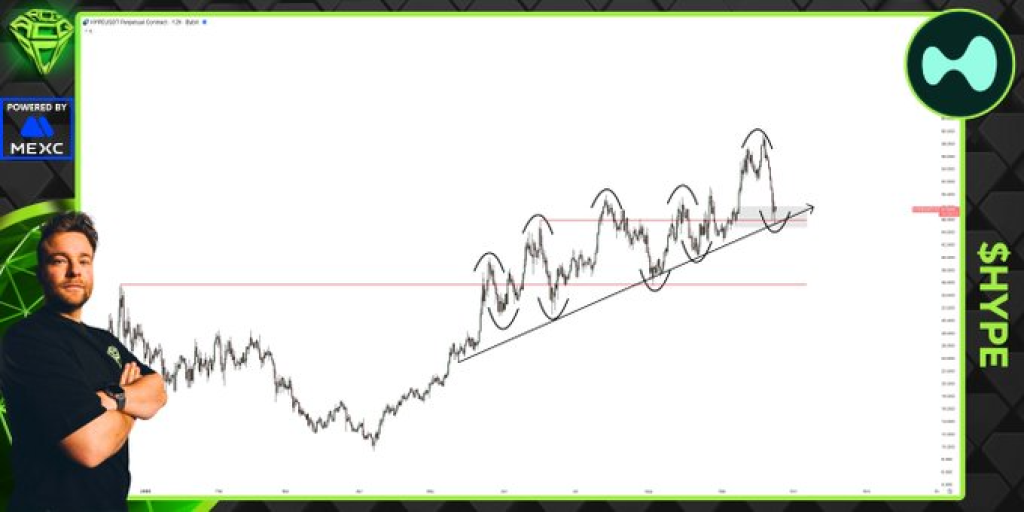

Altcoin trader Sjuul from AltCryptoGems shared a fresh chart update showing that HYPE price is still trading inside a strong long-term uptrend despite the recent dip.

His post points out that the market is testing an important level where past rallies have often started, and he believes this could be the setup for another leg higher.

On the chart, HYPE price has been climbing in a pattern of higher highs and higher lows for months. This creates a rising trendline that the price has tested and defended several times.

Even with the latest pullback, the Hyperliquid price is still sitting right on this key support. Each time the token has dropped toward this area in the past, it has bounced back strongly.

Sjuul describes it as an “interesting zone,” and it’s easy to see why. This is where long-term buyers usually step in, keeping the bullish structure intact.

Read Also: Why Is Aster (ASTER) Price Up Today?

What Traders Are Watching

The current action is a classic battle between short-term sellers and long-term holders. If HYPE can stay above this trendline and close higher on the higher time frame chart, the uptrend remains valid and could trigger another strong move to the upside.

But if the support fails and the HYPE price slips under it, that would break the pattern and likely invite deeper corrections. Traders are keeping a close eye on the daily candles to see which side wins.

Hyperliquid Price Outlook

Momentum still favors the bulls for now. Volume has not fallen off a cliff, and the steady rhythm of higher lows shows that buyers are not giving up. Sjuul suggests that a clean hold of this zone could lead to a fresh rally that mirrors earlier surges.

If that happens, new highs could arrive sooner than expected. But a clear breakdown would change the picture and could bring a sharper drop.

For the moment, though, HYPE price remains technically bullish on higher time frames, and this dip might just be the kind of reset that sets the stage for its next move upward.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.