Recently, a tweet by James V. Straten (@jimmyvs24) drew attention to a curious phenomenon that savvy traders and investors should not ignore: the divergence in funding rates for Bitcoin (#BTC) and Ethereum (#ETH).

What you'll learn 👉

The Data at Hand

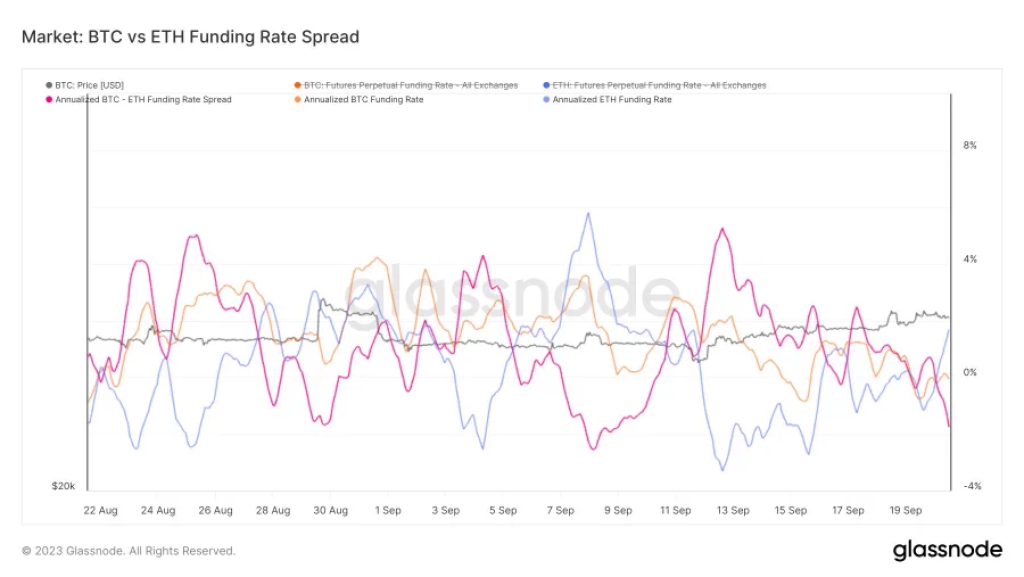

According to Straten’s metrics, there appears to be a widening gap in the way traders are positioning themselves in the Bitcoin and Ethereum markets. Specifically, Bitcoin is seeing an increase in short positions, implying that traders are betting on a price decline. Conversely, long positions are rising for Ethereum, indicating optimism for the asset’s future performance.

The Funding Rate Spread

The divergence is most visible when examining the annualized funding rate spread, a metric used to understand the cost of holding long or short positions in derivative markets. Currently, the spread stands at -1.75%, marking the second lowest point this month. The negative spread suggests that it’s more expensive to hold short positions in Bitcoin than it is to hold long positions in Ethereum.

The ETH/BTC Ratio

Straten’s tweet also hinted at an effort by market participants to prop up the ETH/BTC ratio. The ratio measures the value of one asset in terms of another and is often used to gauge the relative strength of the two cryptocurrencies. By driving up long positions in Ethereum while shorting Bitcoin, traders could potentially be looking to bolster the value of ETH relative to BTC.

Why Does This Matter?

The observed divergence can have a ripple effect on the broader cryptocurrency market. A bearish sentiment on Bitcoin may induce a downturn that influences other altcoins. On the other hand, the bullish sentiment towards Ethereum could spill over into related assets like ERC-20 tokens.

Conclusion

It’s essential for traders and investors to keep an eye on these shifts in funding rates as they offer insights into market sentiment. While it is too early to predict definitive outcomes, the current divergence, as pointed out by James V. Straten, signals contrasting investor outlooks for Bitcoin and Ethereum, setting the stage for intriguing market dynamics in the days ahead.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.