ASTER has been buzzing across Crypto Twitter lately, and the chart is starting to explain why. The ASTER price action might look a little chaotic at first, but underneath it, there’s a pretty clear story forming.

Traders are watching this one closely, and more than a few analysts think the rally still has some fuel left. Analyst Jake Gagain is out here saying “$ASTER to $10 with speed,” and that kind of confidence doesn’t usually come out of nowhere.

What you'll learn 👉

ASTER Is Finding Its Footing After a Wild Start

On the 4-hour chart shared by Jake, the $1 level is acting like a real floor. In a market full of coins that explode and then disappear, that alone is worth paying attention to.

When ASTER launched, it moved like a rocket. The price shot up, tapped above $2.50, and then spent the next few weeks cooling off and sliding toward the $1 range. That’s where things got interesting. Instead of breaking down, ASTER started holding steady.

For almost the entire month, the ASTER price has been bouncing between $1.00 and $1.20. That doesn’t sound dramatic, but this type of quiet consolidation is exactly what you want to see after a massive initial pump. It shows that early sellers have mostly exited and a new base of buyers is slowly building underneath the price.

ASTER Fees Are Surging and That’s the Real Catalyst

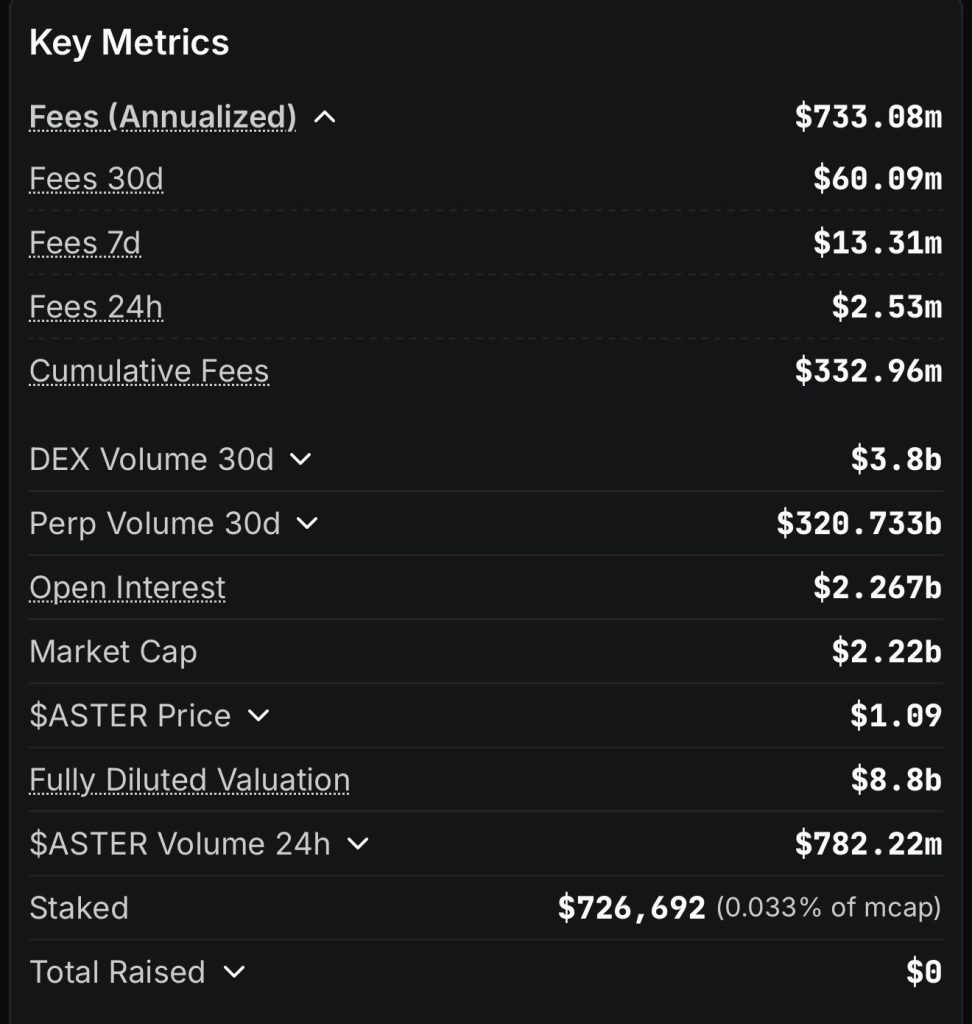

If there’s one reason the ASTER price refuses to cool off, it’s the fees. The numbers being shared by analyst Sully look unreal at first glance.

The project pulled in $2.5 million in fees in a single day. Over the past 30 days, that total hits $60 million which averages out to around $2 million per day. That would be impressive for a top-20 project. For a token sitting at a $2 billion market cap, it’s borderline shocking.

And here’s where it gets even more interesting: roughly 70–80% of those fees go back into buybacks, and half of that gets burned instantly. That means ASTER is constantly reducing its supply while pushing steady buy pressure into the market.

Add in the fact that the project has support from CZ, and it’s not hard to understand why traders are suddenly treating ASTER like it has way more upside left.

Read Also: Aster (ASTER) Price Shows Rare Strength in a Weak Market – Here’s What Could Happen Next

The ASTER Chart Is Coiling Up Again

After weeks of sideways action, ASTER is starting to tighten. The candles are compressing, sellers are getting quieter, and even small bursts of volume are moving the ASTER price noticeably higher. That usually sets the stage for a bigger move.

A breakout back toward the previous $2.50 highs would already be a strong bullish signal. But given the revenue, burn mechanics, and the kind of hype ASTER is generating, people calling for $5 or even $10 are starting to sound less crazy and more early.

What’s Next for ASTER?

The ASTER price has all the ingredients traders look for during an early-stage rally: solid fundamentals, real revenue, non-stop burns, strong community activity, and a chart that refuses to break down.

If the market stays supportive and the fee machine keeps firing, this run might still have a long way to go.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.