The ongoing tensions between Israel and Palestine have raised concerns about potential impacts on financial markets and cryptocurrencies like bitcoin. According to experts, geopolitical conflicts often create volatility in markets as investors react to uncertainty.

According to Miles Deutscher, In the short-term, escalations in the Israeli-Palestinian conflict could lead to fluctuations in stock prices and currency exchange rates. However, historically markets have shown resilience and eventually stabilized after geopolitical shocks.

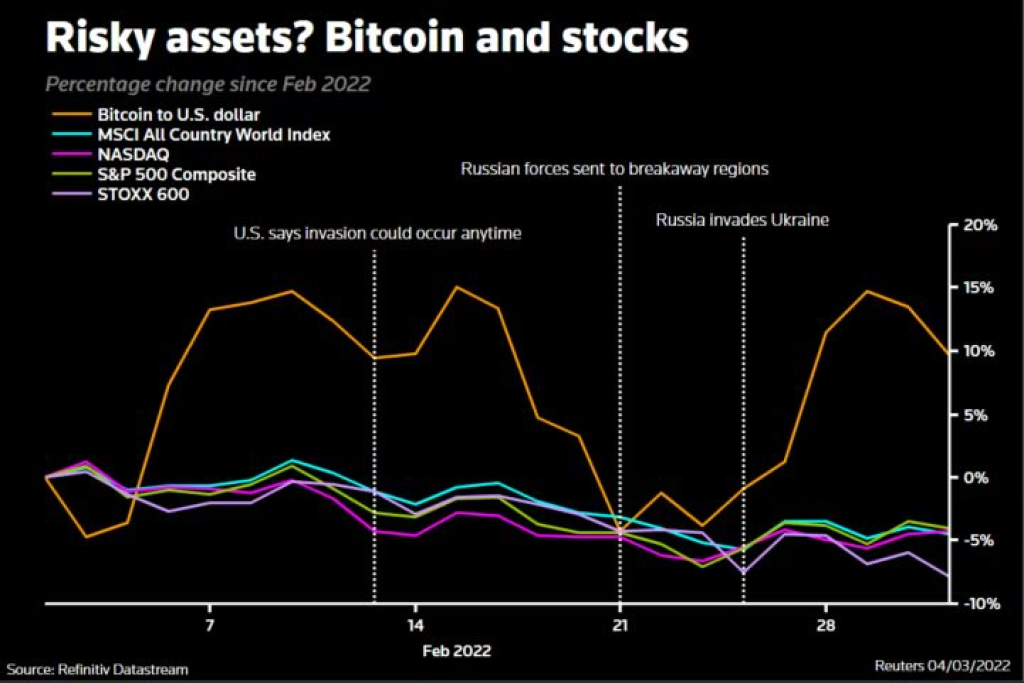

For decentralized cryptocurrencies like bitcoin, conflicts can sometimes boost demand as investors see them as potential safe haven assets. But bitcoin’s high volatility also means any developments in the Israeli-Palestinian crisis could lead to amplified price swings.

“Bitcoin tends to benefit from geopolitical tensions as people seek decentralized assets. But it’s a volatile asset, so any major events could also increase price fluctuations,” said CaptainAltcoin’s leading analyst, Petar Jovanović

Overall, while the Israeli-Palestinian situation brings uncertainty, analysts say financial markets will likely absorb any short-term volatility.

Unless the conflict escalates dramatically, markets are expected to remain relatively stable in the long run. For volatile assets like bitcoin, however, the impacts are less clear and will likely depend on how events unfold.

We express our sincere hopes for a peaceful resolution to the tensions and for the safety of all people in the region during this difficult time.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.