The price of the Curve DAO (CRV) token has experienced a continued selloff, plummeting by over 50% in nearly three weeks. However, today’s price action was particularly severe, with CRV plunging from $0.33 to $0.22, a 35% drop. While this move is part of a broader bearish trend, the sharp decline today appears to have been triggered by specific actors in the market.

What you'll learn 👉

Founder’s Positions Face Liquidation

On-chain analysis by Wu Blockchain revealed that Curve founder Michael Egorov had borrowed a substantial amount of stablecoins, primarily crvUSD, across five different protocols. According to the report, Egorov had collateralized these loans with $141 million worth of CRV tokens across five accounts.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Unfortunately, these positions have begun to face liquidation, adding significant selling pressure to the CRV market. Wu Blockchain stated that approximately $22.6 million worth of CRV collateral positions were liquidated in the past four hours, with around $15 million worth of CRV collateral being liquidated in the last hour alone.

Opportunistic Trader Capitalizes on Liquidations

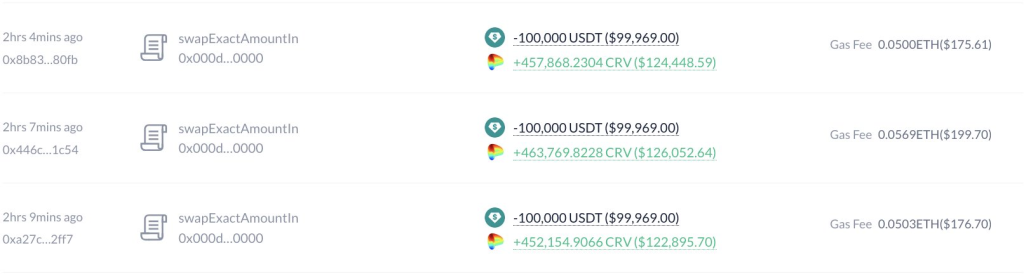

Amid the market turmoil, an opportunistic trader identified as sifuvision.eth seized the opportunity to acquire a substantial amount of CRV at discounted prices. According to Lookonchain, sifuvision.eth spent 300,000 USDT to purchase 1.37 million CRV at a low price of $0.2184, taking advantage of the liquidations.

Read Also: 8 Promising Low-Cap Cryptocurrencies That Could Surge 100x Post-Binance Listing

Interestingly, Lookonchain also revealed that sifuvision.eth holds a short position on CRV, with a debt of 15 million CRV ($4.04 million) on the UwULend protocol. Prior to the CRV liquidations today, sifuvision.eth withdrew 6 million crvUSD from the Curve LlamaLend protocol, potentially contributing to the increase in Michael Egorov’s borrowing rate.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.