With Bitcoin still in the early stages of its current bull run, many crypto analysts are forecasting an extended period of rising prices ahead.

Based on historical patterns, Bitcoin bull markets tend to last substantially longer than bear markets.

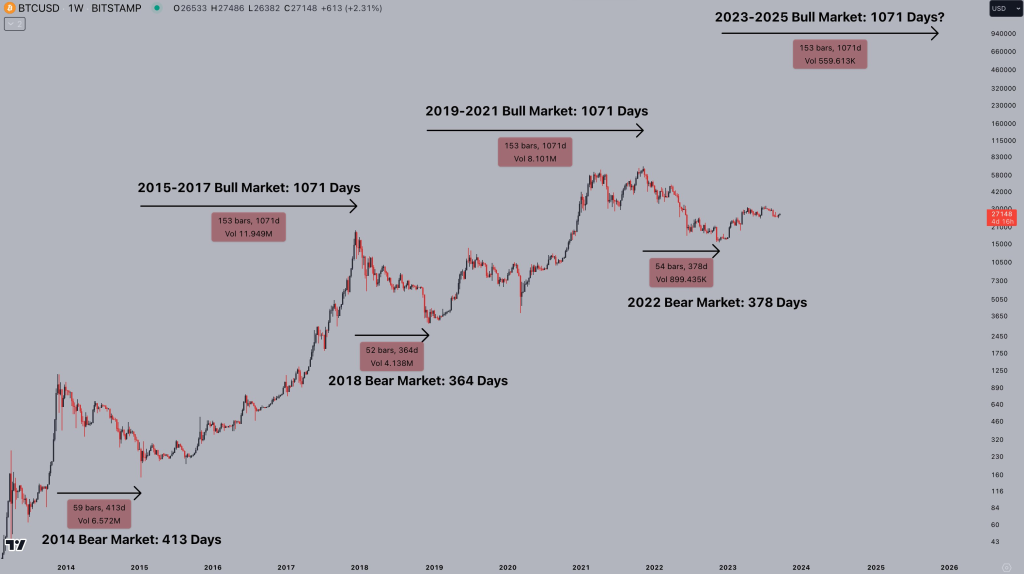

“While Bitcoin bear markets generally take between 350 and 400 days to complete, past bull markets have run for well over 1000 days!” said Jelle. “If this pattern continues, we have >750 days of bull market ahead of us.”

Bitcoin’s most recent bear market spanned approximately 400 days, extending from early 2018 through late 2019. The prior bear cycle from 2014-2015 lasted around 350 days. In contrast, the 2013-2017 bull run lasted nearly 1400 days as Bitcoin prices rose from under $100 to almost $20,000.

Some key factors supporting an extended bullish outlook include growing institutional adoption, mainstream media attention, and innovations like the Lightning Network and ETFs approvals which are expanding Bitcoin’s utility. However, risks such as regulation and competitor cryptocurrencies could potentially cut the bull run short.

As the longest-running cryptocurrency, Bitcoin has gone through multiple boom and bust cycles since its creation in 2009. This time around, renewed investor and developer interest coupled with maturing technology suggests its uptrend still has room to run. While predicting any asset’s price is challenging, historical patterns hint that Bitcoin’s current bull run likely has over two years left until the next prolonged bear phase.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.