The entity responsible for exploiting funds from FTX has shown no signs of slowing down. Since the suspension of swaps on THORSwap, this elusive actor has been engaged in a series of intricate maneuvers involving Ethereum (ETH) and tBTC, facilitated by The TNetwork’s cross-chain capabilities, leaving the crypto community astir.

What you'll learn 👉

The Exploiter’s Persistence

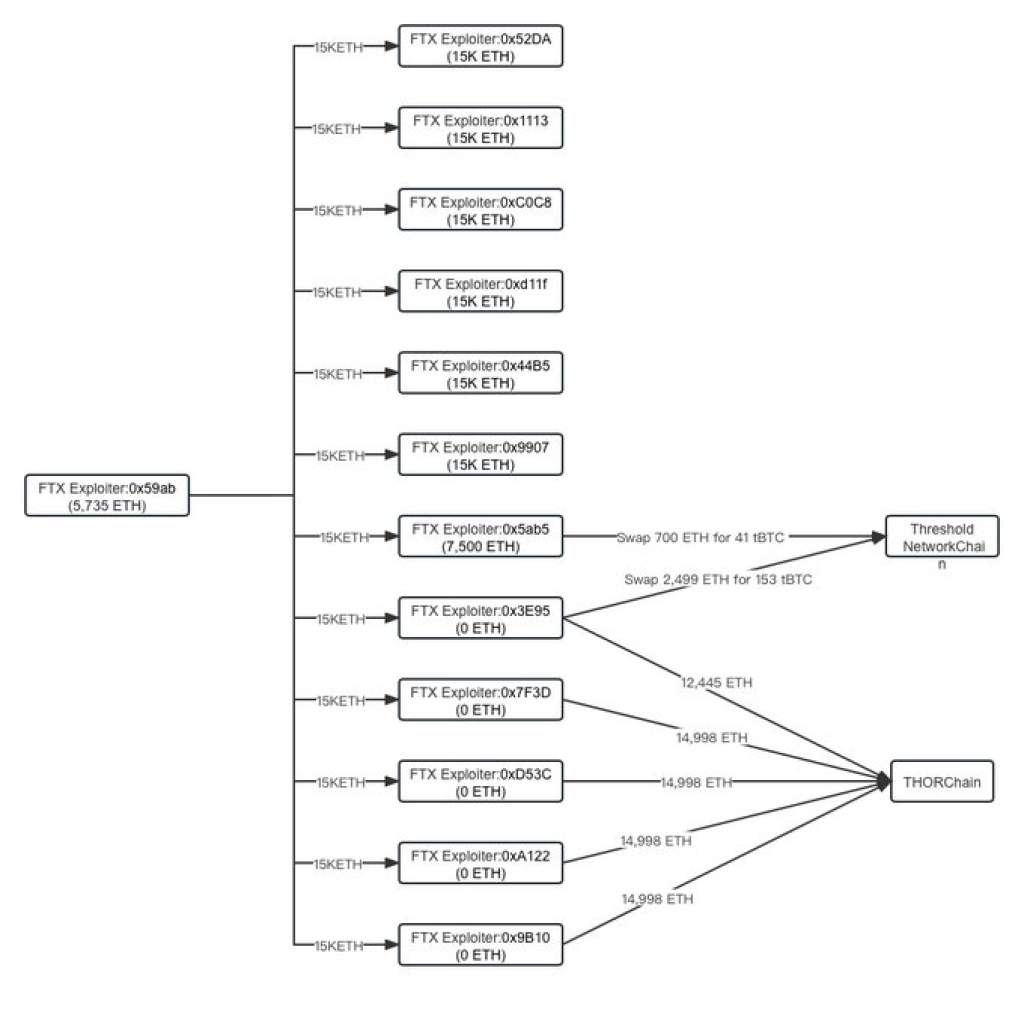

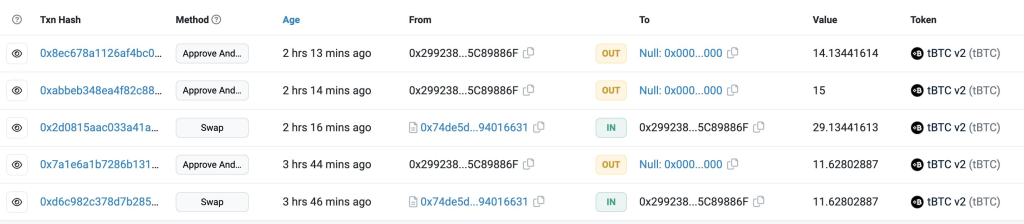

Following the suspension of swaps on THORSwap, the exploiter wasted no time in converting a substantial amount of Ethereum (ETH) into tBTC using The TNetwork’s decentralized exchange (DEX). This audacious move saw approximately 75,000 ETH, with a staggering market value of $124 million, transmute into Bitcoin (BTC) assets. This ETH had its origins in the systematic draining of FTX wallets during the aftermath of the exchange’s collapse.

With a seamless bridging process, the converted assets were successfully transported to the Bitcoin network via TNetwork’s cross-chain capabilities. As of the latest data, the exploiter’s cryptocurrency holdings now stand at around 109,000 ETH, valued at a staggering $179 million.

The Enigmatic Culprit

The identity of the individual or group behind these exploits remains shrouded in mystery. Their relentless swapping and asset transfers indicate a systematic effort to cash out holdings. This has raised complex questions within the crypto community regarding the tracking and potential reclamation of funds that were improperly extracted from FTX prior to its bankruptcy.

As the situation continues to evolve, the crypto community finds itself grappling with the complexities of pursuing justice in a decentralized and often opaque landscape. The FTX Exploiter’s ability to seamlessly move assets across multiple blockchains adds an additional layer of complexity to the ongoing investigation. If the entity is not stopped, how bad can their activities become?

How Bad Can This Become for Investors?

The exploits by the unknown actor draining FTX wallets pose serious risks for FTX investors and creditors hoping to recover funds. With over $124 million extracted already, the potential harm is immense.

First, the disappearing funds significantly reduce assets available for FTX to distribute to investors and creditors through bankruptcy proceedings. Every dollar moved to the exploiter’s wallet is potentially one less dollar that can be repaid to those FTX owes money. This makes it less likely affected parties will recoup a meaningful portion of their losses.

Second, the broad abilities of the exploiter to bridge assets across blockchains creates additional uncertainty around tracking and reclaiming the drained funds. Even if the individual is identified, the decentralized and pseudo-anonymous nature of cryptocurrency transactions means it may be impossible to definitively prove holdings or force the return of extracted assets.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.