The Bitcoin market shows signs of another bull run peak on the horizon. A tweet by analyst Ali has highlighted when the next peak might occur.

Bitcoin’s post-halving rallies follow historical patterns, but with new market dynamics in play, this cycle might have a few surprises. As institutions step in and ETFs gain traction, the question remains: When will Bitcoin hit its peak in this bull run?

What you'll learn 👉

Bitcoin’s Historical Halving Cycles and Price Peaks

Ali’s analysis pointed to Bitcoin’s past cycles, where market tops followed predictable timelines post-halving.

It's been 276 days since the $BTC halving. Looking at previous cycles:

— Ali (@ali_charts) January 22, 2025

– In 2013, the market top came 367 days after the halving.

– In 2017 and 2021, market tops occurred 527 days post-halving.

If history repeats, the next market top could be anywhere from 90 to 250 days away. pic.twitter.com/koj6Truy3c

In 2013, the peak came 367 days after the halving, while in 2017 and 2021, it took 527 days. If history repeats, Bitcoin could reach its next peak between May and October 2025. With 2024 halving now 276 days behind, Bitcoin has entered the historical window for explosive growth.

So far, Bitcoin’s 59.23% gain post-halving is modest compared to past cycles. The extended timeline suggests a slower but sustained rally rather than a parabolic rise. Whether Bitcoin follows the 2013 model with a quicker top or mimics the stretched cycles of 2017 and 2021 remains uncertain. However, analysts believe the strongest phase of this bull run is yet to come.

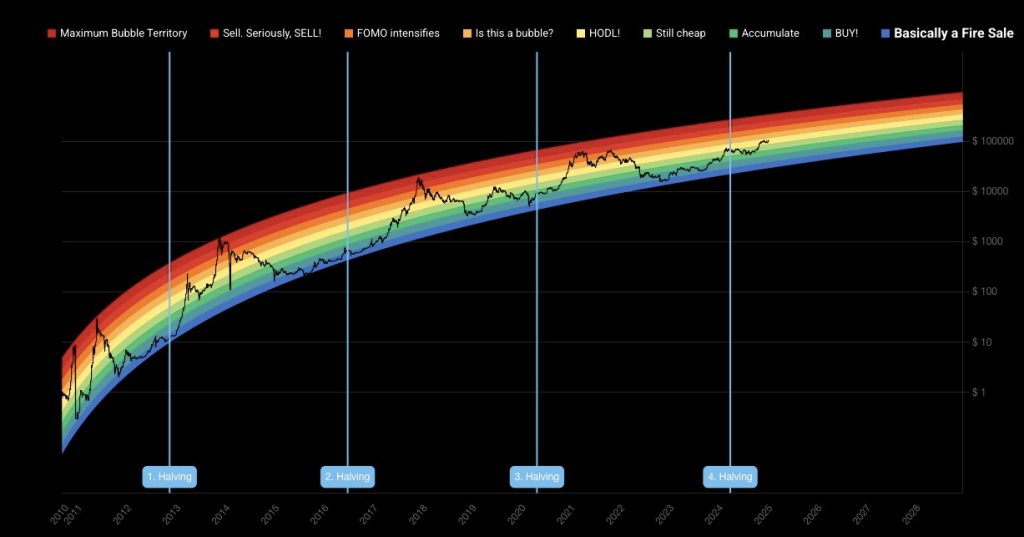

Bitcoin Rainbow Chart Hints at Future Price Action

CoinStats Bitcoin Rainbow Chart, a long-term valuation tool, provides additional insight. This model maps BTC’s price within color-coded bands, from undervaluation (blue) to overvaluation (red).

Historically, Bitcoin peaks occur when it enters the red or orange zones, marking speculative excess. Currently, Bitcoin is nearing the mid-to-upper valuation bands, aligning with the pre-bull-run conditions seen in past cycles.

If previous trends hold, Bitcoin could push into the red zone within the next 12 to 18 months from the 2024 halving. This timeframe matches Ali’s halving cycle analysis, reinforcing the possibility of a peak around mid-2025 and late 2025. The combination of technical indicators and historical data suggests that Bitcoin’s strongest rally phase may still be ahead.

BTC Indicators Signal a Critical Breakout Moment

Bitcoin is currently trading at $105,078 on the daily chart, down 1.00% for the day. The upward trend is still in place despite this slight reversal. At $80,489, the 200-day EMA is much below the current price, indicating a bullish outlook

Near $110,000, a significant resistance level, Bitcoin is consolidating. Prices may rise to $120,000 and higher if there is a breakout over this level.

While the RSI at 61.88 indicates bullish momentum without overbought circumstances, Bollinger Bands shows considerable volatility. If the MACD rises further, BTC could soon see another leg up.

Read also: This Simple Formula Explains Why Kaspa (KAS) Is Still a ‘Strong Buy’

Where Is BTC Headed Next?

The coming 90 to 250 days will impact Bitcoin’s future price trajectory. Bitcoin may see an aggressive climb during this time if history repeats. However, the cycle may be shaped differently by variables like macroeconomic conditions, institutional acceptance, and ETF inflows.

Presently, Bitcoin is still rising strongly, with important levels to keep an eye on. A run toward $120k might be possible if there is a successful breakout above $110k. Conversely, if the 20-day moving average is not maintained, there may be a decline below $100,000.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.