolio rebalancing and autonomous DAO treasury optimization.

The Injective team has ensured their platform remains accessible and efficient for developers. The system uses the latest Geth version, ensuring compatibility with modern development tools like Foundry and Hardhat right out of the box. Additionally, their innovative Single Token Representation system eliminates common inefficiencies like double accounting and manual bridging, streamlining cross-chain interactions.

Read Also: Litecoin Bulls Take Charge as LTC Price Rally Gains Momentum

Currently, Injective’s enhanced EVM is available in beta testnet for developers. The comprehensive nature of this update, combining unprecedented speed with advanced features like AI integration and improved security measures, positions Injective as a potential game-changer in the blockchain space. As the platform continues to evolve, the question remains: will these technological advancements translate into increased value for the INJ token?

With institutional-grade scalability, AI-ready infrastructure, and a MultiVM architecture, Injective’s latest update represents a significant step forward in blockchain technology. As the team continues to push the boundaries of what’s possible in on-chain finance, the crypto community watches with keen interest to see how this technological leap will impact the broader ecosystem.

Will INJ Price Follow Suit?

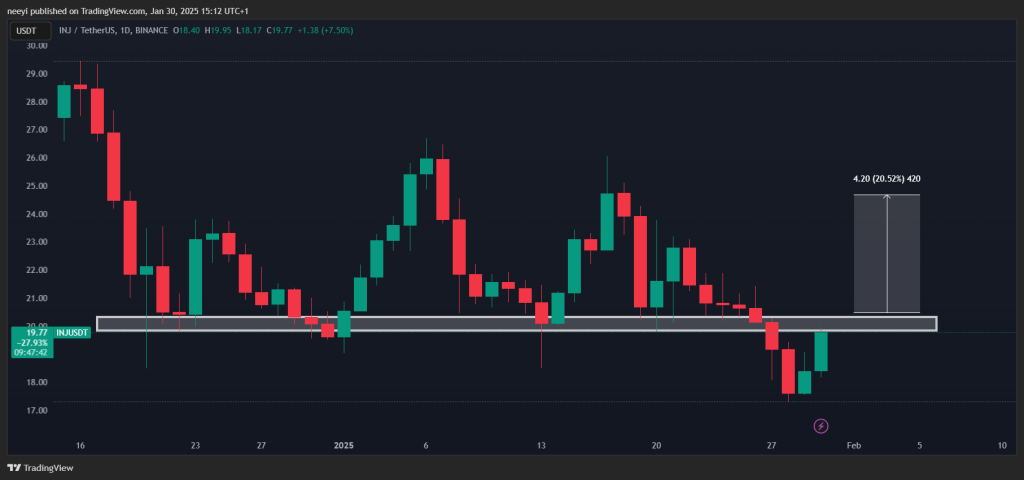

The price of INJ has spiked by more than 11% in the past two days. The INJ price has been trying to retest a broken resistance level at around $19.80.

Buyers will be hoping that the retest is unsuccessful, aiming for a break above the resistance at around $19.80 and $20.30. Breaking above this level could initiate a rally for INJ. However, if this support holds, there could be a bearish continuation or consolidation.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.