Amid the ongoing cryptocurrency bear market, Ethereum has seen its valuation decline substantially from all-time highs. However, the second-largest blockchain network still boasts a market capitalization greater than that of major global corporations like McDonald’s and Pfizer.

According to data from CoinGecko, Ethereum is currently valued at around $187 billion. While down significantly from its 2021 peak above $500 billion, this market cap keeps Ethereum within the top 15 most valuable assets worldwide.

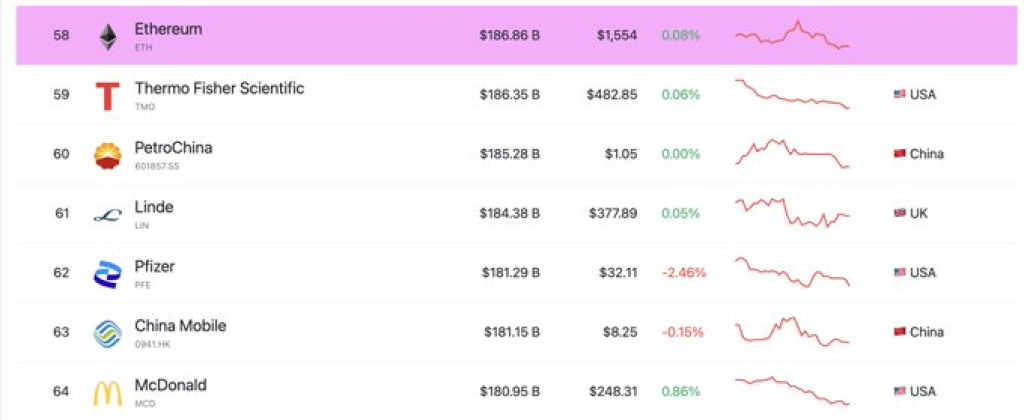

Ethereum trails just behind scientific firm Thermo Fisher but remains ahead of Chinese oil giant PetroChina. Other major companies edged out by Ethereum include industrial gas leader Linde, pharma titan Pfizer, telecom firm China Mobile, and fast food chain McDonald’s.

Ethereum has faced headwinds like declining network activity and futures ETFs sparking little interest. This has fueled predictions it could drop below the market cap of McDonald’s, which vocal Ethereum advocate Ryan Sean Adams called the “ultimate bottom signal.”

However, some analysts remain highly bullish on Ethereum in the long run. With major upgrades like the Merge now complete, banks like Standard Chartered forecast its native Ether token reaching up to $8,000 within two years.

For now, Ethereum remains firmly among the top assets globally. But as crypto volatility persists, its ranking versus corporate stalwarts faces an uncertain future.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.