MATIC lost around 23% of value this week and is now trading at $0.67. This is the cautionary tale of a whale investor who recently experienced $5 million loss in their Polygon (MATIC) holdings.

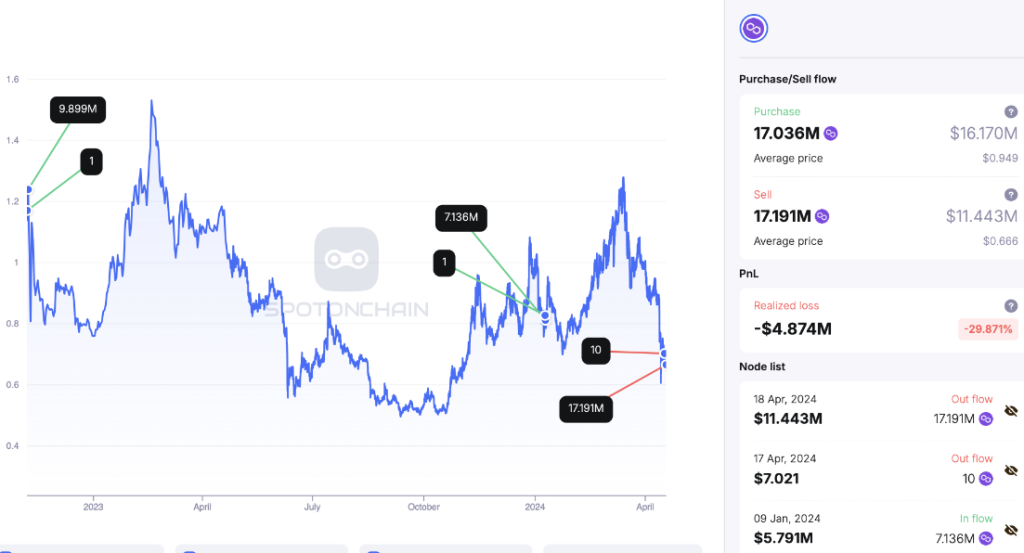

According to data reported by SpotOnChain, the whale investor, known as “Whale 0xa8d,” deposited a massive 17.19 million MATIC tokens (worth $11.44 million) to the FalconX exchange on April 18, 2024, at a price of $0.666 per token. This move came after the whale had previously withdrawn 17.036 million MATIC tokens from Coinbase at an average price of $0.949, amounting to an estimated cost of $16.17 million.

The whale’s strategy involved staking all of their MATIC tokens with the Polygon network to earn additional tokens. However, the recent downturn in the MATIC price has proven to be a costly blow to their investment. SpotOnChain’s analysis reveals that the whale has now realized an estimated loss of $4.87 million, or 29.9% of their initial investment.

This dramatic turn of events highlights the inherent risks and volatility of the cryptocurrency market, where even seasoned investors can find themselves on the wrong side of a trade. The MATIC price has dropped by 23% this week, currently trading around $0.67 at the time of writing, putting significant pressure on the whale’s position.

One of the key factors contributing to the MATIC price decline could be the broader market sentiment. The cryptocurrency market has been in a state of flux, with Bitcoin and Ethereum also experiencing significant price drops in recent weeks. This ripple effect has undoubtedly impacted the performance of altcoins like MATIC.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Another potential factor is the ongoing developments within the Polygon ecosystem. While Polygon has gained significant traction and adoption in the decentralized finance (DeFi) space, there may be concerns about the project’s long-term viability or the ability of its team to execute on their roadmap. These uncertainties can lead to a lack of investor confidence, putting downward pressure on the MATIC token price.

It’s worth noting that the whale’s strategy of staking their MATIC tokens was likely a long-term play, aiming to generate additional returns through staking rewards. However, the sudden price drop has overshadowed any potential gains from staking, resulting in a significant realized loss for the investor.

This cautionary tale serves as a stark reminder of the importance of risk management and diversification in the cryptocurrency market. Even the most seemingly well-thought-out strategies can be upended by sudden market shifts, and it’s crucial for investors to maintain a balanced portfolio and a disciplined approach to mitigate such risks.

As for the whale investor, it remains to be seen whether they will hold onto their remaining MATIC tokens, attempting to recoup their losses, or if they will choose to cut their losses and exit the position entirely.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.