ASTER is gaining interest again, and not just for its chart. The project has been burning tokens at a rate that’s almost unheard of.

As SrPeters pointed out, the team has ramped up its buybacks from $5,000 every two minutes to $5,000 every single minute. That’s $300,000 an hour, or $7.2 million every day, with half of it $3.6 million being burned for good.

That kind of constant buy pressure and deflation isn’t something the market can ignore for long. And it seems the chart agrees.

What you'll learn 👉

ASTER Chart Is Showing a Falling Wedge Setup

Technical analyst Crypto Faibik shared a chart showing the ASTER price forming a classic falling wedge pattern on the 4-hour timeframe. It’s the kind of setup that usually appears just before a breakout.

After weeks of steady decline, the price started to push back toward the upper trendline, and if it breaks through, the ASTER chart points toward a possible target of around $2.80.

At the moment, the ASTER price is trading close to the $1 level, after bouncing off local lows close to $0.85. Volume has started to pick up again, which might be an early sign that momentum is shifting back to buyers.

Traders are watching closely for that clean breakout confirmation, something that could flip the whole trend.

Read Also: ASTER Real Race Starts Now: This Next Move Can Decide Its Future

ASTER Whale Accumulation Backs the Bullish Outlook

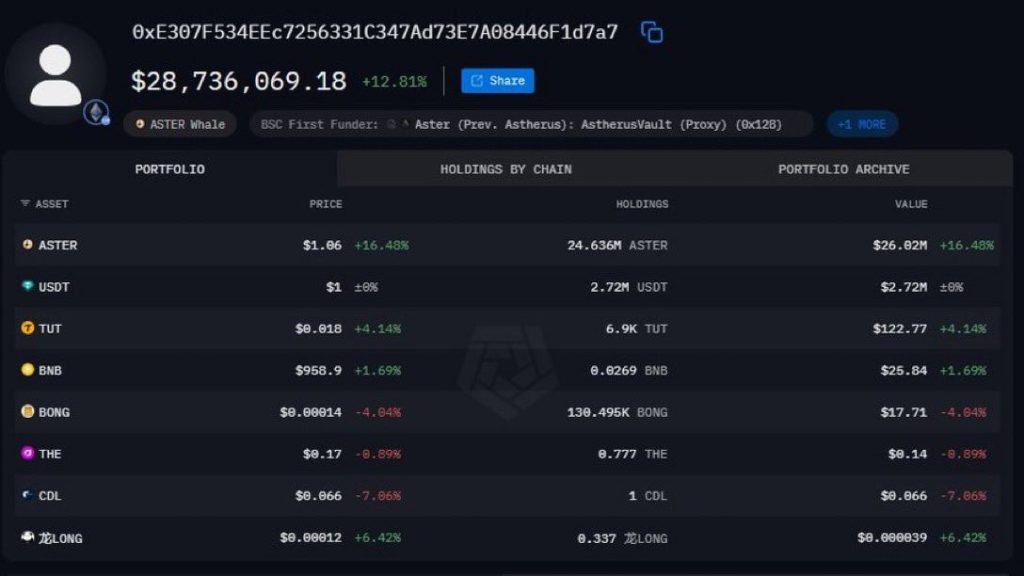

It’s not just the chart that looks promising. On-chain data shared by SrPeters shows that a major ASTER whale has been adding heavily during this dip.

One address now holds over 24.6 million ASTER, worth roughly $26 million, and their overall portfolio is sitting above $28.7 million, up more than 12% in a single day.

Big holders increasing their positions during consolidation phases like this is usually a strong signal that they see value ahead. It’s the kind of move that often comes before a bigger breakout when retail sentiment is still cooling off.

Short-Term Outlook for ASTER Price

If the ASTER price breaks above $1.15–$1.20 with solid volume, that could open the door to $1.50–$1.80 next, and eventually the $2.80 zone if momentum really builds.

On the flip side, failing to stay above $0.90 might mean more sideways action before another attempt higher.

With buybacks of $7.2 million a day and $3.6 million burned daily, supply keeps shrinking while demand quietly grows the ASTER price.

Add in a bullish wedge pattern, whale accumulation, and improving sentiment, and it’s not hard to see why analysts think ASTER could be gearing up for a breakout

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.