For many traders, stablecoins are supposed to be a short stop between positions. Capital moves out of a trade, waits briefly, then gets redeployed. In reality, that waiting period often stretches on. Funds sit untouched for days or weeks, not because traders are inactive, but because the next good opportunity is not always obvious. This is the problem platforms like Varntix are designed to address.

After a while, leaving capital parked starts to feel inefficient. Stablecoins do their job in cutting out volatility, but when they sit untouched, they drag on overall performance. In uneven markets, that trade-off becomes harder to ignore, pushing traders to rethink what stablecoin liquidity should actually be doing for them.

What you'll learn 👉

Rethinking yield beyond volatility

Most crypto yield strategies depend heavily on market conditions. Incentives rarely stay in place for long, and returns often look different once capital is already deployed. When markets are moving fast, that uncertainty can be tolerated. When they are not, the appeal fades quickly, especially for traders who are more focused on protecting capital than squeezing out extra upside.

This is where fixed income crypto enters the picture. Instead of relying on price movement, the focus shifts to structure. Terms are defined in advance, returns are planned, and capital is allocated with a specific outcome in mind. For traders who already think in terms of risk control, this approach feels more familiar.

Varntix is built around that logic. Varntix is a digital asset ecosystem focused on structured, fixed-term income strategies that allow traders to earn predictable returns on stablecoin capital.

How Varntix fits into this shift

The Varntix ecosystem is designed to give stablecoin holders a clearer alternative to leaving funds idle. Rather than placing capital into open-ended pools, traders can deploy stablecoins into structured opportunities with known timeframes and return expectations.

The platform offers a passive income model that allows traders to earn up to 24% on stablecoins by committing capital under predefined conditions. The emphasis is not on constant optimization or chasing incentives, but on setting expectations upfront and letting the structure do the work. This makes the experience closer to a fixed income product than a typical DeFi yield strategy.

Why traders are paying attention now

The timing behind this shift is not accidental. Markets remain volatile, but consistency has been harder to come by, even for experienced traders. Add broader economic uncertainty to the mix, and risk is no longer taken lightly. Many traders are choosing to slow down, waiting for clearer conditions rather than forcing capital into uncertain positions.

As a result, stablecoins are sitting idle more often. Instead of pushing funds into marginal trades, many traders prefer to wait. Varntix addresses this waiting period directly by offering a way to earn income without committing to long-term exposure or speculative positions. That practical use case is what sets it apart.

Turning idle stablecoins into working capital

Stablecoins are central to the Varntix ecosystem because they remove price noise from the equation. Returns can be evaluated clearly, and performance is not distorted by market swings. When combined with fixed-term deployment, stablecoins become a tool for consistency rather than just defense.

Participants allocate capital for a defined period and understand how yield is generated before committing. This structure reduces the need for constant oversight. Once capital is deployed, there is no requirement to react to daily price changes or adjust positions frequently. For traders managing multiple strategies at once, that simplicity matters.

Flexibility without losing control

One of the main reasons traders engage with Varntix is flexibility. Capital is not locked away indefinitely. Traders can earn predictable returns during slower periods and then redeploy funds when market conditions improve.

This makes the ecosystem especially relevant for those who manage their portfolios actively but do not want capital sitting idle between decisions. Stablecoins shift from being passive placeholders to productive assets that contribute to overall performance.

A broader move toward structured on-chain income

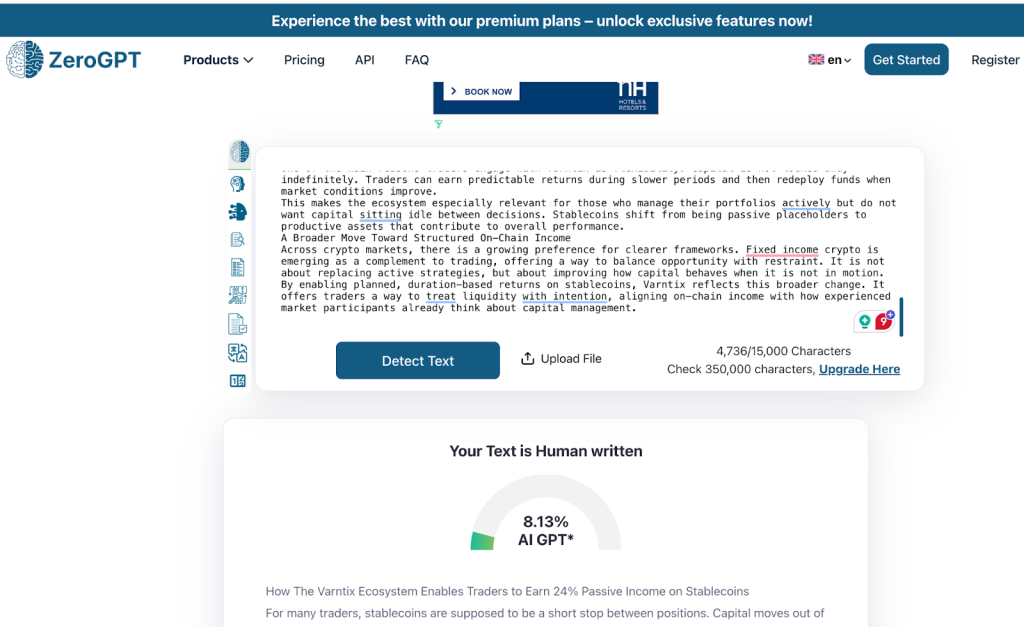

Across crypto markets, there is a growing preference for clearer frameworks. Fixed income crypto is emerging as a complement to trading, offering a way to balance opportunity with restraint. It is not about replacing active strategies, but about improving how capital behaves when it is not in motion.

By enabling planned, duration-based returns on stablecoins, Varntix reflects this broader change. It offers traders a way to treat liquidity with intention, aligning on-chain income with how experienced market participants already think about capital management.