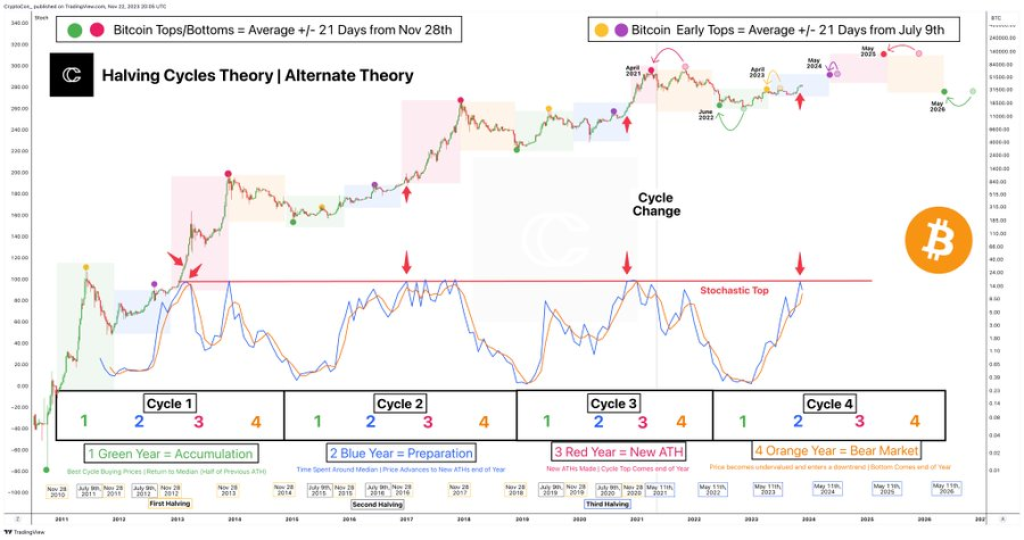

According to crypto analyst Rekt Capital’s recent video and CryptoCon’s tweet, predictions for the current Bitcoin bull cycle’s peak range from mid-2025 to late 2025. By examining data from previous Bitcoin halvings and market cycles, insights emerge on when this cycle’s frenzied top may materialize.

The Role of Bitcoin Halvings

Rekt Capital’s video emphasizes how Bitcoin bull runs align with Bitcoin’s quadrennial halving events, where the bitcoin mining reward gets cut in half. Comparing data from the 2012 and 2016 halvings, parabolic bull phases peaked around 518-546 days following each halving. If this pattern holds, the current cycle should top in September-October 2025 given the next halving occurs in April 2024.

However, CryptoCon notes the possibility of this cycle accelerating faster than normal – the “Alternate Theory.” Some indicators like Bitcoin’s monthly stochastic oscillator already resemble cycle tops though price action has yet to confirm anything definitive. If the alternate theory holds, a blow-off top could emerge as early as mid-2025.

Phases to Watch Pre-Peak

Rekt Capital does note crucial phases still ahead even if the cycle peak aligns with past halving data. First, a pre-halving retracement could occur in the four months before April 2024, followed by an extended “reaccumulation phase” where prices consolidate. The duration of reaccumulation will impact the length of the eventual parabolic rally.

Mitigating Risk Near the Top

With so much uncertainty around precisely timing the cycle peak, Rekt Capital advises against extreme greed near the top – slight imprecisions can lead to massive losses. Instead, he suggests dollar-cost averaging up until the approximate peak span then proceeding more cautiously. Since peaks align roughly with halving dates, some flexibility is prudent.

The Need for Recalibration

With variations across market cycles, both analysts emphasize recalibrating market theories based on what current price action confirms. If Bitcoin suddenly reaches new all-time highs far earlier than historical models predict, it signals a shift to new paradigms is occurring. Until then, the baseline halving cycle theory holds merit.

Read also:

- Ripple (XRP) Eyes Multi-Year Highs if This Fourth Accumulation Pattern Holds True – Analyst

- Best Crypto Coins for Gamers

- Crypto Millionaire Set His Sights on a New Lowkey Crypto Gem for 2023

By blending these expert insights, a data-driven narrative emerges on navigating and surviving Bitcoin’s volatile yet rewarding bull market cycles. The next year promises further clarity on whether history continues rhyming or if crypto investors need to throw out the old playbooks.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.