The prospect of a 0% capital gains tax on U.S.-based crypto assets is fueling speculation about a potential surge in market activity.

With discussions gaining traction among policymakers, digital assets such as XRP, LINK, RENDER, HBAR, and ONDO are emerging as key beneficiaries of this policy shift. Market observers suggest that such an initiative could drive increased liquidity into these networks, particularly from institutional players in Wall Street and Silicon Valley.

What you'll learn 👉

Policy Shifts Could Open Market Floodgates

Kyren, a top analyst, pointed out the significance of this development, stating that the elimination of capital gains tax on U.S.-based digital assets would serve as a major catalyst for Web3 innovation.

He emphasized the potential for increased liquidity flowing into these networks, particularly from institutional investors. “Trump has played with the idea of 0% capital gains tax on ALL US-based cryptos,” Kyren wrote on X, adding that this could incentivize the growth of blockchain-based applications built within the U.S. ecosystem.

Here's a potential bull case for US based cryptos:

— Kyren (@noBScrypto) February 12, 2025

These include: $RENDER $HBAR $ONDO $XRP $LINK & a few others.

Trump has played with the idea of 0% capital gains tax on ALL US based cryptos.

This is obviously a huge incentive to support US based Web3 innovation.

In return… pic.twitter.com/ou3eNUKlEr

Moreover, he also noted that the country is home to some of the most influential blockchain projects, with Ondo leading in real-world asset tokenization alongside BlackRock, while Chainlink remains a cornerstone for decentralized finance.

Rebecca, another X user engaging in the discussion, highlighted a statement from Vice President JD Vance, reinforcing the administration’s commitment to advancing American technology.

She quoted Vance saying that the U.S. aims to ensure that its AI sector remains dominant globally, leveraging American-designed and manufactured chips. This assertion, she suggested, aligns with the growing significance of RENDER, which is gaining traction in the AI and media landscape.

Altcoins Show Signs of Strength

Market analysts are also monitoring the broader altcoin market for signs of stability.

Patric H. from CryptelligenceX noted that altcoins appear to be forming a horizontal range following recent market liquidations. He stated that while certain assets present attractive risk-reward setups, he remains cautious, opting for tight stop-loss levels to manage potential downside risks.

The #Altcoins market is starting to look much better.

— Patric H. | CryptelligenceX (@CryptelligenceX) February 13, 2025

It almost seems like the market is trying to form a horizontal range below the close of the liquidation candle.

I'm willing to increase my market exposure, as certain altcoins already offer lucrative RR setups with nearby… pic.twitter.com/0phND1olrJ

Despite a short-term pullback, analysts argue that a favorable regulatory environment could reinforce positive sentiment around U.S.-based blockchain networks. With major financial and tech firms engaging in blockchain adoption, the long-term outlook for these assets remains compelling.

Read also: This Chart Pattern Signals an XRP Price Rally to $15

Market Sentiment Remains Cautious

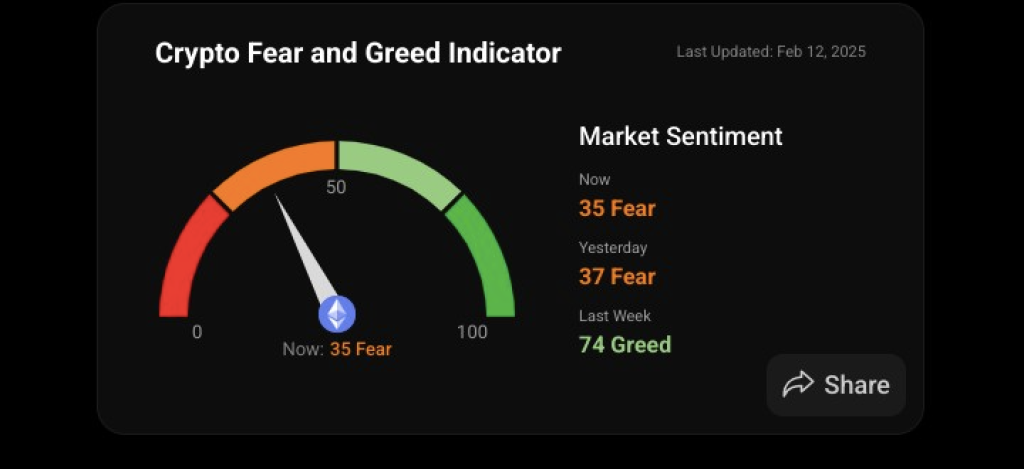

While the discussion around a tax-free crypto environment is generating optimism, market sentiment remains cautious.

According to CoinStats’ Crypto Fear and Greed Indicator, the market currently sits at 35 (Fear), indicating a hesitant stance among traders. The sentiment has slightly improved from the previous day but marks a stark contrast from last week’s 74 (Greed) rating.

The sharp shift in sentiment suggests a cooling-off period following recent volatility, but historical trends indicate that prolonged phases of fear can present buying opportunities. Analysts argue that if the proposed tax incentive materializes, it could restore confidence and trigger a renewed inflow of capital into the sector.

With increasing discussions around regulatory reforms and institutional involvement, the trajectory of U.S.-based cryptos remains a focal point for traders and policymakers. Whether the proposed tax policy gains legislative backing remains uncertain, but the growing engagement from influential figures suggests that the conversation around incentivizing Web3 innovation in the U.S. is far from over.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.