Stablecoins are digital tokens (much like Bitcoin and Litecoin) that are intended to provide measurable stability and security in the super volatile crypto market. These days they provide everything else but that.

Tether saga is a recurring topic in the crypto scene – every couple of months there are cries of doom, Bitfinex is like a cat with 9 lives, it was dead so many times, almost as many as bitcoin was.

Drama with Tether isn’t new, but until now USDT has mostly maintained its $1 peg. In January it was reported that Bitfinex and Tether were both under investigation by authorities on potential fraud allegations. The core of the allegation is that Bitfinex issued Tether tokens without the U.S. dollars held in reserve that are meant to underpin the cryptocurrency, a claim strongly denied.

Tether was especially “stable” yesterday as it lost its peg to USD and dipped way down to $0.87. Today is another story, they are back at the one buck level again.

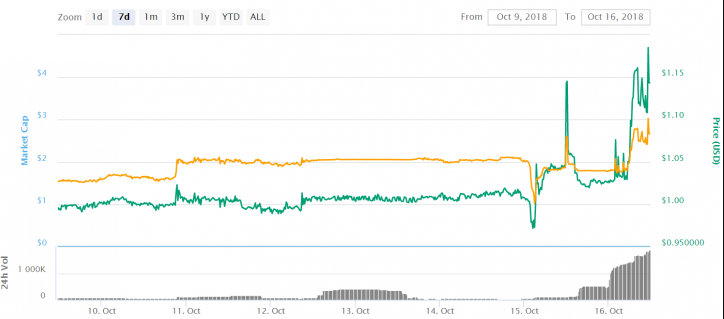

However, Tether’s brother from another mother, Gemini Dollar (GUSD) lost its peg to the buck, by going in the opposite direction. It soared to the $1.19 height which is another example of a coin missing its sole purpose of maintaining a stable peg to a the dollar.

The Winklewoss twins, who founded Gemini, one of the United States’ largest cryptocurrency exchanges, have created and dubbed the new currency Gemini dollars, known by the symbol “GUSD.” Gemini has said each GUSD will be FDIC insured, federally audited, and entirely backed on a 1:1 basis by U.S. dollars. In other words, it’s a “stablecoin.” Gemini hopes that its more closely regulated GUSD currency will give institutional money confidence to enter the crypto market.

The wannabe Tether alternatives are gaining serious momentum. OkEx announced listing for all four stablecoins earlier this week, while volumes in all of them continue to rise alongside investor uncertainty over Tether.