Fantom is one of those altcoins that has been performing impressively during this bull cycle. Altcoin Sherpa and Santiment have updated their outlooks regarding the FTM price, offering intriguing insights into its potential trajectory.

The recent analysis of Fantom by Sherpa reveals a compelling narrative of accumulation, breakout, and potential growth.

What you'll learn 👉

Fantom (FTM) Price Analysis

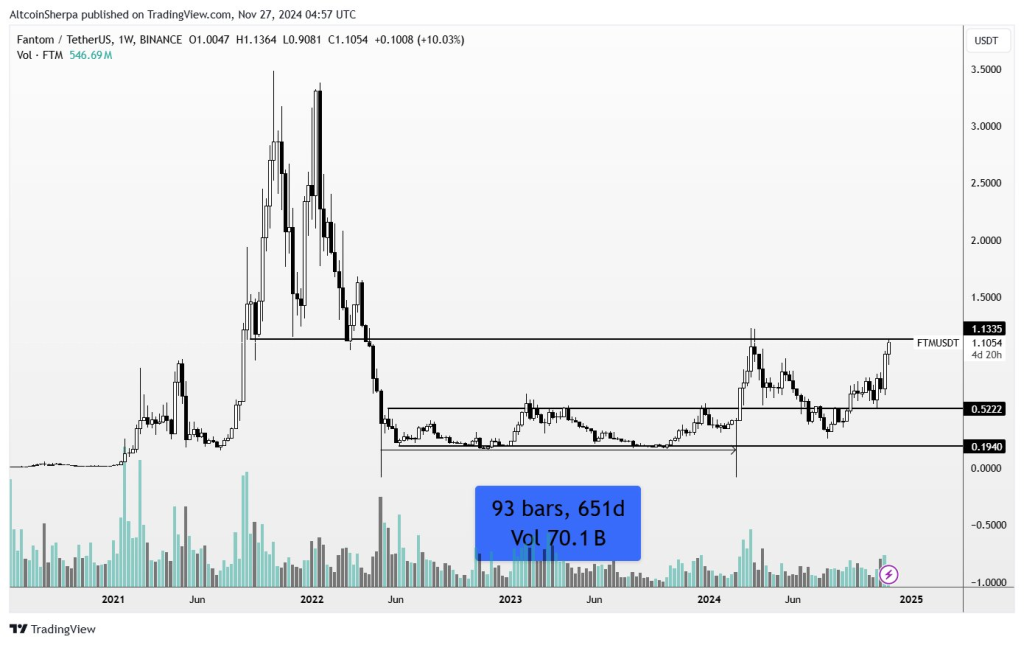

Over the past two years, the FTM price has demonstrated a consolidation phase, trading steadily between $0.1940 and $0.5222.

This prolonged period, characterized by low volatility and consistent trading volume, aligns closely with the Wyckoff accumulation theory, where smart money gradually builds positions before a potential breakout.

The $0.1940 level represents a strong historical low, serving as a robust long-term support zone. As the price broke through the mid-range support of $0.5222, it signaled a potential bullish trend reversal. Currently, the Fantom price is testing the resistance zone at $1.1335, a level that previously acted as support during its parabolic run in late 2021.

The recent price action shows increased volume during the breakout, confirming growing bullish sentiment. If FTM successfully breaks through the $1.1335 resistance, the next potential target could be in the $2.50–$3.00 range. This breakout suggests that Fantom is aligning with the broader market cycle, where altcoins tend to follow Bitcoin’s macro trend.

On-Chain Analytics and the Fantom Price Pump

Santiment’s analysis provides additional context to Fantom’s price movements. The cryptocurrency has surged an impressive 63% in just six days, rising from around $0.70 to $1.10. This rapid appreciation is accompanied by a notable increase in network activity, particularly in daily active addresses.

However, analysts caution that such spikes in activity often correlate with market tops. The surge in daily active addresses suggests growing speculative interest, potentially driven by the Fear of Missing Out (FOMO).

Interestingly, the data suggests investors should monitor the potential decline in active addresses as a potential signal for re-entry at lower prices. This strategy could provide an opportunity for more calculated market entry.

Several fundamental aspects continue to support Fantom’s positive narrative. The involvement of developer Andre Cronje lends credibility to the project. The Sonic rebrand and reduced venture capital sell pressure have positioned FTM favorably in the competitive crypto landscape.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.