A profitable strategy involving ETH and stETH is being utilized by crypto whales according to on-chain analyst Lookonchain. At first glance, the mechanics of this strategy appear simple – exchange ETH for stETH on a decentralized exchange, then redeem stETH for ETH on Lido. However, the strategy has gained traction for its ability to generate consistent yields upwards of 8.6% APY for whales with substantial capital.

The whale’s strategy revolves around the exchange and redemption of ETH and stETH. A single ETH can be exchanged for 1.0038 stETH on decentralized exchanges (DEX), such as 1inch. Simultaneously, on the Lido platform, one stETH can be redeemed for one ETH at a 1:1 ratio. This creates an arbitrage opportunity where 1 ETH can be used to earn an additional 0.0038 ETH, equivalent to approximately $0.6, per transaction.

However, it’s crucial to note that gas fees play a significant role in the feasibility of this strategy. The gas fee, in this context, refers to the cost of executing a transaction on the Ethereum blockchain. For smaller funds, the incurred gas fee may outweigh the profits from the arbitrage. Thus, this strategy is primarily suitable for whales – entities with substantial funds.

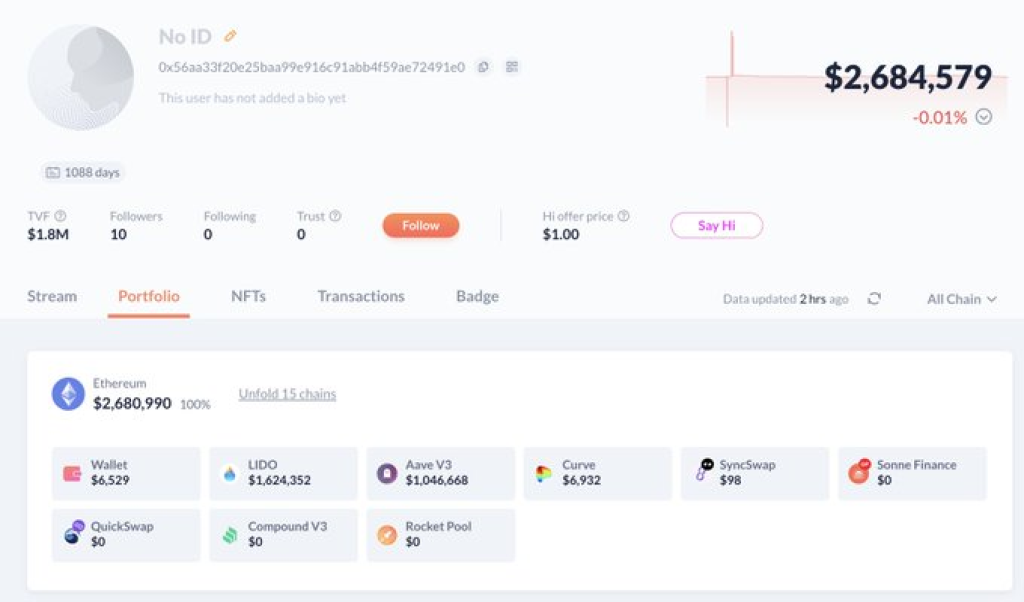

To illustrate, the whale exchanged 1,370 ETH for 1,370.3351 stETH on 1inch and subsequently redeemed 1,370.3351 ETH with 1,370.3351 stETH on Lido. The transaction cost 0.0061 ETH in gas fees and yielded a profit of 0.329 ETH, or $540. While $540 might appear insignificant for a whale, employing 1,370 ETH for arbitrage daily would accumulate to 118 ETH ($194K) after one year, boasting an Annual Percentage Yield (APY) of 8.6%.

Moreover, if ETH and stETH were to depeg, the whale stands to gain even more. For instance, in May 2022, ETH/stETH depegged to 0.94, meaning 1,370 ETH could be used to arbitrage a staggering 87 ETH in a single transaction.

The whale’s strategy sheds light on the intricate and potentially lucrative world of crypto arbitrage, especially within the Ethereum ecosystem. It underscores the necessity of substantial capital and a keen understanding of the market dynamics, gas fees, and platform mechanics to navigate the depths of such arbitrage opportunities successfully.

While the strategy is not without its risks, particularly concerning the stability of pegged values, it offers a fascinating glimpse into the methods employed by crypto whales to accumulate wealth in the digital finance realm.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.