In a shocking incident reported by on-chain data analysis firm LookOnChain, an anonymous cryptocurrency trader fell victim to a devious phishing scam, resulting in the loss of 1,155 Wrapped Bitcoin (WBTC) tokens, valued at $71 million at the time of the incident.

This catastrophic event serves as a stark reminder that crypto market is very risky…

What you'll learn 👉

The Anatomy of the Attack

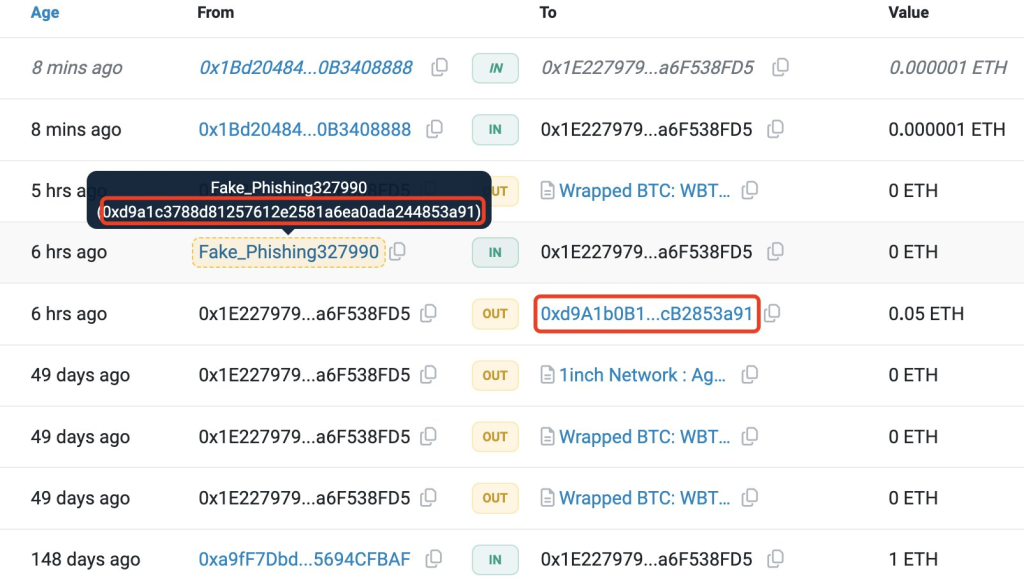

According to LookOnChain’s report, the ill-fated trader’s ordeal began when they created a new Ethereum address approximately six hours prior to the incident. As a preliminary step, the trader transferred a small amount of 0.05 ETH to this newly generated address, a common practice employed to verify the functionality and ownership of the address.

Seizing the opportunity, an unidentified malicious actor swiftly sprang into action, generating a counterfeit Ethereum address that appeared nearly identical to the trader’s genuine address. The scammer then proceeded to send a nominal amount of 0 ETH to the trader, effectively inserting the fraudulent address into the trader’s transaction history.

Many cryptocurrency wallets, in an effort to streamline the user interface, employ a visual shorthand technique, concealing the middle portion of lengthy addresses with an ellipsis (…). It was this very design choice that played right into the hands of the scammer, enabling their deceptive scheme to unfold seamlessly.

When the trader attempted to transfer their substantial WBTC holdings to the newly created address, they inadvertently copied the scammer’s counterfeit address instead of their legitimate one. Unaware of the mistake, the trader unwittingly signed and executed the transaction, effectively transferring a whopping 1,155 WBTC tokens, worth a $71 million, directly into the scammer’s malicious digital wallet.

What is a Phishing Attack?

A phishing attack is a type of cyber fraud that employs deceptive tactics to trick individuals into divulging sensitive information or performing actions that compromise their security. Phishing attacks often involve the creation of fake websites, emails, or other digital communications that mimic legitimate platforms or services, with the intent of luring unsuspecting victims into revealing their private keys, seed phrases, or other critical information.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +In the case of the $71 million WBTC heist, the scammer employed a sophisticated form of phishing known as an “address manipulation attack.” By generating a counterfeit address that closely resembled the trader’s legitimate address, the scammer exploited the visual shorthand employed by many cryptocurrency wallets, effectively camouflaging their malicious intent and tricking the trader into transferring their valuable assets directly into the scammer’s control.

Read also: Meme Coins Surge: PEPE and BONK Show Robust Gains as Market Confidence Soars – Here’s Why

Lessons Learned and Preventive Measures

This unfortunate incident serves as a poignant reminder of the paramount importance of exercising extreme vigilance when dealing with cryptocurrencies and digital assets. Even the slightest lapse in attention or deviation from established security protocols can have devastating consequences, as demonstrated by the $71 million WBTC loss.

To mitigate the risks of falling victim to similar phishing attacks, crypto enthusiasts and traders alike are strongly advised to implement the following preventive measures:

- Double and triple-check addresses: Before executing any cryptocurrency transaction, it is crucial to meticulously verify the recipient’s address by carefully inspecting the entire string of characters, rather than relying solely on the abbreviated version displayed in wallets.

- Utilize reputable wallet software: Opt for well-established and trusted cryptocurrency wallet software that prioritizes security features and incorporates robust safeguards against potential phishing attempts.

- Enable additional security measures: Implement multi-factor authentication (MFA), hardware wallets, and other advanced security measures to add an extra layer of protection to your cryptocurrency holdings.

- Stay vigilant: Maintain a heightened state of awareness and scrutinize any unsolicited or suspicious communications, websites, or digital interactions related to cryptocurrencies, as they may be potential phishing attempts.

- Educate yourself: Continuously expand your knowledge of cryptocurrency security best practices, emerging threats, and preventive measures to stay ahead of ever-evolving cyber threats.

The crypto ecosystem, while brimming with immense potential and innovation, remains a lucrative target for malicious actors seeking to exploit vulnerabilities and capitalize on unsuspecting victims.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.