Technical analyst Rekt Capital recently shared some interesting perspectives on Twitter about the potential price movement of Bitcoin in October. Rekt Capital has built a reputation for high-quality analysis and a nuanced understanding of cryptocurrency market dynamics. Let’s examine the key points from the recent analysis, the historical precedents for October’s performance, and the possible future outlook for Bitcoin.

What you'll learn 👉

Projection for October 2023: A Revisit to $29200

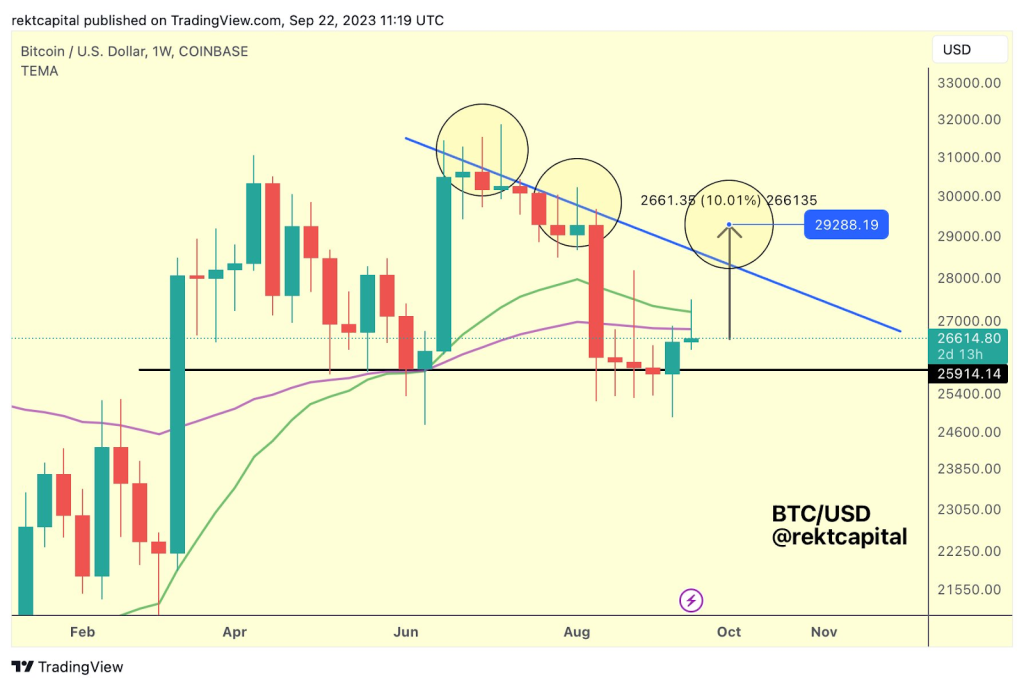

Rekt Capital emphasizes that historically, October has been a notably positive month for Bitcoin (#BTC). This observation is crucial as it sets a precedent for potential market behavior, allowing traders and investors to strategize accordingly.

However, the expert analyst points out the surprising lack of attention given to the possibility of experiencing a price reaction in October 2023, similar to October 2019. During that period, Bitcoin experienced a rally of +10%, a significant movement worth considering for future projections.

Drawing parallels between 2023 and 2019, Rekt Capital speculates that if Bitcoin were to rally +10% this coming October, the price could revisit the $29200 mark. This scenario could lead Bitcoin to form a long upside wick beyond the Lower High resistance before potentially rejecting it again.

This move could confirm the current move as a relief rally, providing a valuable perspective for traders and investors looking to understand the market’s potential direction. The $29200 mark is a pivotal point for market enthusiasts to watch, as it could dictate subsequent market movements and trends.

The Possibility of Another Drop: A Macro Higher Low Perspective

The famous Twitter analyst also delves into the discussions surrounding the likelihood of another drop into the Macro Higher Low. Many argue that such a scenario is improbable due to the uniqueness of the March 2020 Black Swan event attributed to the COVID crash. Rekt Capital acknowledges the unprecedented nature of the COVID crash, which resulted in a -72% drop from the 2019 Local Top to the March 2020 Higher Low.

However, he posits that Bitcoin doesn’t necessarily need another Black Swan event to retrace -37% over the coming months. If $31000 was the 2023 Local Top, a -37% drop would align with revisiting the Higher Low, offering a different magnitude than the COVID crash.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.