Some metrics are showing signs of potential reversal for Dogwifhat (WIF). The meme coin is positioning for what could be a big rally according to some market analysts. As sentiment indicators reach critical levels, players in the space are pointing to historical patterns that suggest WIF may have found its bottom.

Cronald Dump, a crypto commentator highlighted the correlation between extreme fear in the market and yearly price lows. “Note: Each time we saw this level of fear it has been year low. If this is not signal for you that $WIF bottomed then I do not know what is,” Dump posted on X.

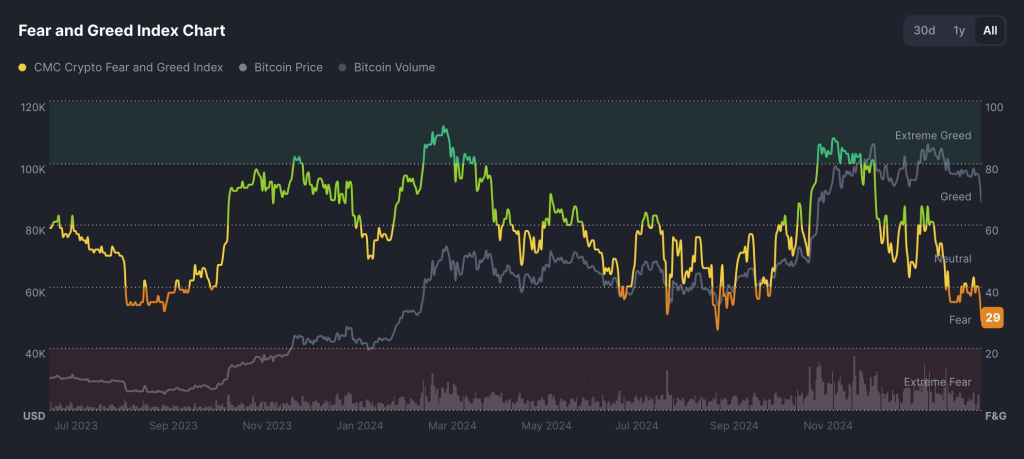

The Fear and Greed Index is a key sentiment indicator for crypto markets. It has dipped into the Fear zone with a reading of 29. This metric, which ranges from extreme fear (below 20) to extreme greed (above 80), has historically served as a signal for market reversals.

Fear and Greed Index Yearly Low Leads to a Rebound for WIF

Kevin Svenson, another analyst, echoed this sentiment, noting that “Each time we have hit this level of extreme fear, it has been the yearly low.” His observation is backed by market data spanning from mid-2023 to early 2025, which shows a consistent pattern of price rebounds following periods of extreme fear.

Looking at the chart data, we can observe a strong correlation between the Fear and Greed Index (represented by the yellow line) and Bitcoin price movements (shown by the gray line). The cyclical nature of these metrics reveals that previous dips into the Fear zone during September 2023, January 2024, and September 2024 all marked significant bottoms before substantial rallies.

“We are in 2025, year in which crazy moves will happen,” Cronald Dump emphasized in his analysis. “Prices will ‘go way higher’ than what we saw in 2024.” His advice to investors was straightforward: “Stack hats and hodl.”

The relationship between Bitcoin price and the Fear and Greed Index has been consistent over the observed period. Peaks in the Greed and Extreme Greed zones have aligned with Bitcoin price highs, while Fear levels have consistently signaled price bottoms.

Read Also: Indicator Signals ‘Buy’ for Chainlink (LINK) as Key Metrics Turn Bullish: Here’s the Outlook

What makes the current situation particularly noteworthy is the trading volume, displayed as bars at the bottom of the chart. Periods of heightened fear combined with increased volume have historically preceded some of the most significant price movements in the market.

According to Svenson, the current Fear level marks a “full reset” of market sentiment, similar to patterns observed before previous yearly lows. If this historical trend continues to hold true, the current market conditions could represent a prime buying opportunity for Dogwifhat and other cryptocurrencies.

Cronald Dump’s target of “42.69” for WIF suggests significant upside potential from current levels, assuming the pattern of fear-driven bottoms continues to play out as it has in previous cycles.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.