Several large Ethereum whales made notable transactions today that could impact ETH’s price action, according to on-chain data analytics firm LookOnChain.

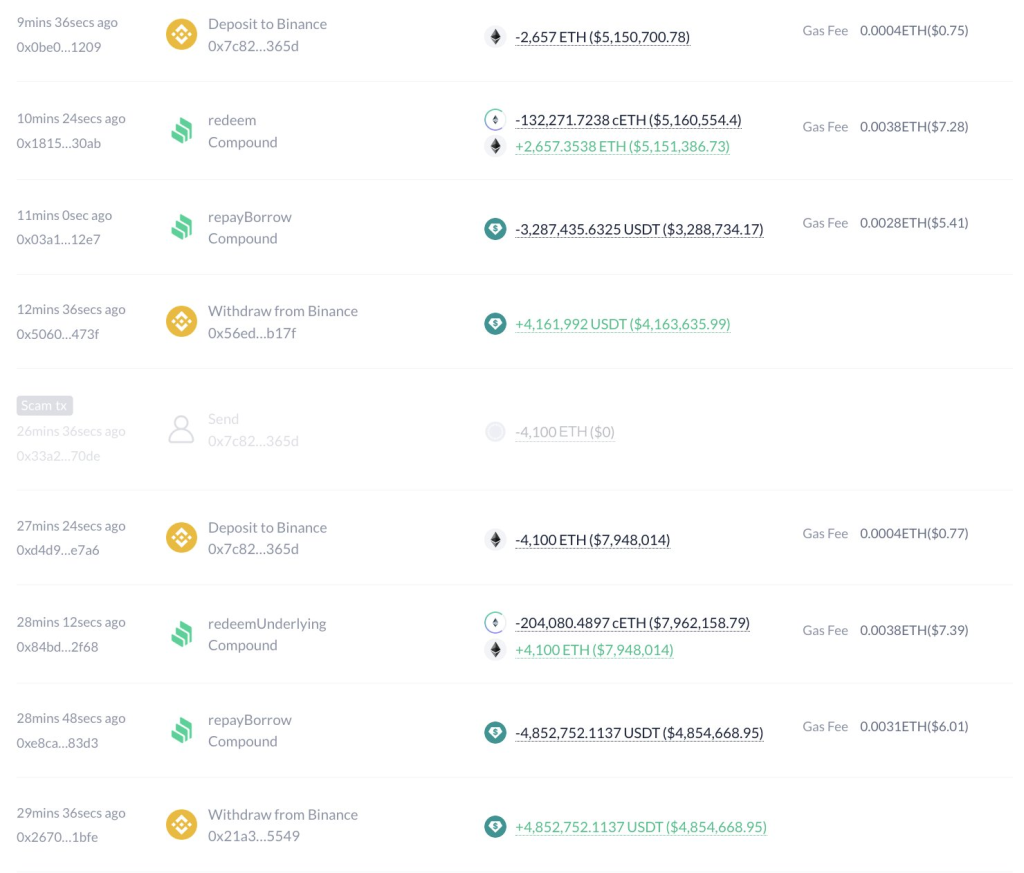

First, a whale who is long ETH sold 12,048 ETH (worth $23.4 million) to repay debt. This whale had previously bought 12,047 ETH (worth $21.3 million) from Binance on October 23 when ETH was trading around $1,768.

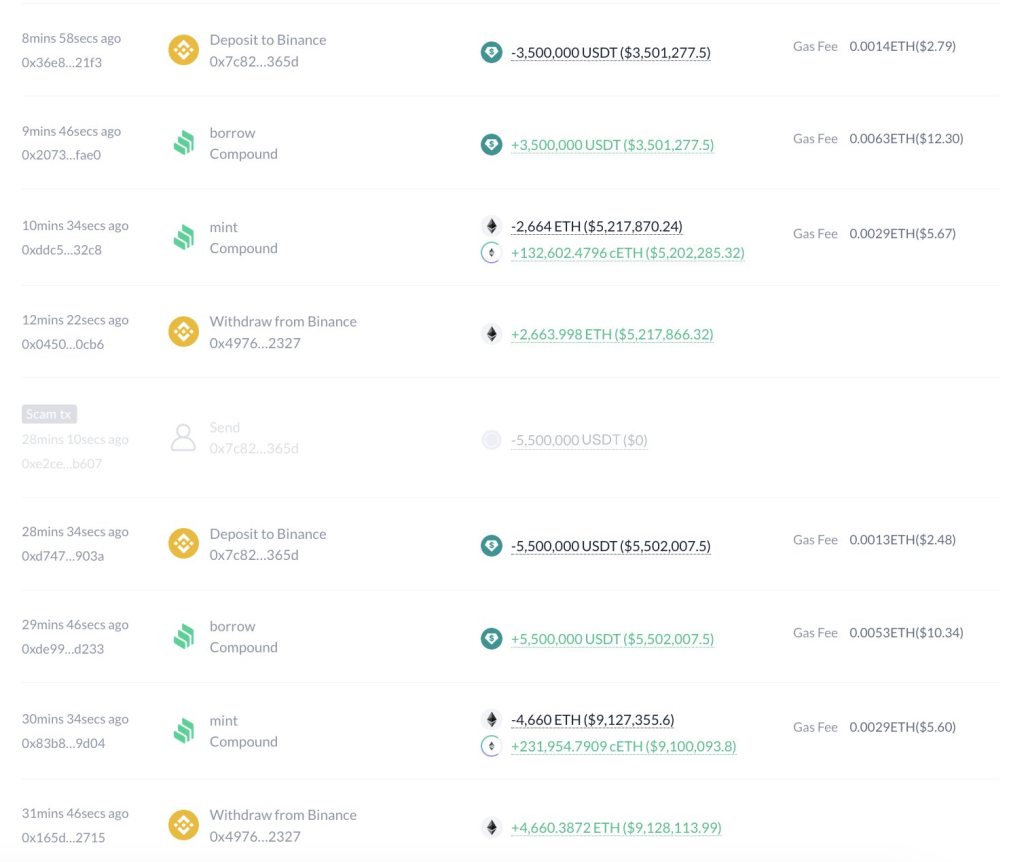

By using ETH as collateral on lending platforms like Aave and Compound, the whale was able to borrow stablecoins to buy more ETH and profit from ETH’s price appreciation.

In another move, two fresh wallets withdrew a combined 21,076 ETH (worth $41.23 million) from Bitfinex. When large amounts of coins are withdrawn from exchanges, it can signify that whales are moving funds into cold storage wallets for longer-term holding. This decreases ETH liquidity on exchanges, which can potentially have a positive effect on the price.

Finally, the same whale from the first transaction deposited 7,324 ETH (worth $14.3 million) into Compound as collateral to borrow $9 million USDT. The whale then deposited the USDT onto Binance likely to buy more ETH and further increase their ETH position.

Overall, these large transactions by ETH whales suggest continued bullish sentiment and a preference to hold ETH for the long-term. With ETH holding support above $1,970, whales appear to be taking advantage of opportunities to accumulate more ETH and bet on higher prices.

Their actions could put upwards pressure on ETH as more coins move into off-exchange wallets. However, heavy selling by whales could also risk triggering pullbacks if they decide to take profits.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.