Dogecoin has been having a pretty rough time lately. The DOGE price has been slowly bleeding lower for months, stuck in that messy kind of chop where nothing really feels clean. But now the selling has started to pick up, and price has finally been pushed into one of those long-term support zones that traders only really focus on when things get serious.

That’s why the charts are suddenly lighting up again. Ali Martinez says the big line to watch is around $0.054, calling it the main level where a bounce could start. BitGuru is looking at it from another angle, pointing out that Dogecoin already swept major downside liquidity near $0.09 and is now sitting in a long-term demand area.

What you'll learn 👉

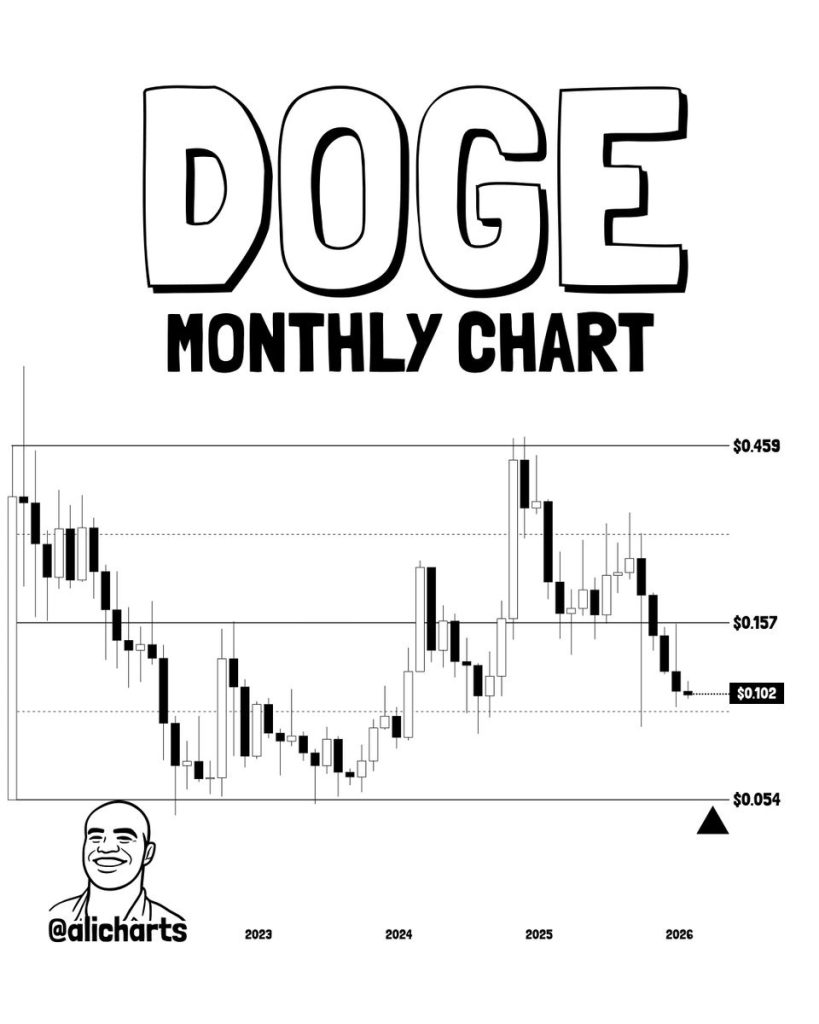

The Monthly DOGE Chart Shows Where the Real Floor Sits

Zooming out to the monthly chart makes the bigger picture pretty obvious. Dogecoin peaked near $0.459, then rolled over hard and never managed to reclaim the mid-range level around $0.157. Once a level like that breaks, it usually doesn’t just disappear. It tends to hang overhead as resistance for a long time.

Since that breakdown, the DOGE price has been stepping down into lower territory, hovering closer to the $0.10 region now. And when you look at the structure, it becomes clear that the next real historical base sits much lower, near $0.054.

That’s the zone Ali Charts is focused on. It isn’t some random target. It’s one of the last major demand floors on the monthly chart, and it’s where buyers have stepped in before Dogecoin hit similar exhaustion points.

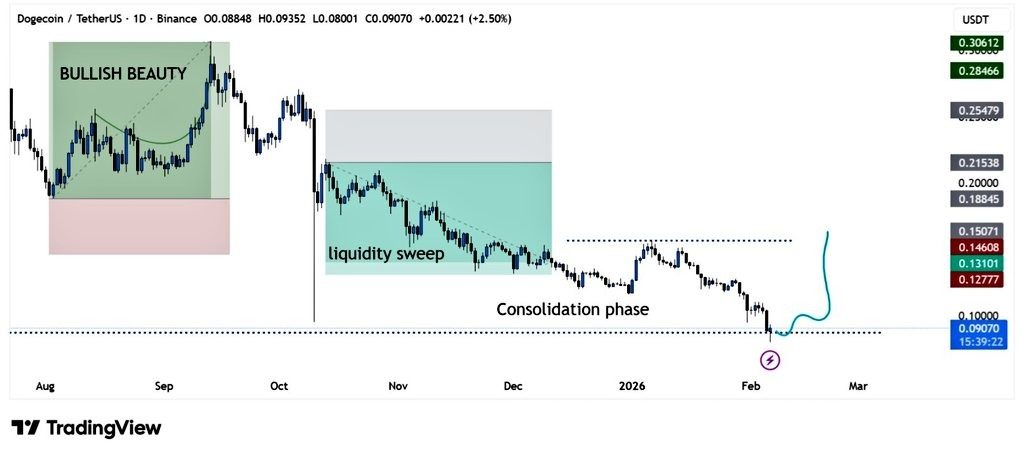

The Daily Chart Shows the Liquidity Sweep Setup

BitGuru’s daily chart gives more context on what’s happening in the short term. The DOGE price recently swept a major downside liquidity pocket near $0.09. That’s usually where stop-losses pile up after long consolidation phases, and once price taps that zone, the market often reacts sharply.

The chart labels this as a liquidity sweep, followed by the DOGE price settling into a long-term demand region. This is typically the area where markets either start building a base or break down further if buyers don’t show up.

BitGuru also notes that Dogecoin spent months consolidating before this drop. That matters because long sideways ranges often lead to bigger reactions once price finally escapes the box.

If buyers defend this demand area, the chart starts to open room for a snapback move back toward the old range highs.

Read Also: Silver Price Crash Is Over “For Real This Time,” Analyst Predicts a Surge Back Above $90

Where the DOGE Price Could Head Next

Right now, the DOGE price is sitting at a real decision point. The current demand zone is the first line of defense after the liquidity sweep. If price can stabilize here, the next logical move would be a recovery push back into the previous consolidation range.

But if this level fails, attention shifts quickly toward the deeper monthly support Ali highlighted at $0.054. That stands out as the next major zone where a larger bounce attempt could form.

The DOGE price isn’t drifting in the middle of nowhere anymore. It has moved into a long-term demand region after sweeping major downside liquidity, and the charts are now showing a clear support battle.

Ali sees $0.054 as the ultimate bounce level on the monthly structure, while BitGuru believes the current demand zone could already be enough for a sharp recovery if buyers step in.

Either way, this is the part of the chart where Dogecoin usually stops being quiet. The next move from here will likely decide whether this is the start of a base or just the setup for one more deeper flush before the real rebound begins.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.