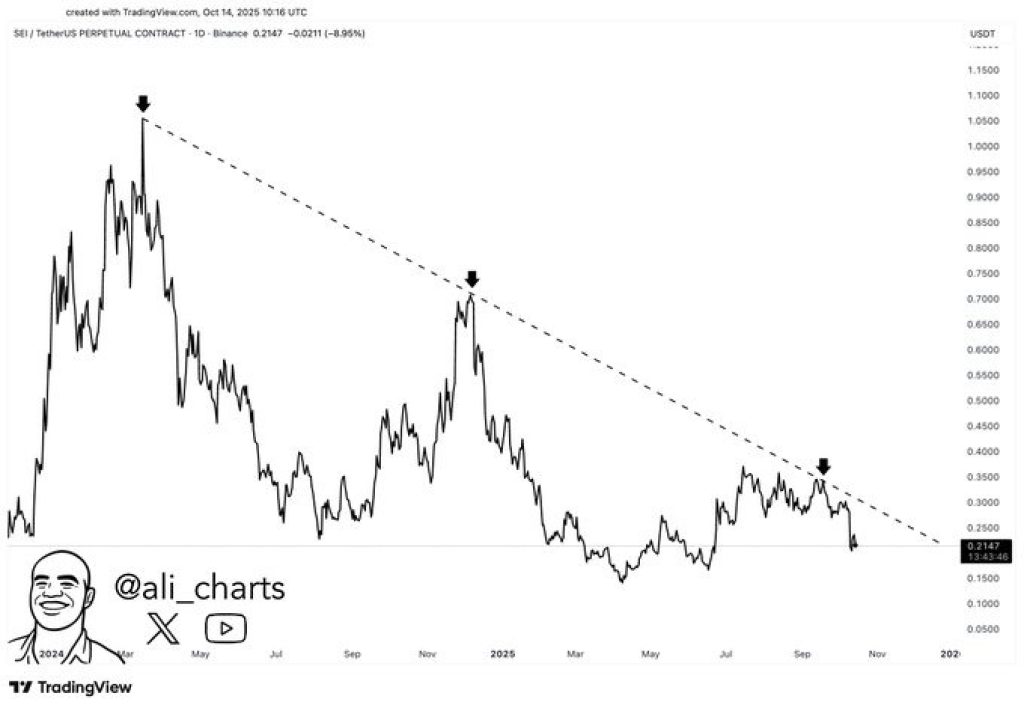

Popular analyst Ali has once again caught the crypto community’s attention, this time with a bold statement about SEI’s price action. Sharing a clean technical chart, he wrote, “One trendline stands between $SEI and a parabolic rally. It’s not a matter of if, but when.”

Ali is referring to a single, well-defined resistance line that has controlled SEI market structure for months. According to him, once this line finally breaks, SEI price could be set for an explosive move that takes traders by surprise.

What you'll learn 👉

Here’s What The SEI Chart Is Saying

The chart Ali shared connects SEI major lower highs across multiple months, a textbook descending resistance trendline. Every rally attempt since the SEI peak has stopped exactly at that line, turning it into the key technical barrier holding back a potential breakout.

Right now, SEI price is hovering around $0.21, sitting directly below that resistance zone. The setup looks tight, and historically, the more price compresses beneath a line like this, the stronger the breakout when it finally happens.

If SEI closes a daily candle above that descending trendline and manages to hold it as support, it could flip the entire market structure bullish.

From there, the next targets are the $0.26–$0.28 range, followed by $0.33–$0.35, where sellers previously took profits. A clean rally through those zones could quickly bring $0.45–$0.50 back into play, and if momentum keeps building, a push toward $0.60–$0.70 isn’t out of the question.

Read Also: How Much Could $2,900 Invested in ASTER Be Worth by 2026?

What Happens If It Fails

Of course, no breakout is guaranteed. If SEI price gets rejected again at the trendline and slips back under $0.20, it would keep the downtrend alive and likely drag the price back toward $0.18–$0.16, the same support area that’s held the market since summer.

A few more failed breakout attempts could also cause traders to lose patience, meaning SEI might spend longer consolidating before the next serious move.

The Bigger Picture

Ali’s comment, “It’s not a matter of if, but when,” reflects growing confidence in SEI price long-term structure. When a descending trendline holds this cleanly for months, it often signals that traders are waiting for one final catalyst to break it.

Once that happens, sellers are forced to cover, volume surges, and the price tends to accelerate quickly.

In short, SEI entire market right now comes down to a single line. If it breaks and holds, the next rally could unfold fast, and as Ali suggests, it might just be a question of when, not if.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.