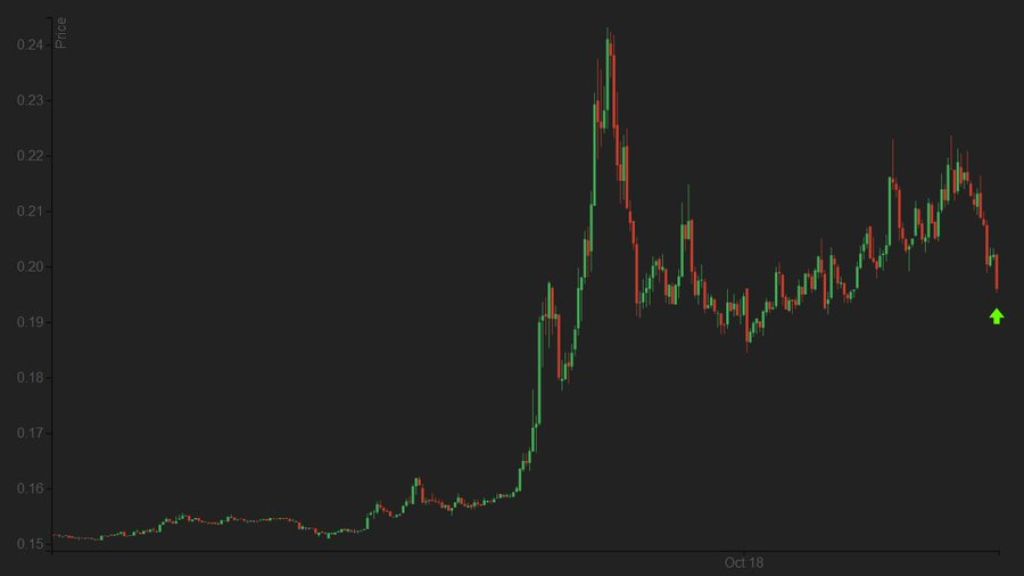

OAX, the token underpinning the OAX decentralized finance project, has pumped over 59% in the last 24 hours. A confluence of factors appears to be responsible for the rapid price uptick.

Launched in 2017, OAX aims to bring decentralized finance and digital assets into the mainstream. The project has built an ecosystem for decentralized trading and payments.

According to analyst Bitpeaks, OAX currently has strong buy support just below its price around $0.196. The bid-to-ask ratio is 3:1, indicating more buyers than sellers.

OAX also received a low manipulation risk score from InvestorsObserver’s proprietary system. This metric analyzes recent volume changes to gauge how easily a token’s price can be moved.

Additionally, OAX’s trading volume has exploded 5000% in the past day as per CoinMarketCap. This intensified activity often coincides with price rallies.

The combination of surging volume, high buying interest, and Quantified’s low manipulation risk rating helps explain OAX’s ability to surge 50% amid a wavering broader crypto market.

Sustaining these factors will determine if OAX can turn its sudden spike into a sustained uptrend. But for now, the trifecta of bullish analytics has powered its breakout.

OAX currently trades around $0.24, up 59% in the past 24 hours. Its parabolic move illustrates how forgotten altcoins can abruptly awaken during periods of volatility.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.