A recent tweet from crypto analytics firm Lookonchain has revealed a significant cryptocurrency transaction involving a prominent digital asset investor, often referred to as a ‘whale’. The unidentified investor deposited a whopping 16 million Phantom (FTM) tokens, worth around $4.8 million, to the Binance trading platform with the intention of selling. The transaction, influenced by the recent crisis with the Multichain protocol, happened within the last week.

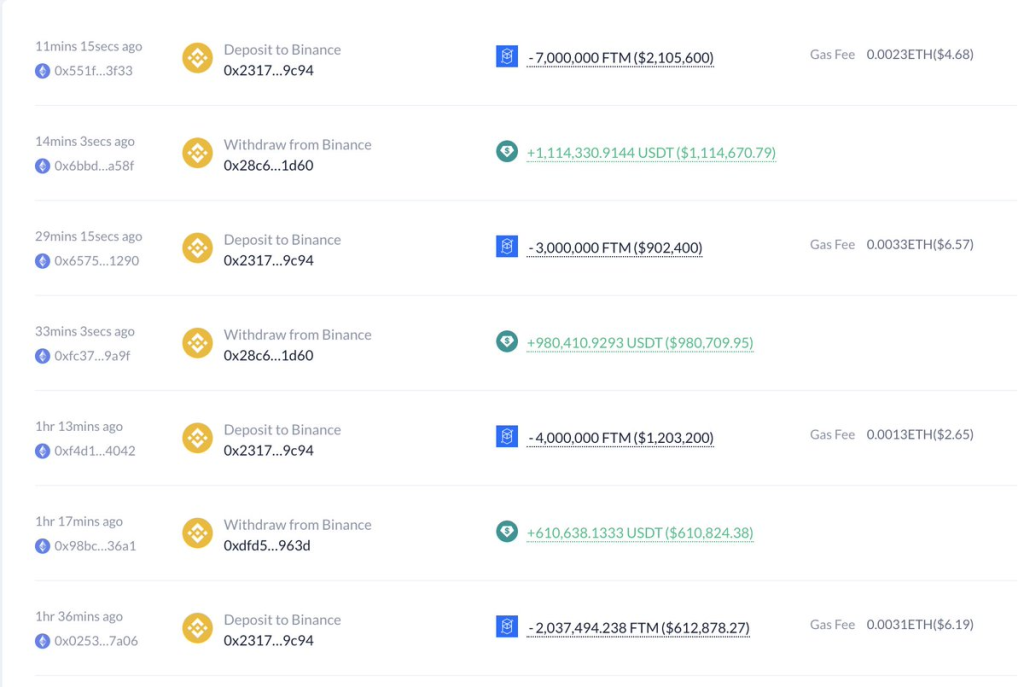

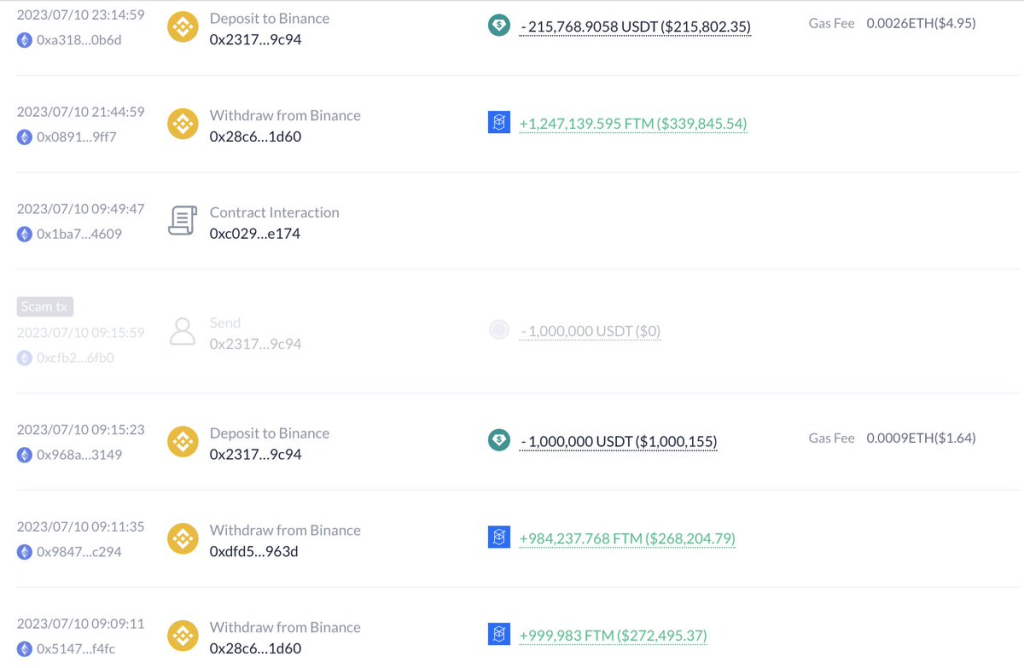

In a subsequent tweet, Lookonchain revealed the whale had purchased these tokens at an average price of $0.24, but they are now being sold at roughly $0.3 each. The whale has also withdrawn 2.7 million Tether (USDT) from Binance, signifying the initial profits from the FTM token sales. Based on this activity, the whale stands to make an estimated profit of around $985,000.

While the hefty transaction seems to have been a strategic move for the whale, it is inextricably linked to the recent turmoil surrounding the Multichain protocol.

Multichain, a cryptocurrency bridging protocol designed to connect different blockchains, has recently announced it is halting operations due to financial distress and legal trouble involving its CEO, Zhaojun. The protocol had been struggling since May, when it suspended routes due to an upgrade that resulted in prolonged fund transfer durations.

With approximately $1.26 billion worth of cryptocurrencies still locked in its system, according to DeFi Llama, the repercussions of Multichain’s sudden collapse are still unfolding. In the wake of this announcement, Multichain’s native token, MULTI, suffered a 30.54% price drop over the past week.

Zhaojun and his sister were recently detained by Chinese authorities, adding another layer of complexity to the situation. The cessation of Multichain’s operations has underscored the volatility and inherent risks in the cryptocurrency market, highlighting the need for investors to conduct thorough research before entering into any crypto-related ventures.