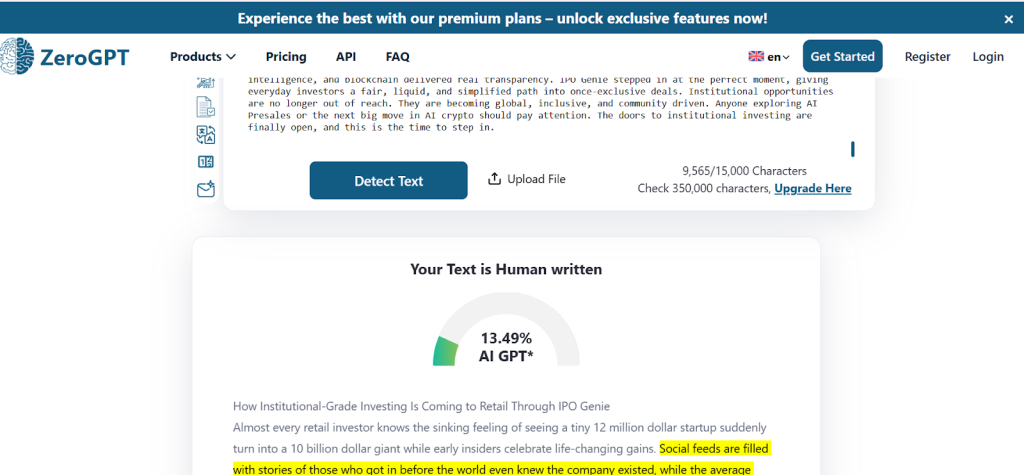

Almost every retail investor knows the sinking feeling of seeing a tiny 12 million dollar startup suddenly turn into a 10 billion dollar giant while early insiders celebrate life-changing gains. Social feeds are filled with stories of those who got in before the world even knew the company existed, while the average investor is left wondering why these chances never reach them in time.

For years, private markets felt like a velvet-rope world reserved for the wealthy and well-connected. But in 2025, everything began to shift. Technology, tokenization, AI analysis, and clearer regulations started tearing down those walls. At the center of this transformation emerged IPO Genie ($IPO), one of the most talked-about AI Presales and a rising contender for the best crypto of 2025, finally giving retail investors access to opportunities once limited to institutions.

What you'll learn 👉

The Private Market Problem: Why Retail Has Been Locked Out

The private market is enormous. More than 3 trillion dollars move into private equity, venture capital, pre-IPO startups, and private debt every year. Yet retail investors see almost none of it. In fact, they have historically accessed less than 1% of this entire market.

A Market Built Exclusively for Institutions

In 2000, the average company went public after about 4 years. Today, companies stay private for more than 12 years. That means 90% of their total value growth happens long before retail investors can participate.

- Uber grew from a 5 billion dollar valuation to 70 billion dollars while still private.

- Airbnb hit 31 billion dollars before listing.

- SpaceX sits above 150 billion dollars without being public.

- Stripe is valued around 95 billion dollars privately.

The biggest winners are always insiders, venture firms, institutions, and private networks.

Retail investors get what is left over.

Why Retail Never Had a Real Chance

The system was designed to exclude them.

Traditional private deals required:

• Minimum checks of 250,000 to 1,000,000 dollars

• Lockups of 7 to 10 years

• Accreditation rules that excluded 97% of people

• Insider relationships and private networks

• No transparency or liquidity

Platforms that tried to democratize access only solved parts of the problem. Some offered only secondary markets. Others lacked compliance. Some had poor deal flow. None created the full institutional experience in a way retail could afford or understand.

The result was a massive wealth gap that grew year after year.

Why 2025 Is the Turning Point for Retail Access

Three forces collided in 2025, creating a perfect opening for everyday investors.

The Tokenization Wave

Analysts predict the security token market will reach 10 trillion dollars by 2030.

More than 16 trillion dollars in real-world assets are expected to move on-chain in the next few years.

Tokenization finally made large, illiquid investments divisible, transferable, and accessible. It is one of the most significant financial revolutions of this decade.

AI Disruption in Deal Discovery

AI began transforming every layer of finance. The AI crypto market is projected to reach 45 billion dollars by 2030. Investors want predictive insights, automated research, and intelligent deal discovery.

This is why AI Presales have become one of the hottest sectors. Utility matters more than hype. People want tokens that give them real informational advantages.

Retail Investors Want Real Utility

The 2025 investor is smarter than the investors of 2021 or 2022. They want:

• Transparency

• Liquidity

• Governance rights

• Real assets

• Real rewards

• Real access

This shift in expectations created the perfect environment for IPO Genie to step in.

IPO Genie: The Platform Bringing Institutional-Grade Deals to Retail

IPO Genie stepped into the 2025 market with a bold promise. Give retail investors access to the kinds of deals that belonged only to Silicon Valley’s wealthy insiders. Make it simple. Make it compliant. Make it transparent. And most importantly, make it liquid.

