The Federal Reserve has announced an interest rate cut of 0.50 percentage points yesterday, marking the first reduction in over four years.

Bitcoin’s price reacted positively to this news, pumping from the $59K range to now over $62K.

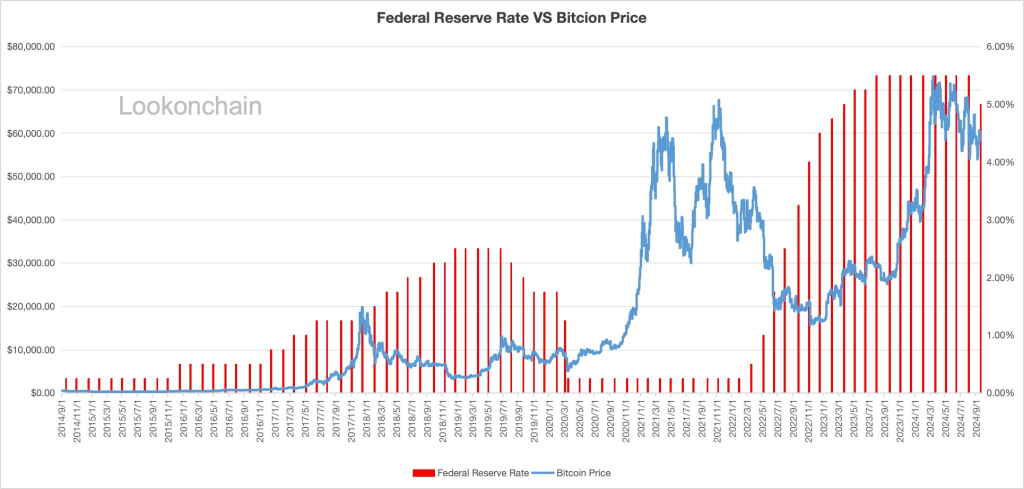

LookOnChain posted a chart breaking down how rate cuts have actually affected Bitcoin’s price over the past 10 years. Let’s take a closer look.

What you'll learn 👉

Rate Cuts and Bitcoin: Historical Breakdown

From 2015 to 2016, the Federal Reserve kept interest rates relatively low, around or below 0.5%. During this time, the BTC price stayed pretty steady at lower levels and didn’t show much reaction to the low rates.

Things got interesting in 2017 and 2018 though. The Fed started hiking rates big time, especially in the second half of 2017. Rates jumped from below 1% to almost 2.5% in 2018. However, despite these rate hikes, Bitcoin went on a tear, hitting nearly $20,000 in late 2017 – its first major peak. But as the Fed kept raising rates in 2018, the Bitcoin price took a big hit, crashing back to the $3,000-$4,000 range by early 2019.

In 2019, the Fed made some rate cuts, bringing rates down from about 2.5% to just above 1.5%. Bitcoin’s price didn’t move much during this time, staying mostly between $8,000 and $10,000. Then 2020 hit, and with the pandemic, the Fed slashed rates to nearly 0%. Bitcoin loved this, growing in the second half of 2020 and smashing past $20,000 by year’s end.

2021 was Bitcoin’s year to shine. With rates still super low (around 0%), Bitcoin’s price went through the roof, reaching its all-time high of around $70,000 in late-2021. It seems those ultra-low rates really fueled Bitcoin’s bull run as investors looked for alternatives in the low-interest environment.

From 2022 to now, we’ve seen the Fed aggressively hiking rates again, going from 0% to over 5% by 2023. Bitcoin felt the heat, dropping from its 2021 highs to below $20,000 at various points. It’s since bounced back to the $25,000-$30,000 range, but these rate hikes seem to have cooled off Bitcoin’s momentum a bit.

Read also: This XRP Chart Looks Like a ‘Time Bomb’ – Will Ripple’s Token Repeat 2017?

How a 50bps Rate Cut Might Affect BTC in 2024

With the Federal Reserve announcing a 50bps rate cut yesterday, we might see a bullish impact on Bitcoin. This is based on how the market has reacted to similar events in the past. Usually, when the Fed cuts rates, it leads to more money flowing around and cheaper borrowing. This often pushes investors towards riskier assets like Bitcoin, which tend to do well when interest rates are low.

The rate cut could make it easier for people and businesses to borrow money. This typically gives a boost to speculative investments. Investors looking for better returns might turn to Bitcoin, as it’s done well during times when monetary policy was loose.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Lower rates also mean traditional savings accounts and bonds don’t pay as much. This could make Bitcoin more appealing as a way to protect against inflation or the weakening of regular currencies. With this rate cut, we might see more people interested in Bitcoin as a way to store value.

That being said, the crypto market has had some rough patches when rates went up, but this cut could bring back some positive vibes. This is especially true for investors who aren’t afraid of a bit of risk and see Bitcoin as a way to hedge their bets or make some speculative gains. If the broader economic picture looks good, this rate cut could help push Bitcoin’s price upward.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.