Ethereum slipping below $3,200 has put a spotlight back on how sensitive large-cap crypto assets remain to macro shocks. As global markets reacted to fresh tariff threats from former President Trump, ETH moved quickly lower alongside Bitcoin and the broader altcoin market.

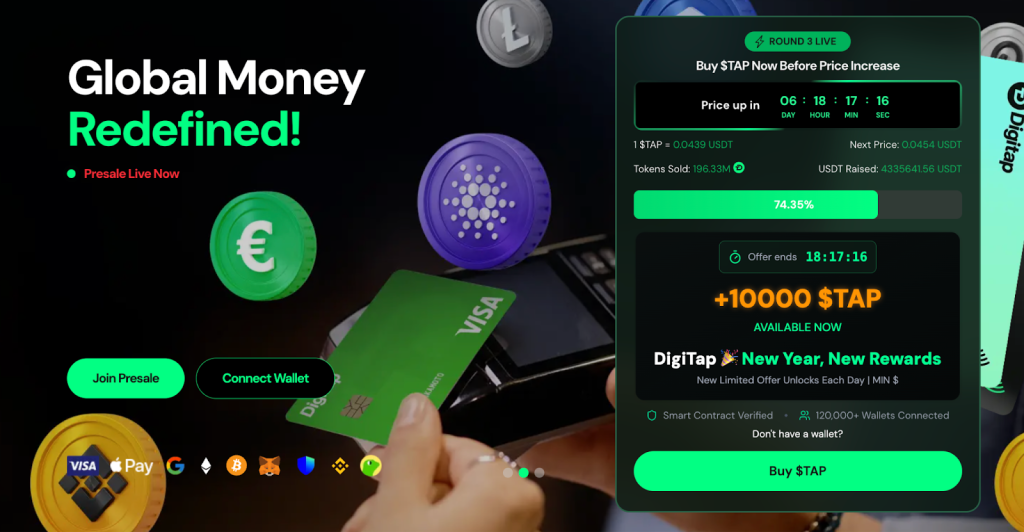

At the same time, a very different story has been playing out elsewhere. Digitap ($TAP) has crossed $4 million raised in its presale, continuing to attract capital while larger assets struggle to hold key levels. For investors searching for the best crypto presale 2026, the contrast is becoming harder to ignore.

What you'll learn 👉

Tariff Fears Trigger Sell-Off Across Ethereum

Ethereum’s latest drop was driven less by anything inside crypto and more by events outside it. News that the U.S. could impose 10–25% tariffs on European imports triggered a risk-off move across global markets. Crypto, which trades around the clock, reacted immediately.

ETH fell as much as 5.3% intraday, mirroring Bitcoin’s 3.8% decline. The Coinbase Premium Gap dropped to -0.58%, a sign that U.S. investors were selling rather than accumulating. In short, Ethereum behaved exactly as a high-beta risk asset tends to behave when macro uncertainty spikes.

What comes next will depend largely on geopolitics and policy. Markets are watching potential EU retaliation and how central banks respond at upcoming events, such as Jackson Hole later this summer.

Support Turns to Resistance for Ethereum

From a technical perspective, Ethereum has work to do. Price has broken below both the 23.6% Fibonacci retracement at $3,277 and the 200-day moving average near $3,658, two levels that had previously offered support.

There are some mixed signals. RSI is hovering near 59, which suggests ETH isn’t deeply oversold, and the MACD histogram remains positive. That leaves room for a short-term bounce if selling pressure eases.

Still, the near-term picture is cautious. A $3,277 reclaim would help stabilize sentiment. Failure to do so could bring the $3,000 psychological level into play, especially if macro conditions worsen.

Best Altcoins to Buy as ETH Consolidates

Ethereum is one of the most important assets in crypto, but it is also tightly linked to macro headlines, leverage cycles, and institutional risk management. That makes it harder for retail investors to find asymmetric upside, even when fundamentals remain solid.

Digitap is moving forward on a very different track. Instead of trading in open markets, Digitap is progressing through a structured presale, where prices increase at defined stages rather than daily volatility.

The project has now raised over $4 million, with growing participation from retail investors looking for the best crypto presales before broader market exposure. That momentum is driven by something ETH can’t offer at this stage: early positioning.

