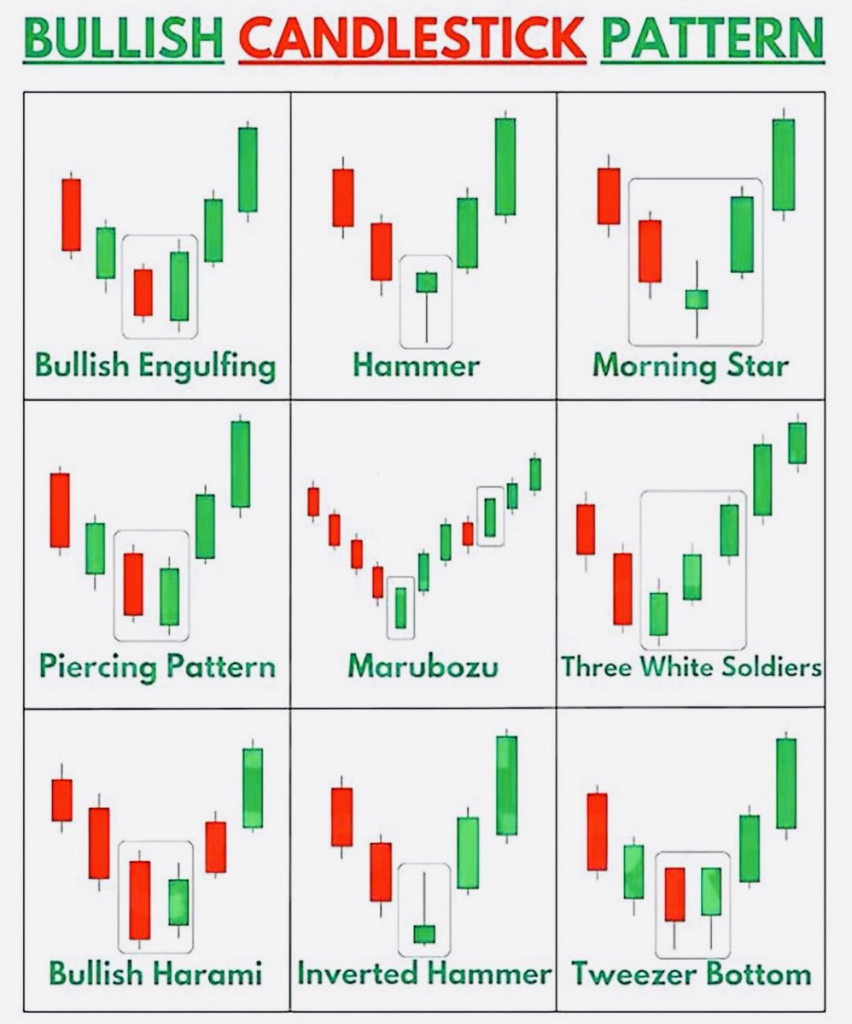

Candlestick charts are a crucial tool for traders to analyze price movements and identify potential opportunities in the market. Recognizing bullish candlestick patterns can provide valuable insights into shifting momentum and emerging uptrends. Here are some of the most common bullish candlestick signals:

What you'll learn 👉

Bullish Engulfing

This pattern forms when a large green (or white) candle completely engulfs the previous red (or black) candle, signaling a potential trend reversal. It indicates buyers have overwhelmed sellers and taken control.

Hammer

A hammer appears after a decline and has a small body with a long lower wick, resembling a hammer shape. It shows buyers stepped in and rejected lower prices.

Morning Star

A three-candle formation consisting of a large red candle, followed by a small body candle, and completed by a strong green candle. It hints at bearish sentiment fading.

Piercing Pattern

This two-candle pattern starts with a red candle, followed by a green candle that opens lower but rallies to close above the midpoint of the first candle. It suggests buyers have come back into the market.

Marubozu

Marubozu candles have little to no wicks and demonstrate strong directional conviction from buyers or sellers. Green marubozu candles show relentless buying pressure.

Three White Soldiers

A bullish pattern composed of three consecutive long green (or white) candles with consecutively higher closes. It reflects strong uptrend momentum.

Bullish Harami

This occurs when a small green body candle forms within the range of the previous red candle’s body. It indicates potential weakening of bearish force.

Inverted Hammer

Found after a downtrend, an inverted hammer has a small upper body with a long lower wick resembling an upside-down hanging hammer. It hints at an impending uptrend.

Tweezer Bottom

This involves two candles with matching lows coming after a downtrend. The twin bottoms imply a shift from bearish sentiment to renewed buying momentum.

Recognizing candlestick patterns is a valuable skill, but trading decisions should factor in other indicators and analysis as well. These patterns signal potential trend changes, but require confirmation to trade on.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.