Wallets associated with the collapsed FTX exchange and sister trading firm Alameda Research have transferred over $10 million worth of digital assets to major exchanges Binance and Coinbase, according to blockchain data analytics firm Lookonchain.

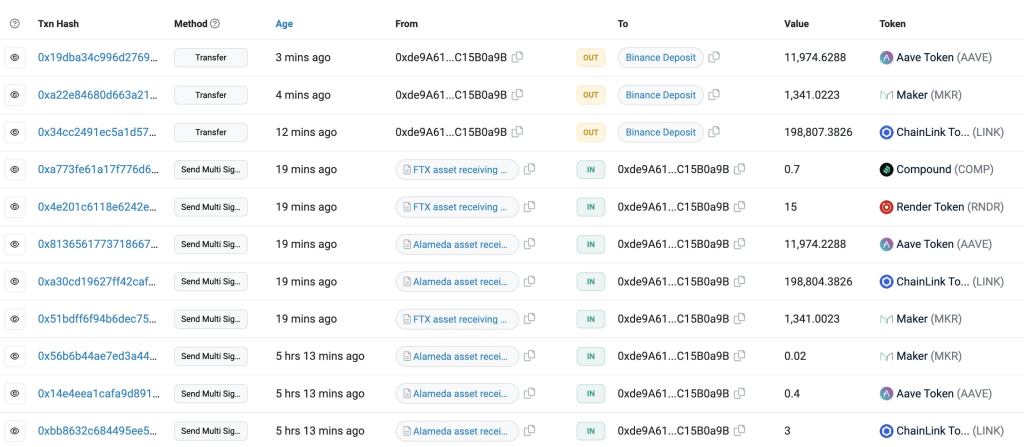

The transfers involved nearly 3,000 Ether, 1,300 Maker tokens, 12,000 Aave tokens, and almost 200,000 Chainlink tokens. Lookonchain detected the movements from known FTX-linked wallets to Binance and Coinbase via an intermediary wallet.

The activity has fueled speculation that FTX bankruptcy administrators may be liquidating portions of the company’s remaining crypto holdings to raise cash for debt repayment. The destinations being large liquid exchanges like Binance hints at possible sales.

However, the reasons behind the transfers are still unclear. The bankruptcy proceedings remain ongoing following FTX’s spectacular collapse in November 2022 amid liquidity issues and alleged fraud.

Overseeing FTX’s unwinding is John Ray III, who also handled the infamous Enron bankruptcy. FTX founder Sam Bankman-Fried resigned when the company filed for Chapter 11. He was later arrested on criminal fraud charges and released on bail.

Lookonchain’s findings illustrate that FTX still holds substantial crypto reserves, even after its implosion triggered billions in losses. Liquidating digital assets could help pay back some of what is owed to customers and creditors.

But analysts caution the motives behind the wallet movements are still speculative. The receiving exchanges may simply be providing custodial services.

Nonetheless, on-chain activity reveals FTX retains a sizable crypto treasury. With creditors owed billions, any signs of liquidation or asset shifting attract intense scrutiny from analysts and market watchers.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.