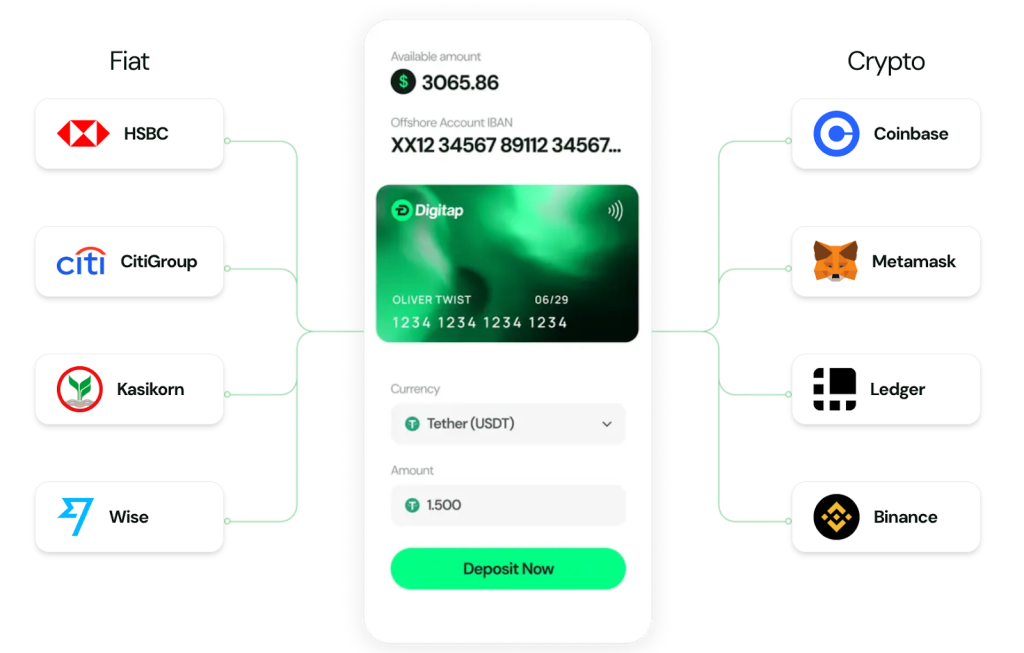

Digitap is building a crypto-fiat omnibank focused on real-world payments. The app is already live on iOS and Android, and more than 120,000 wallets have already been connected. Users can hold crypto and fiat in one place, receive payments in crypto, automatically convert them to cash, and move funds via SEPA or SWIFT when needed.

USE THE CODE “TAPPER20” FOR 20% OFF FIRST-TIME PURCHASES

How Digitap’s Presale Rewards Early Buyers

Digitap’s presale started at $0.0125 and has now moved to around $0.0439, meaning early participants are already well ahead. More price increases are still scheduled, with a confirmed launch price of $0.14, giving the presale a clear upward path rather than day-to-day volatility.

This tiered structure offers a level of predictability rare in crypto, especially during uncertain market conditions, while the product is already live and in use.

Beyond pricing, the team has been making changes based on how people are actually using the platform. Recent updates focus on faster customer support, clearer step-by-step guides, easier crypto-to-crypto and crypto-to-fiat swaps, and new payment links and invoicing tools that simplify cross-border payments.

Alongside these, Digitap has set aside a 240 million $TAP reward pool for staking and user incentives, with extra bonuses currently available through New Year promotions.

Taken together, these moves show a project that is being shaped around everyday users and long-term use, rather than short bursts of attention, which is why many analysts see $TAP as one of the best altcoins to buy in 2026.

USE THE CODE “TAPPER20” FOR 20% OFF FIRST-TIME PURCHASES

Is Digitap the Best Altcoin to Buy in 2026?

Ethereum’s drop below $3,200 reflects macro fear, unwinding of leverage, and technical weakness. While institutional interest remains strong, near-term price action shows how exposed ETH is to forces beyond crypto itself.

Digitap, meanwhile, with a live product, growing user base, and structured presale momentum, offers exposure earlier in the cycle.

Ethereum represents stability. Digitap represents an opportunity, and that’s why its $4 million raise is standing out amid markets that are growing more selective.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.