A Bridge Between Blockchain and Private Markets

Instead of offering low-tier or speculative projects, IPO Genie partnered with elite hedge funds, VC firms, and private deal networks.

Investors can access vetted early-stage companies in sectors such as AI, robotics, fintech, and next-gen technology. And all of this can be done with entry points as low as 10 dollars.

Institutional-grade trust was built through:

• Fireblocks custody

• CertiK-audited smart contracts

• Chainlink-verified data feeds

• Built-in compliance workflows

This made the platform a serious contender in AI Presales and one of the leading picks for the best crypto of 2025.

A Simple Three Step System

IPO Genie simplified everything:

- Buy $IPO

- Choose a curated startup or pre-IPO deal

- Exit whenever needed

No 10-year lockups. No piles of legal documents. No insider-only access barriers.

It is investing redesigned for the modern world.

IPO Genie and the Rise of AI Presales

One of IPO Genie’s breakthroughs was its intelligent engine known as Sentient Signal Agents.

Sentient Signal Agents

This engine operates around the clock. It analyzes startup financial data, team backgrounds, market sentiment, GitHub activity, funding signals, and behavior indicators. It identifies early breakout potential long before traditional institutions pick up the trend. In a market where speed and insight matter, investors began seeing it as a major advantage.

This technology placed IPO Genie firmly within the leading AI Presales of the year. It attracted both crypto traders who love AI-driven systems and traditional investors who understood the value of predictive tools.

On-Chain Transparency and Compliance

Every ownership movement and investment record is stored on-chain for full transparency. Smart contracts automate distribution. Multi-signature wallets provide added protection. KYC and compliance systems adapt to different jurisdictions. This infrastructure made retail investors feel secure in a market that was once filled with uncertainty.

The $IPO Token: Access, Rewards, and Real Utility

The $IPO token is more than a trading instrument. It unlocks the entire ecosystem.

Tiered Access to Exclusive Deals

Investors who hold more tokens unlock more exclusive opportunities. This includes priority allocations, higher-yield staking pools, early access, and curated deal lists. Bronze holders receive access to core deals. Platinum holders gain entry to the most high-growth opportunities.

It flips the old venture capital model and empowers everyday people.

Staking, Governance, and Fee Rewards

IPO Genie rewards active participation. Holders earn staking rewards, voting rights, and a share of platform fees. They can influence which deals appear on the platform. They help shape the future of the ecosystem. It feels less like a platform and more like a community-led venture hub.

Why Analysts Believe IPO Genie Could Ignite the Next Big Investment Cycle

Momentum is important in early blockchain projects, and IPO Genie has plenty of it.

Explosive Presale Performance

IPO Genie raised 2.5 million dollars within hours of launching its presale. The sale filled up rapidly, with more than 97% claimed early. Thousands of investors joined the platform during the first phases. Social sentiment increased dramatically, and on-chain activity showed strong accumulation by whales.

Many market watchers began describing it as one of the most promising opportunities in AI crypto for the year.

A High Asymmetric Opportunity

The presale price was extremely low. Investors controlled large amounts of tokens with relatively small entries. If the token were to list at 0.10 dollars or higher, the upside potential could be significant. Analysts compared the opportunity to early Solana and Avalanche movements. Some even suggested the token could reach levels that turn small investments into much larger returns. This perception boosted its standing among AI Presales gaining fast traction.

Why IPO Genie Stands Apart From Other Investment Platforms

Several platforms attempted to open private markets to retail investors, but each had limitations. AngelList offered high-quality deals but lacked liquidity and required significant capital. EquityZen provided liquidity but did not offer new primary deals. Republic offered accessibility but inconsistent deal quality and no token utility. Tokenization platforms had excellent infrastructure but no elite deal flow.

IPO Genie blended the strongest features from each space. It offered quality deals, liquidity options, compliance systems, community governance, and AI-backed discovery. This combination is rare and one of the main reasons the platform is gaining recognition as the best crypto of 2025 for long-term utility and real-world impact.

Final Thoughts

For decades, private markets belonged only to institutions and insiders, leaving retail investors locked out until all the value was gone. In 2025, everything began to shift. Tokenization opened access, AI added intelligence, and blockchain delivered real transparency. IPO Genie stepped in at the perfect moment, giving everyday investors a fair, liquid, and simplified path into once-exclusive deals.

Institutional opportunities are no longer out of reach. They are becoming global, inclusive, and community driven. Anyone exploring AI Presales or the next big move in AI crypto should pay attention. The doors to institutional investing are finally open, and this is the time to step in.

Visit the IPO Genie website and follow the official Twitter for the latest announcements.

Disclaimer: Cryptocurrency involves risk, and nothing here should be viewed as financial advice. Always research thoroughly and make decisions based on your own judgment.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.